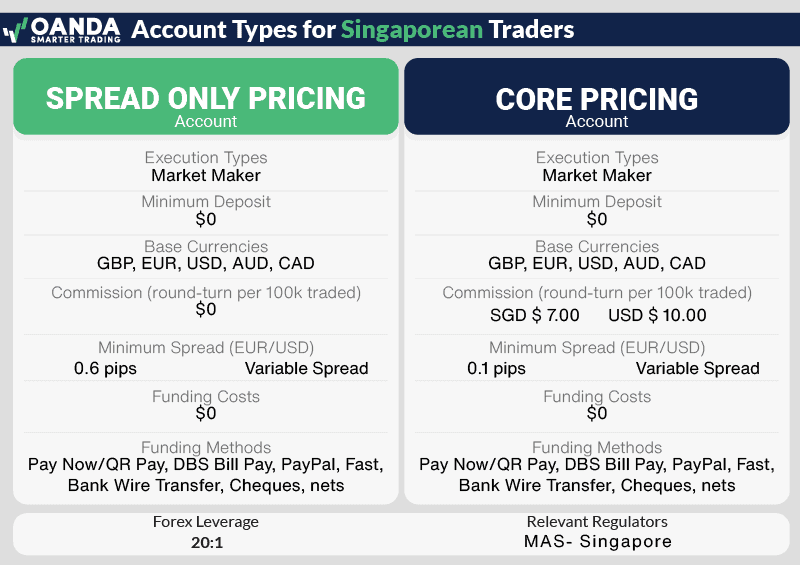

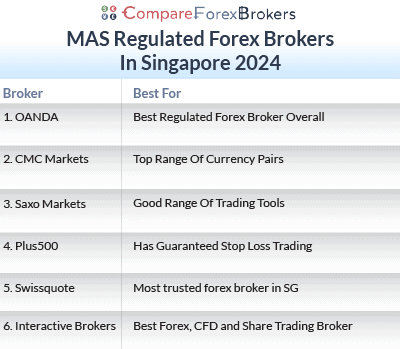

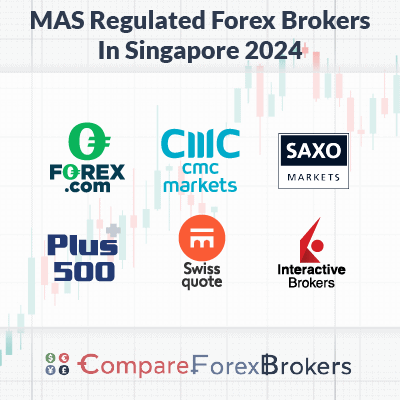

MAS Regulated Forex Brokers

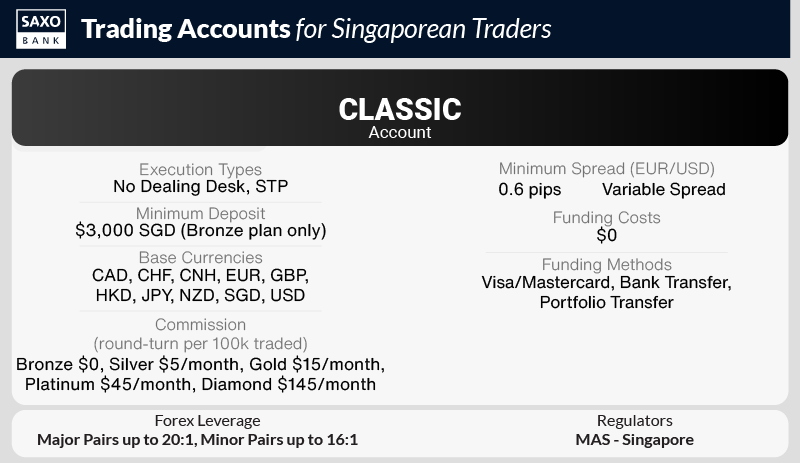

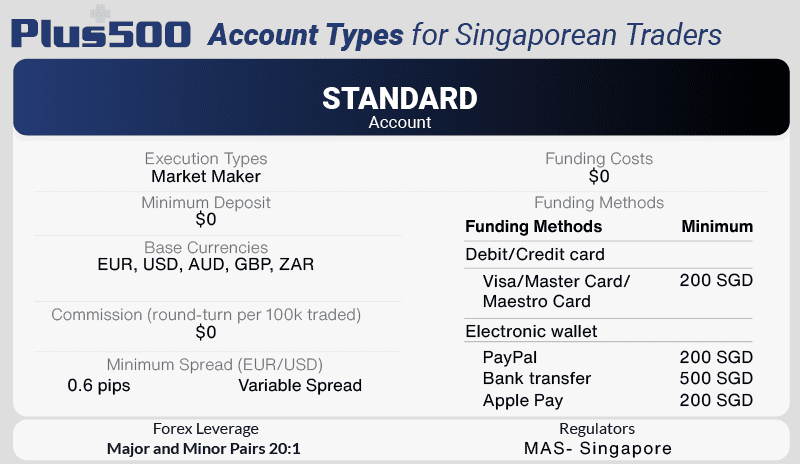

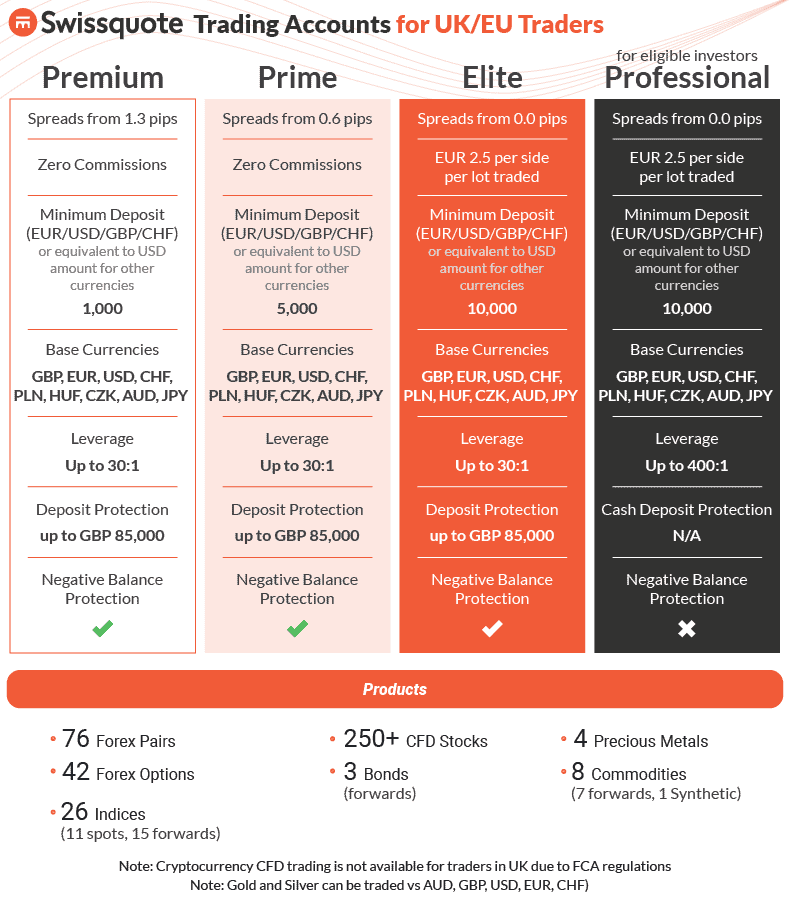

Top forex brokers are MAS regulated (Monetary Authority of Singapore). We review the best MAS regulated forex brokers based on trading platforms, CFDs, minimum deposits and fees, trading accounts, spreads and demo accounts.

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert