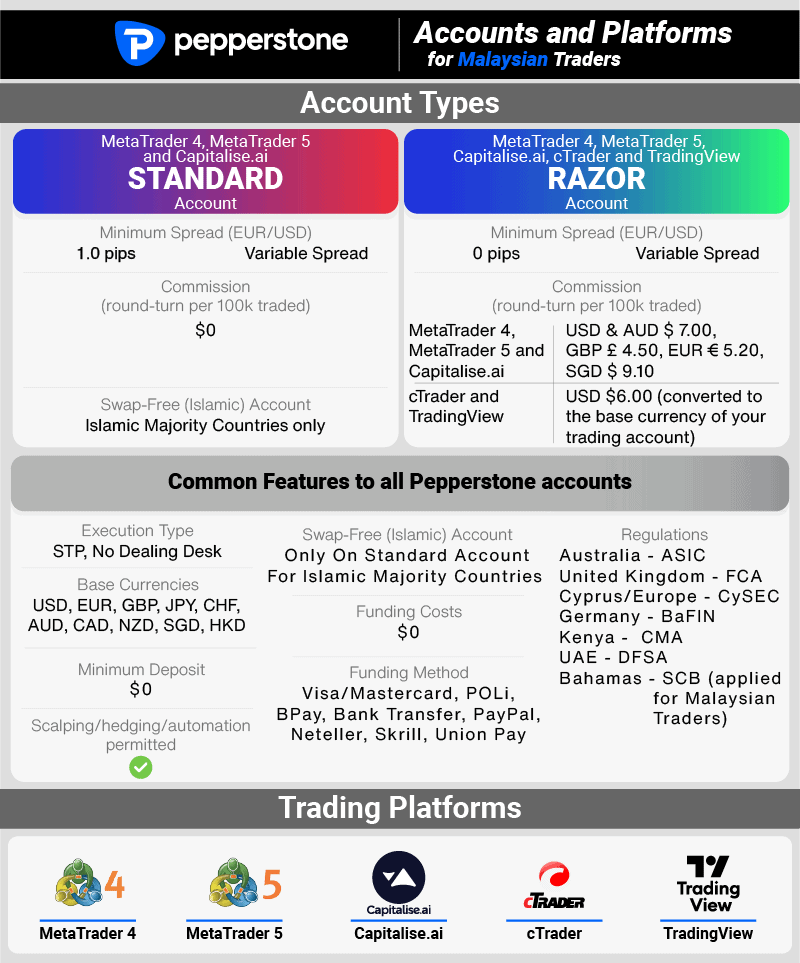

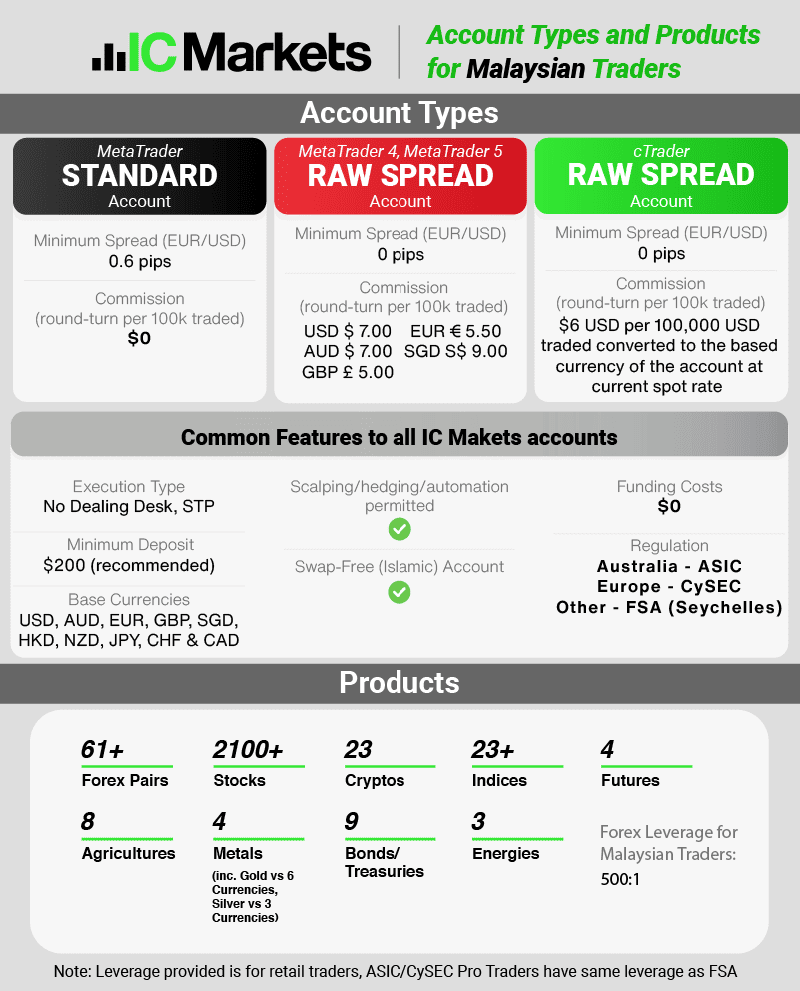

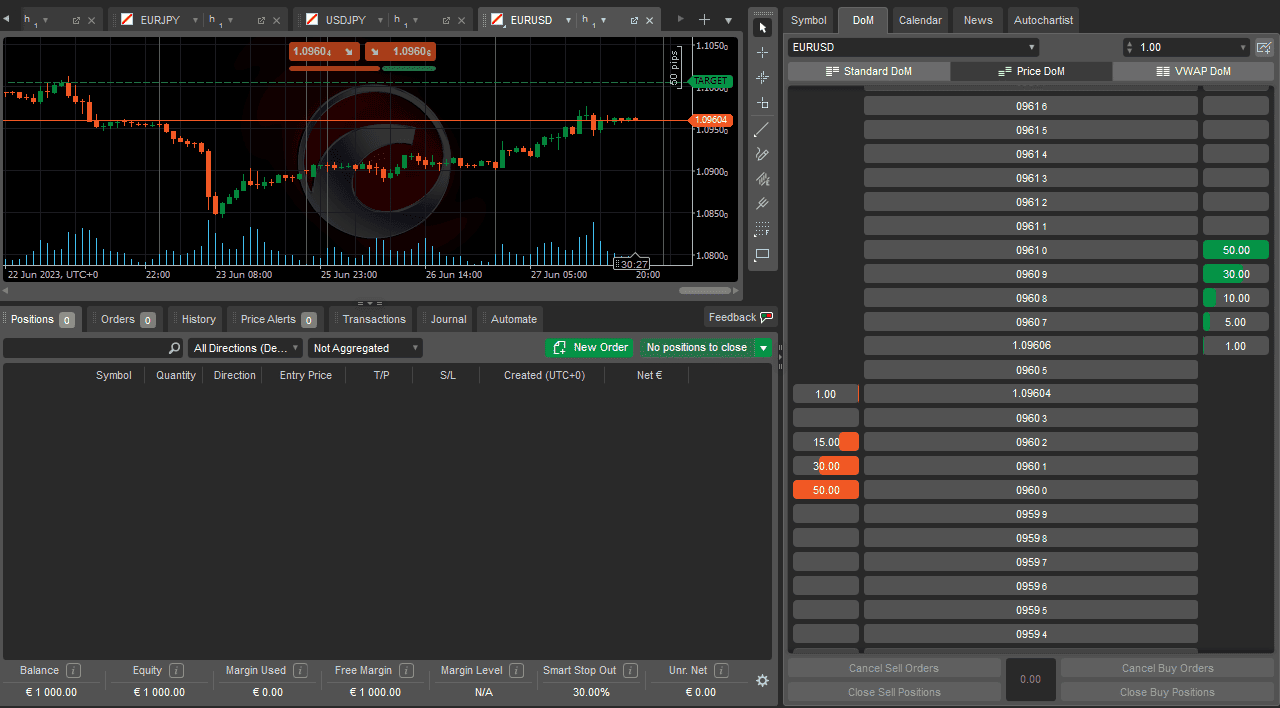

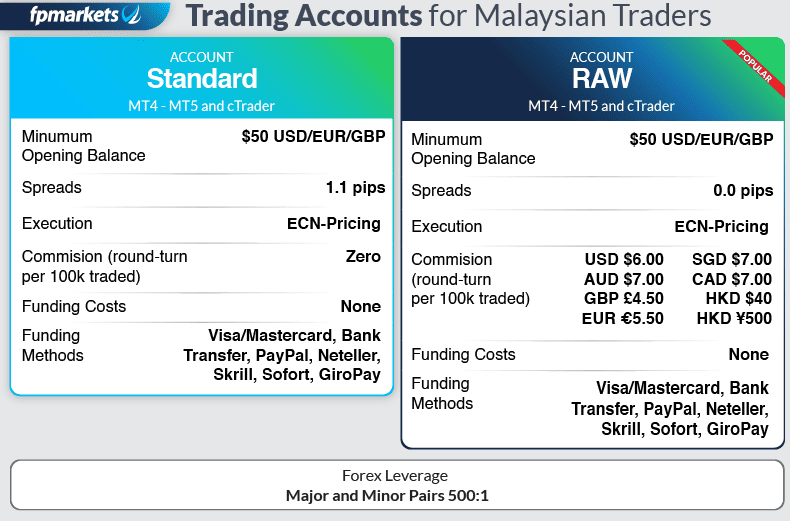

Trading Platforms

The top trading software in Malaysia can use robot, algo and copy or social trading. Find the best platforms in 2024 to automate your trading and free up your time to do other things.

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert

