IG Spread Betting Review

IG Markets offers excellent trading conditions and competitive spreads. For my IG spread betting review, I’ve tested the broker’s costs, services, and platforms, and I’ll discuss its strengths and weaknesses to help you decide if IG is the best for your situation.

My Take

My Take

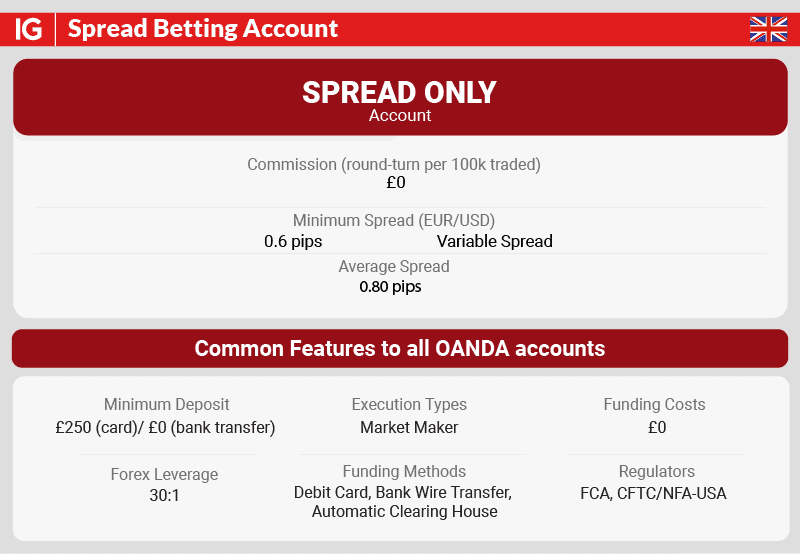

Fees

Fees

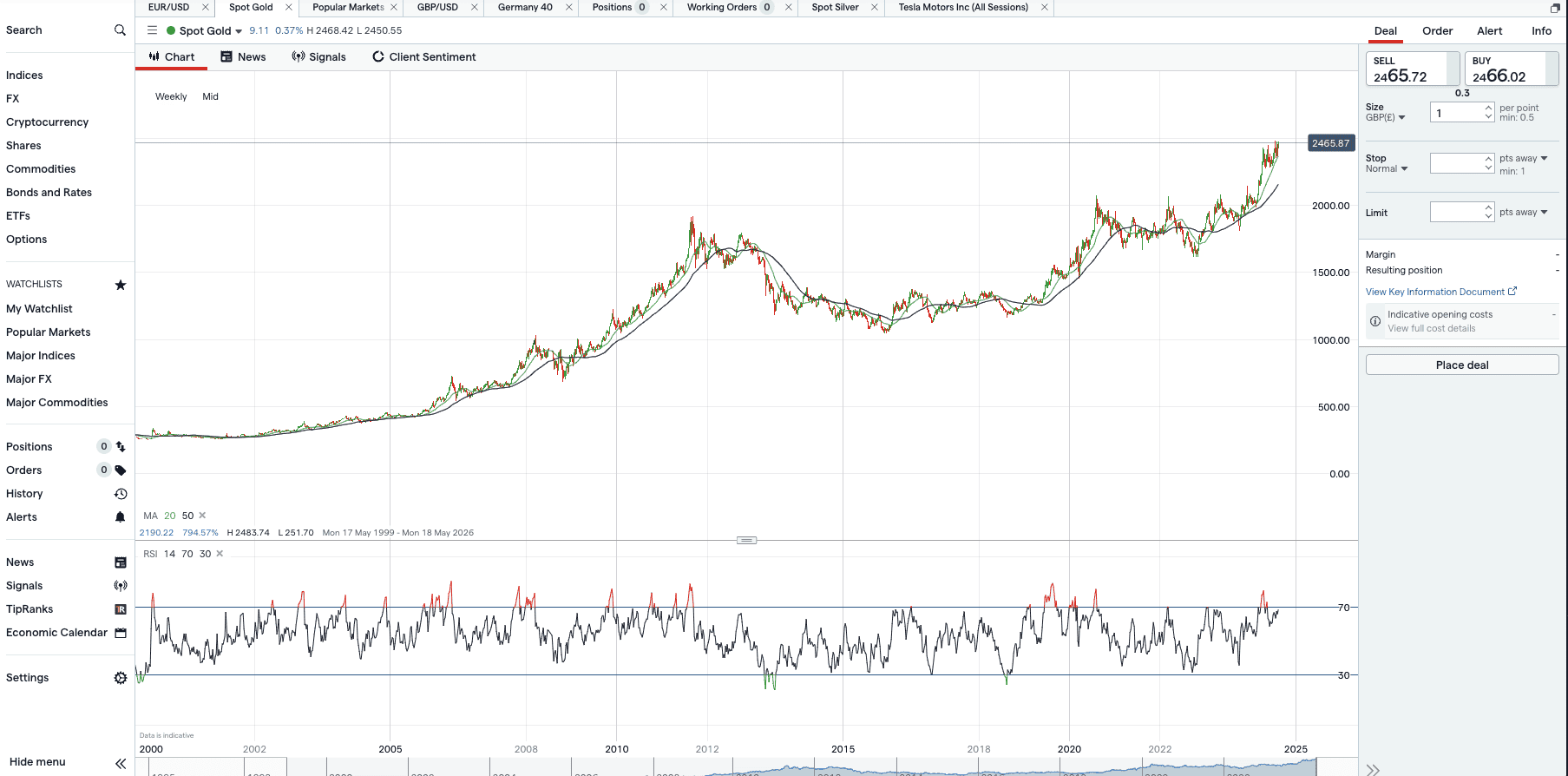

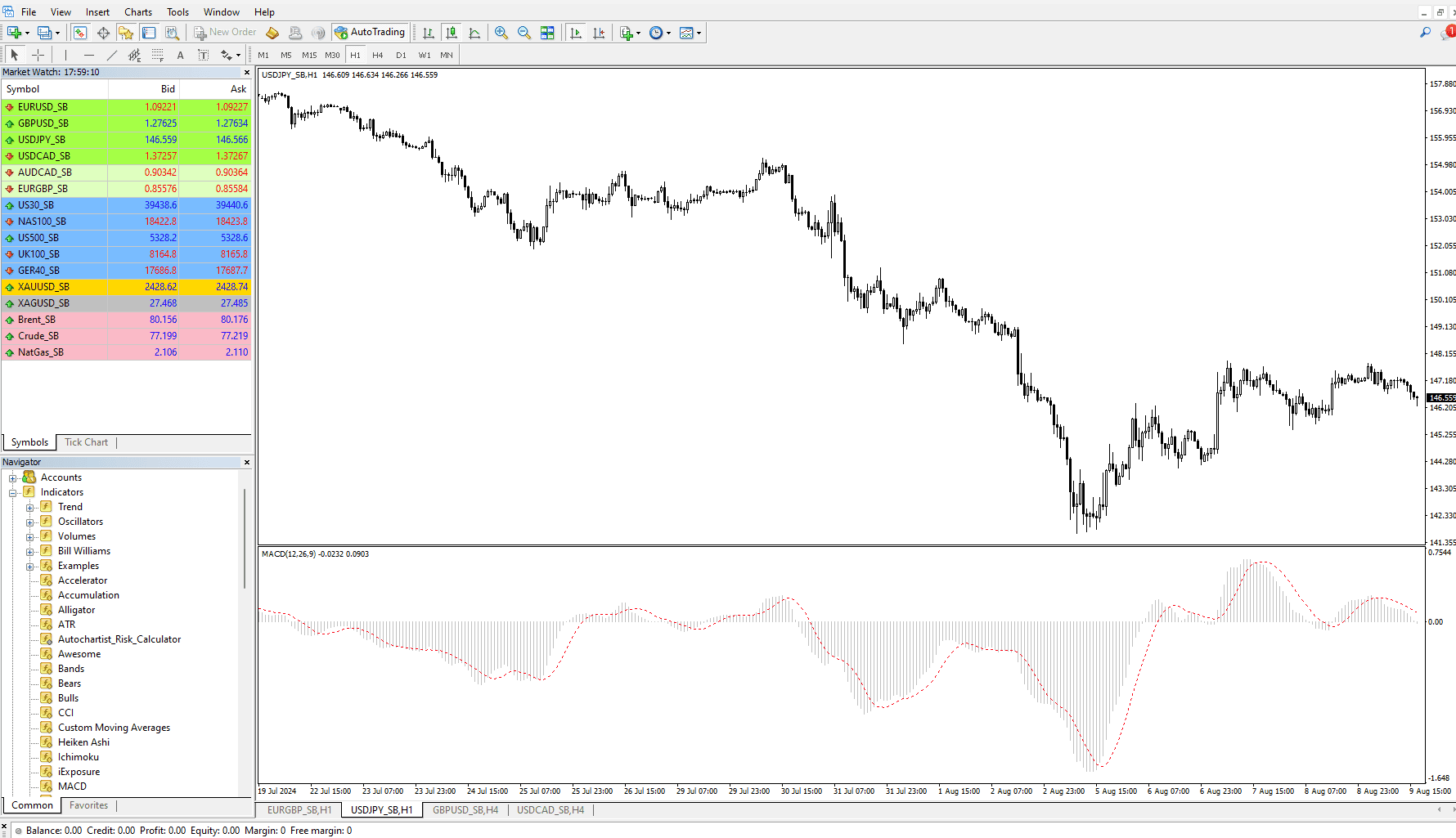

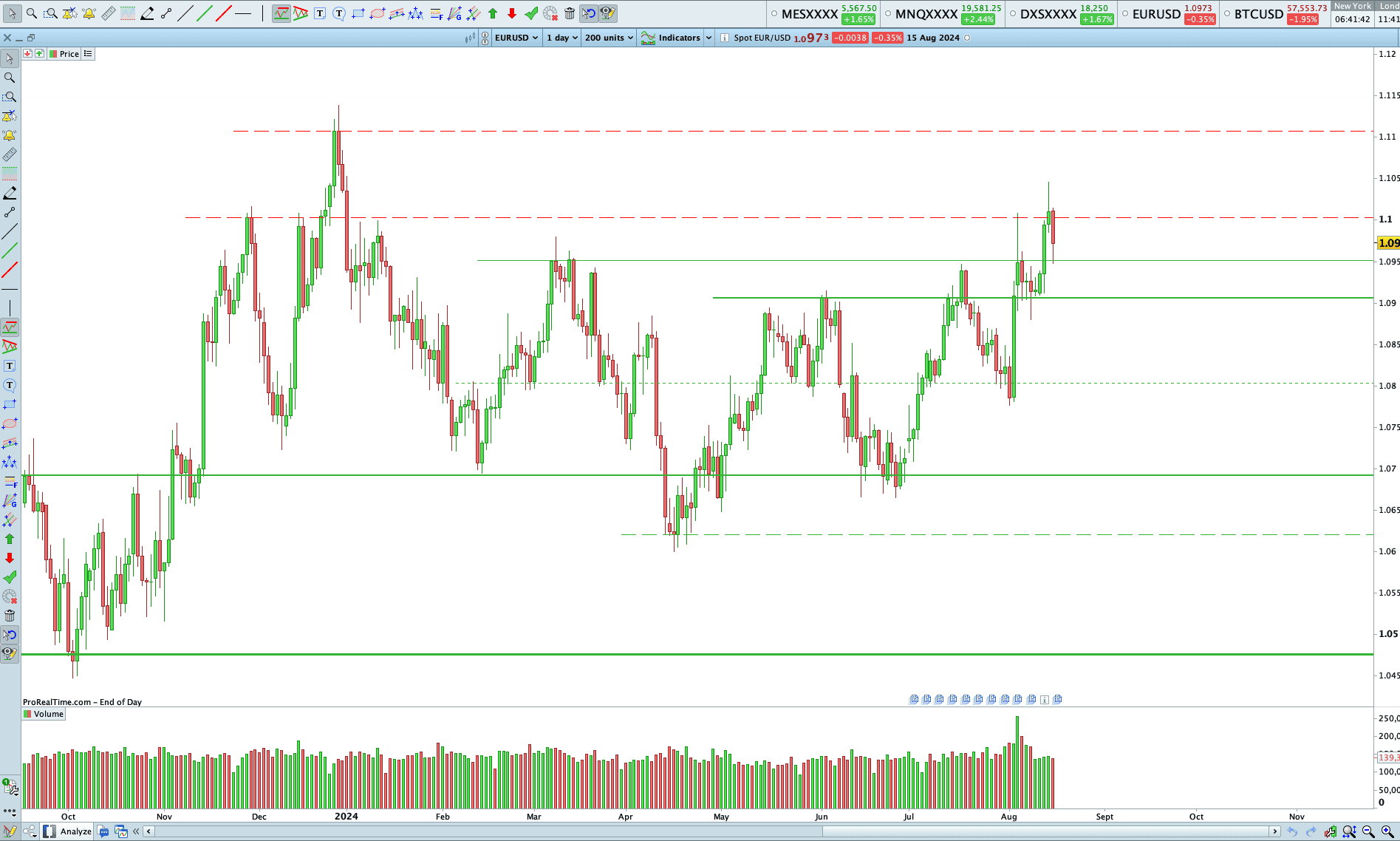

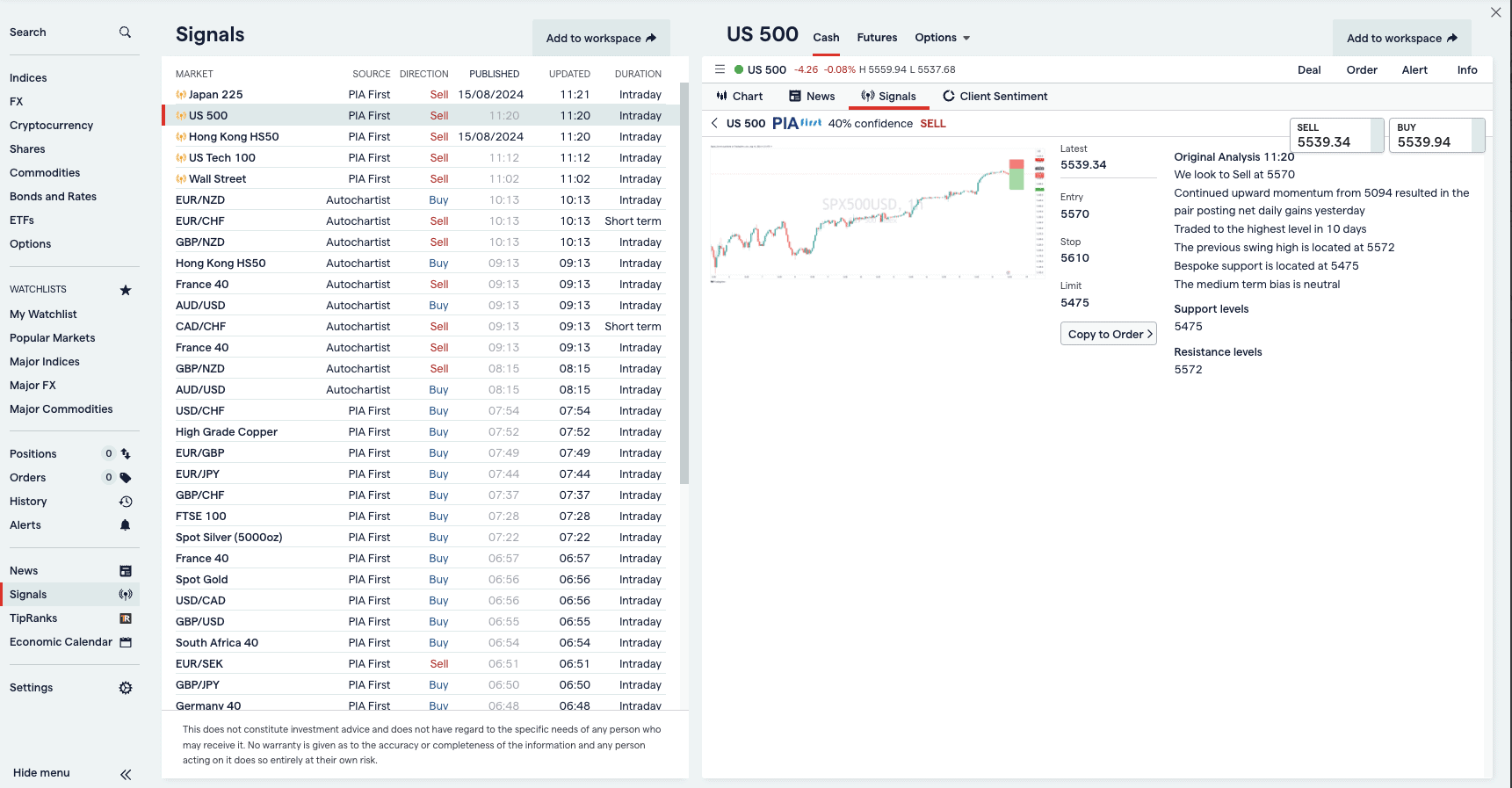

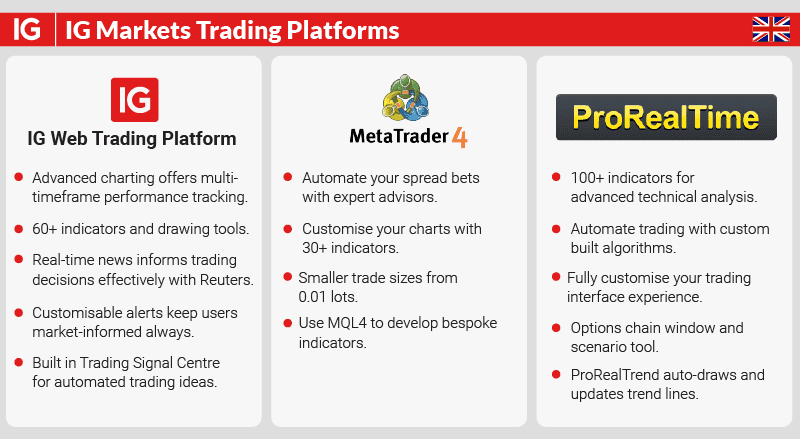

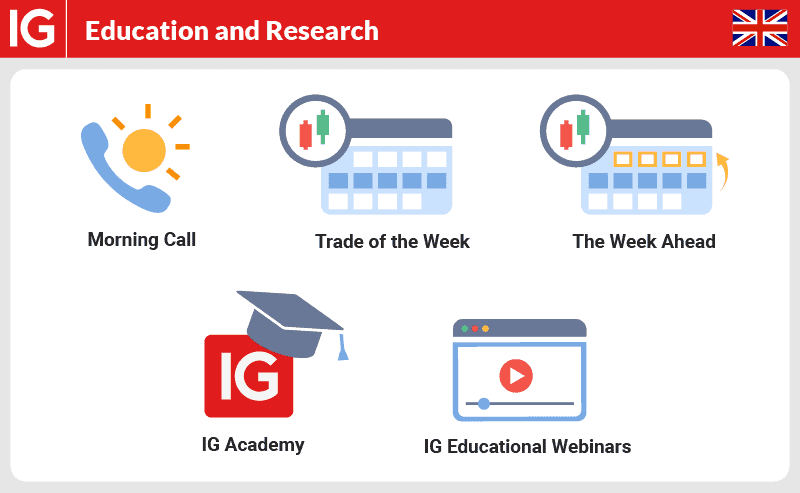

Platforms

Platforms

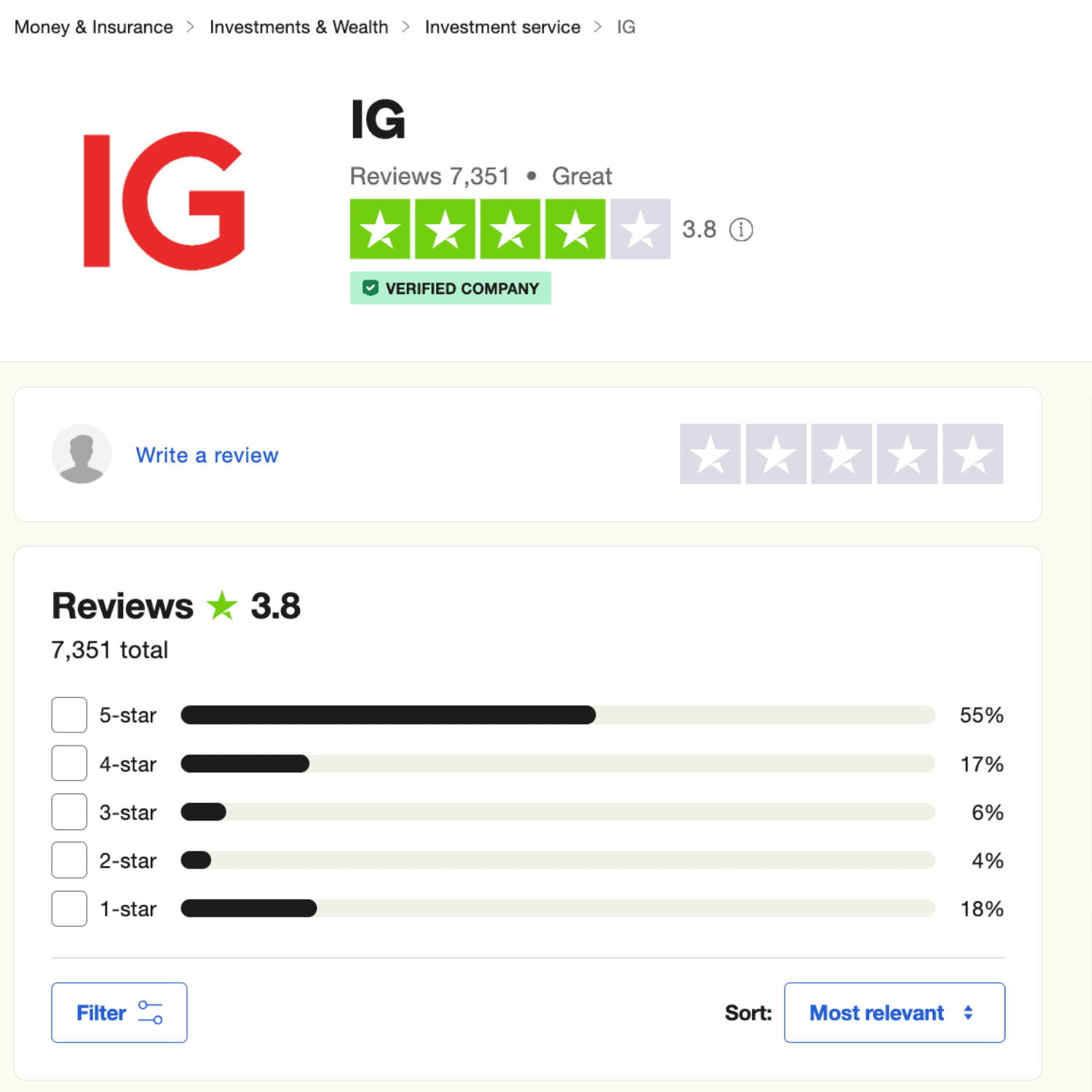

Trust

Trust

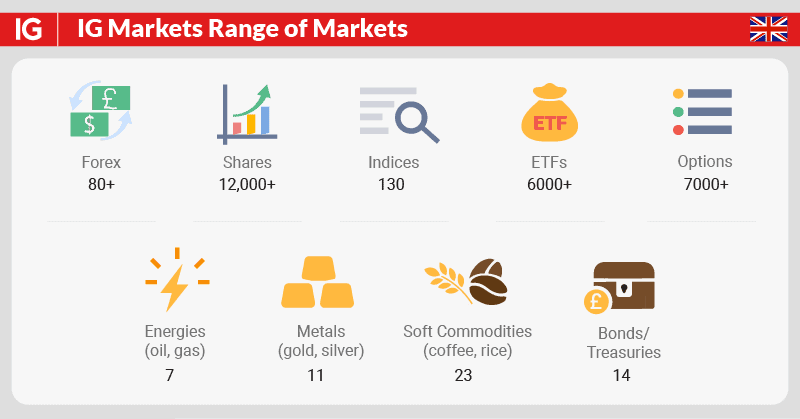

Markets

Markets

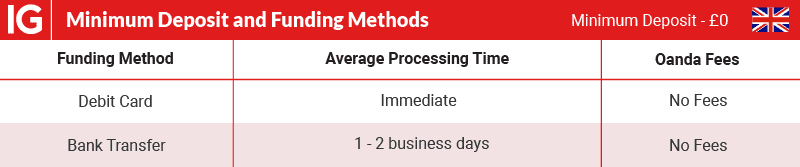

Funding

Funding

Customer Support

Customer Support

Ask an Expert

How does IG Markets’ platform perform for spread betting?

IG Markets’ platform is highly regarded for its performance and features, making it a strong choice for spread betting.

Are IG Markets’ spreads competitive compared to other brokers?

Yes, IG Markets offers competitive spreads, especially on forex and major indices.