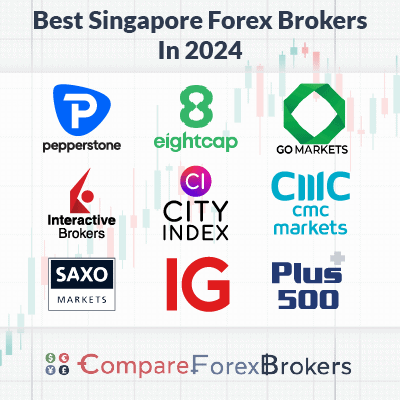

What Are the Best Forex Brokers In Singapore?

Currency trading in Singapore requires a MAS regulated foreign exchange broker with the best Singapore forex brokers offering low spreads, CFDs and MT4.

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert

Is forex trading illegal in Singapore?

N0, forex trading is legal in Singapore however it is highly recommended to use a broker that is regulated by Singapore’s financial regulator known as the the Monetary Authority Singapore (MAS).

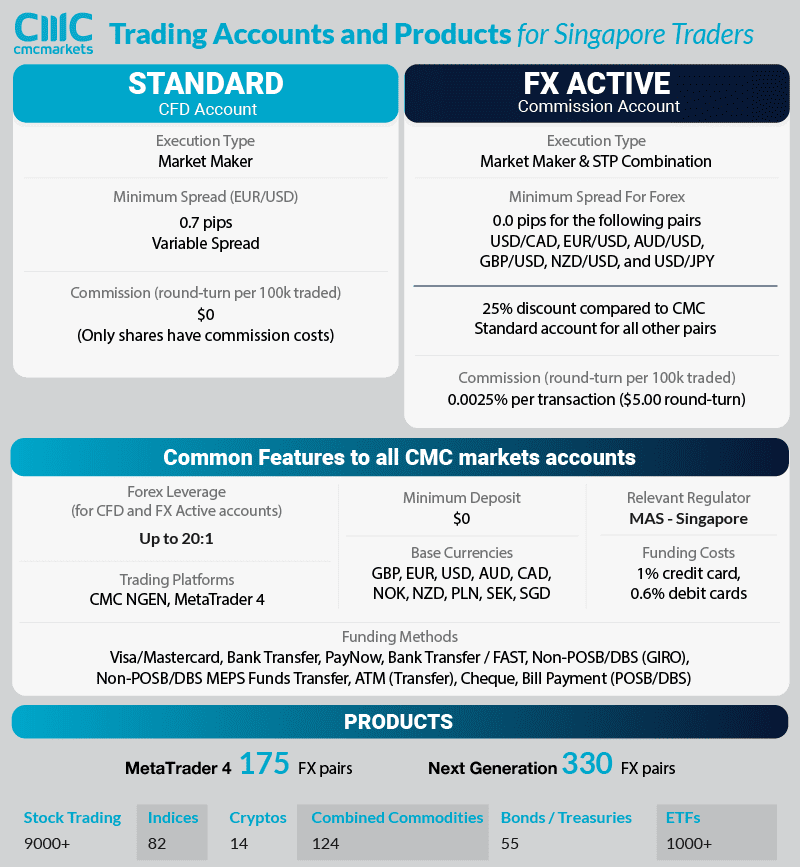

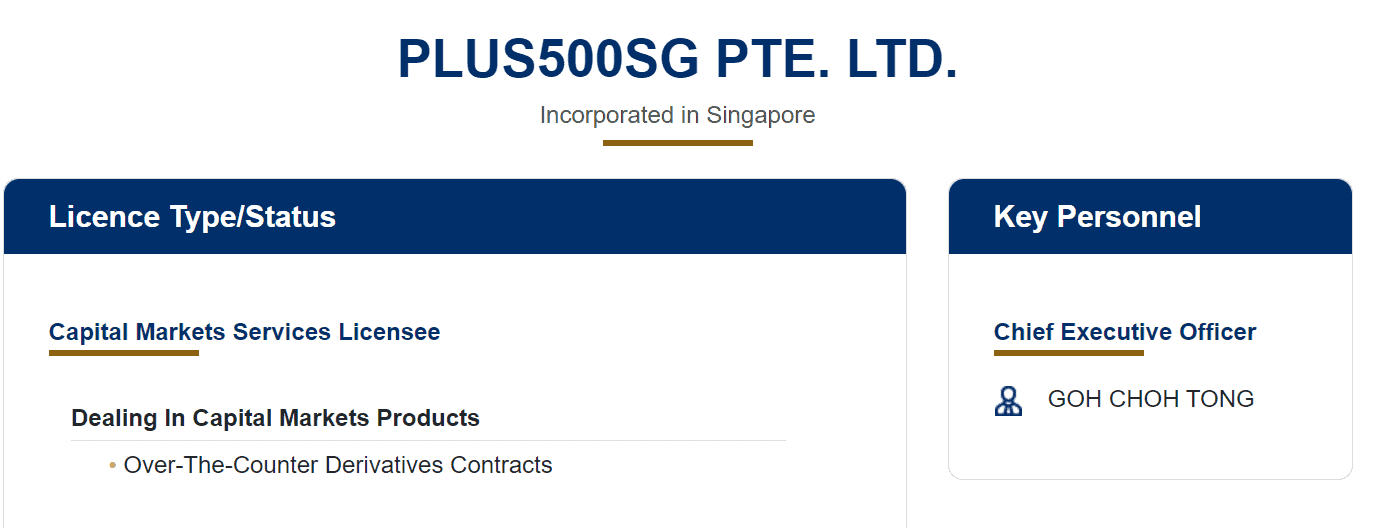

Brokers regulated by this authority include Oanda, CMC Markets, Swissquote, Plus500

What is the most popular commodity traded through Singapore CFD brokers? What leverage can I get trading it?

Gold is the most popular commodity to trade with Singapore CFD brokers. The leverage available is 5:1 (20% initial margin). Other commodities such as Silver, Oil also have the same leverage.