I want to open an account with you to trade with your automated trading facility.

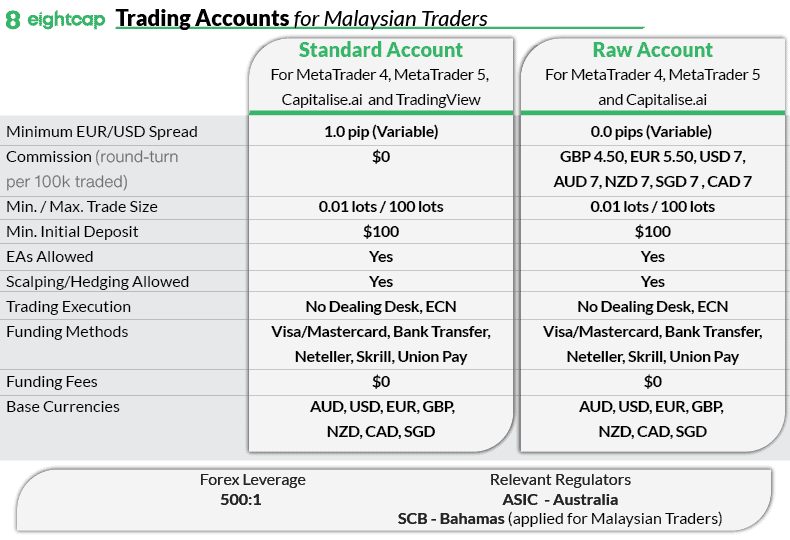

We don’t personally offer an automated trading facility, however, feel free to sign up with any of the recommended brokers on this page. A new broker to consider is eightcap. They have Capitalise.ai which is a very good platform to automate your trading.

Sorry, we don’t have an automated trading facility. We compare forex brokers, we do not provide trading services ourselves.