Best Forex Brokers for fast VPS

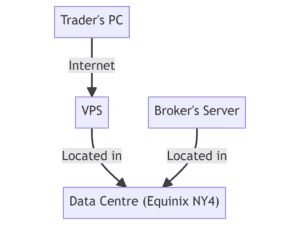

The Spread-Bet.co.uk team tested 15 brokers using MetaTrader 4 with Virtual Private Servers (VPS) to find which forex brokers have the fastest execution speeds. Read on to find the best brokers for trading with VPS.

Our spread bet content is supported and we may receive payment when you visit a partner site.