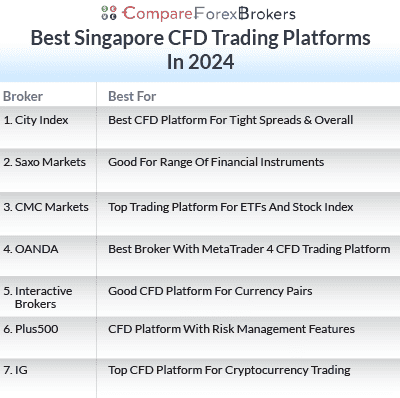

Best Singapore CFD Brokers In 2024

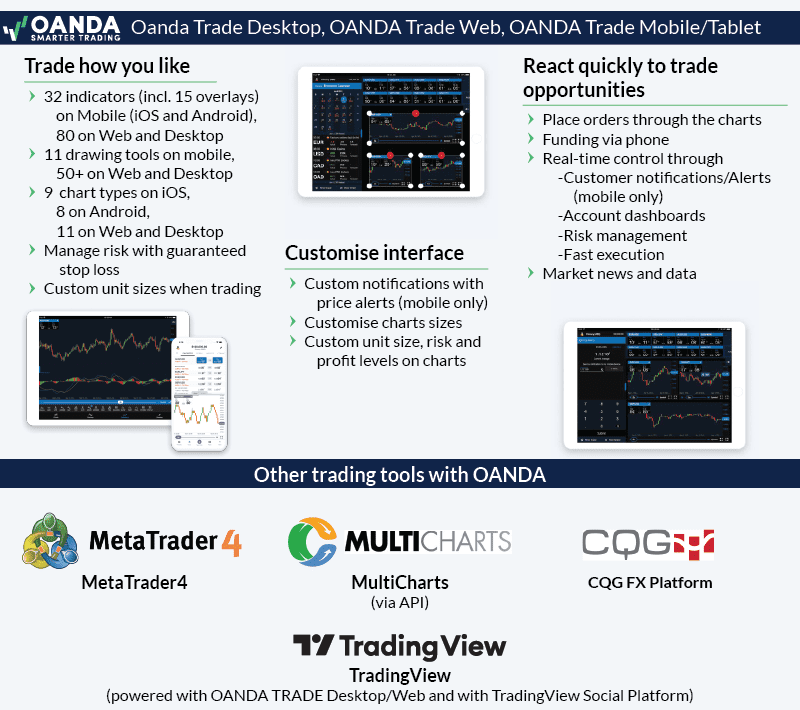

Good trading platforms should make it easy to trading CFDs.Types of CFDs include indices, forex, metals and cryptocurrencies. Our team has compared the best CFD trading platforms from MAS regulated forex brokers for Singapore traders.

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert

How much money do you need to trade CFD?

To make a trade, you need enough capital to cover margin requirements. This margin will vary depending on the trade with, the how much leverage you use and the size of your trade. Some broker may also have a minimum deposit requirement to open an account.