Spread betting allows you to speculate on the price of gold without owning the underlying market. In this article, I’ll explore spread betting gold in detail and explore how you can take advantage of these price movements.

Spread Betting with gold can be explained as a type of derivatives trading where you speculate or bet that the future price movement of gold will rise or fall. If you think the price will go up, you can profit from being long, if you think the price will go down, you can profit from being short.

In this post, we’ll take a deep dive into the finer points of spread betting gold. You’ll learn why it’s interesting, how it works, and which is the best spread betting broker to do it with.

Why Spread Bet With Gold?

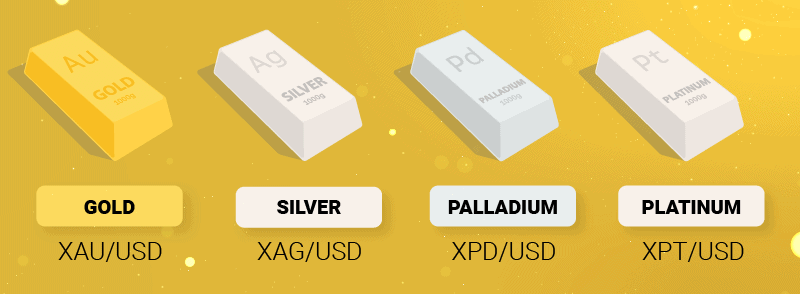

People like to spread bet with gold specifically because it allows you to bet on one of the rarest precious metals in the world without owning the commodity. Precious metals like gold, silver, palladium, and platinum are popular because people have confidence in their value, which can be attributed to factors such as rarity and usefulness. Most of all they are corrosion-resistant meaning they last a long time (if not forever).

| Why Spread Bet With Gold | |

|---|---|

| A Precious metal | It's rare, valuable and doesn't no corrode |

| Don't own asset / underlying instrument | No holding or storage cost |

| Good for frequent and short-term betters | No time delayed due to exchange of hands |

| A good hedge | Maintains value and has a positive correlation |

| Why Spread Bet | |

| Can use leverage | Margin trading means you don't need large amounts of cash |

| Easier to access | Easier to trade with an online broker than a gold dealer |

| Tax exemptions | No capital gains tax or stamp duty as you don't own the asset |

| No currency conversion fees | Spread betting is done with GBP not USD |

Another reason is that gold is costly to store, spread betting does not require you to own the underlying asset. Not owning the assets also means there is no time-consuming exchange of the asset making it a good choice for frequent and short-term betting.

Lastly gold is a good hedge. For example, when geo-political or economic factors such as inflation weaken the USD, gold is a popular investment option as it maintains with intrinsic value. It also acts as a good hedge or counterweight to other assets such as commodity-based currency pairs or stocks that mine gold since there is a positive correlation between the two.

As you can see from the image above, I have overlaid the price of gold with AUD/USD to demonstrate its correlation.

How Does Spread Betting With Gold Work?

The process for spread betting on gold is relatively simple, and all spread betting companies offer a gold market, making it easily accessible.

You can make spread bets on gold and other precious metals in different currencies, and each is impacted slightly differently. You will find that the most common currency to bet on precious metals is the USD, and depending on which platform you are using, you may see the ticker of gold and other precious metals differently.

If you trade using MT4/MT5, then you will see the precious metals as tickers, which are:

- XAU/USD

- XAG/USD

Whereas on proprietary platforms like the one IG has, they make it easier for you by labelling the assets by their names. TradingView uses the combination of the name and the ticket symbol.

1. Load up your favourite platform

As gold is a popular commodity to spread bet, all spread betting platforms have access to gold markets. I like to use the MetaTrader 4 platform as it allows me to completely customise my platform and use my custom indicators to pick out potential trade ideas.

2. Do your research

Gold is sensitive to technical and fundamental analysis, so it is essential to understand the current economic policies affecting the price of gold before implementing your trading strategy.

For example, suppose the world economies are in an inflationary period. In that case, it makes no sense to look for short positions in gold while using technical analysis, as these positions have a lower chance of success because the overall data points to gold moving up.

3. Enter the position

Once you have researched and found an opportunity to bet, the next step is to place a bet based on the analysis.

Placing a bet on spread betting platforms is similar; you just open a betting ticket and input your bet details.

4. Manage the bet

Gold is a volatile asset and can quickly move up and down a few points within minutes, so it’s a good idea to keep an eye on it. Alternatively, you could place a stop loss and a take profit, and these orders will automatically close your trade if the market reaches the prices you set. If the market reaches your stop loss, it will close your position in a loss; if it reaches your take profit, your bet will close in a profit.

5. Closing the bet

If you are in a profitable position and happy with the current profit, you can exit the trade manually by pressing the “close trade” button on your spread betting platform.

Broker That Offers Gold Spread Betting

All UK-regulated spread betting firms offer gold as an price instrument to bet against (long or short). The main variables between these brokers are the fees (the spread) they charge against gold trading which has a variance of up to 75% based on our research.

Other factors to consider when comparing spread betting brokers that offer gold include customer service, funding options, customer support levels and other markets offered. You can view our comparison page of providers or the Pepperstone review page which we named the 2025 best spread betting platform for the second year in a row.

Why Is Gold Spread Betting Popular?

The popularity of spread betting gold tends to correlate with the popularity of buying and selling gold across the globe. Pick just about any country on the map, whether it’s India, the USA, the UK, or Myanmar, and you’ll be sure to find an active gold trading industry.

Let’s take a deeper dive and look at some of the factors that make spread betting gold an interesting activity…

1. A Precious Metal

Gold is the original precious metal, where for multiple millennia, societies have stored their wealth and used the shiny metal as an exchange of value.

As we moved into the financialised, digital age in the past few decades, human nature has shone through, and betting on the price of gold has become popular.

2. Stable

While the price of gold can be volatile at times, historically it holds up better than the stock market. When a stock market crashes, the downswings can be enormous, whereas gold retains its value comparatively better.

3. Makes A Good Hedge

Gold has historically been a good hedge against inflation and in times of war or global chaos. If you ever hear of rumblings about a new war on the horizon, you’ll be sure to see sudden movement in the price of gold.

4. Leverage

Spread betting gold allows you to take a small amount of capital, and through the use of leverage, take on a large trading position. This has the effect of greatly increasing the size of your potential profits and losses when trading the product.

5. Low Spreads

With gold being traded heavily across the globe, both at a retail level, amongst institutions, on trading floors, and via spread betting and CFD brokers, there is a very thick market for the product, and that means the gold trading spreads tend to be very tight.

6. No Capital Gains Tax

For traders in the UK, if you choose to spread bet, your profits will often be completely tax-free. This is due to the HMRC classifying spread betting as a form of gambling.

7. Commission Free Trading

When actively trading, paying commissions every time you enter and exit a trade can kill your profitability. With gold spread betting, you’re often not paying any commissions.

8. 24 Hours Trading

Gold is traded 24 hours per day, 5 days per week. This means that you can have a trading position, place a stop loss, and not have to worry about the price gapping and causing a huge loss while the market is closed. Another benefit of 24-hour trading is that you’re able to day trade at any hour, which can help you to fit your trading activities around your day job.

Who Trades Gold And Precious Metals?

Retail Traders (spread bettors) bet on precious metals and other commodities to speculate on the betting market direction without having to own the underlying asset or buy and hold the asset.

Institutional investors (hedge funds, funds/ETFs, pension funds) use strategies involving precious metals and would acquire gold itself or buy into companies that also profit off the price of gold. This gives you indirect exposure to gold.

Central banks buy gold as foreign exchange reserves and buy or sell based on how they manage the reserves. Gold Mining companies will buy futures to hedge against the change in price from when they mine to when they sell it.

Is Spread Betting Gold Good For Beginners?

When you begin spread betting, one of the first decisions you have is choosing which product to trade. For many people, that may well be gold.

Gold is widely followed, traded around the clock, and is known in the industry to have reasonably easy-to-read price action. If that sounds enticing, all you have to do is open a spread bet account and pick the right trading platform.

Gold Spread Betting Examples

Gold spread betting can seem a little complicated at first, but you should be able to quickly get the hang of it. Let’s examine a few trading examples of spread betting gold:

Example 1: Spread Bet Gold Profit

The price of gold is trading at 2,300, and with news out of the Middle East indicating there may be a new war on the horizon, you start thinking that the price of gold will rise.

You load up your spread betting platform, and take a long position in gold, for a value of £10 per point. You’re now positioned to profit £10 for every point that the price of gold rises.

One morning, you awake to news of the start of a major new conflict, spooking the world and spiking the price of gold.

You check your spread betting platform and see that gold is trading at 2580, 280 points higher than when you entered your position.

You decide to take profits on your successful trade and close the position at 2580, locking in a profit of 280 points for a total value of £2800 profit.

Example 2: Spread Bet Gold Loss

Let’s take the same scenario, where you’re bullish on gold, and it’s currently trading at 2070.

You get long at 2,300 for a value of £10 per point.

You’re expecting a conflict to erupt in the Middle East, but you awaken one day to news of a ground-breaking peace agreement. It’s great news for the world, but it’s not great news for your gold position.

You quickly load up your spread betting platform, and see that the price of gold is now trading at 2,220, a total of 80 points below where you entered.

You decide to cut your losses at this point and close the position for an 80-point loss, locking in a total loss of £800.

Ways To Spread Bet Gold

While spread betting is a simple and tax-free way to trade the price of gold, there are other trading products that may interest you. Products such as futures, CFDs, gold-index products, and even gold stock CFDs are alternative ways to speculate on the price of gold.

Why Is Gold A Safe Bet?

With gold, it’s been a form of currency and store of wealth for literally thousands of years, so you know the product itself is legitimate, as opposed to a new cryptocurrency or a smallcap stock.

Though it must be said, there are still risks inherent in trading and spread betting, so it’s hugely important to have a well-thought-out risk management plan before placing your first spread bet.

What Leverage Can I Use With Gold?

Due to FCA regulation in the UK, spread betting companies will offer 20:1 leverage on gold and precious metals spread bets. That means that you’ll be able to hold a position of 20 times the value of the margin you have available in your account.

Strategies To Spread Bet Gold And Metals Effectively

There are countless trading strategies available that will help you to spread bet on the price of gold and other metals. These range from break-out trades, to trend following, to scalping around news announcements. What’s most important is that you backtest a strategy and really try to master it.

FAQ

Why Gold Has High Spreads

At times, you will find that gold has unusually high spreads. This usually coincides with factors such as market volatility, lack of liquidity due to a holiday, traders being away from their desks, or even upcoming economic news.

It’s a good idea to use our spread betting calculator before you place your spread bet, just to double-check your numbers and make sure you’re intelligently managing your trading risk.

How Do You Bet On Gold Prices?

Betting on the price of gold is extremely simple if you understand a few concepts. Ideas such as going long or short, the trading spread, and the use of leverage should be studied before you place your first spread bet.

How Does The Spread Bet Work?

Spread betting involves deciding which way the price of a product will move, whether up or down, then deciding which direction you’ll bet on, and then deciding how much risk you’d like to take. If you’re long and the price moves up, you’ll make a profit, if you’re short and the price moves down, you’ll also make a profit, but if things don’t go as planned, you’ll make a loss.

How Do I Win If I Bet On The Spread?

Spread betting involves having some insight into the likely future direction of the price of an asset, and then betting on it to either go up or down. It’s simple, but it’s not always so easy, successful spread betting involves knowing how to read charts, how to manage risk and keeping your mindset in check.

Ask an Expert

Is spread betting on gold a good hedge against inflation?

Yes, gold is often used as a hedge against inflation because its value tends to rise when currencies weaken.

How does gold compare to other commodities for spread betting?

Gold is more stable than some other commodities like oil, but it still has enough volatility to make trading interesting.