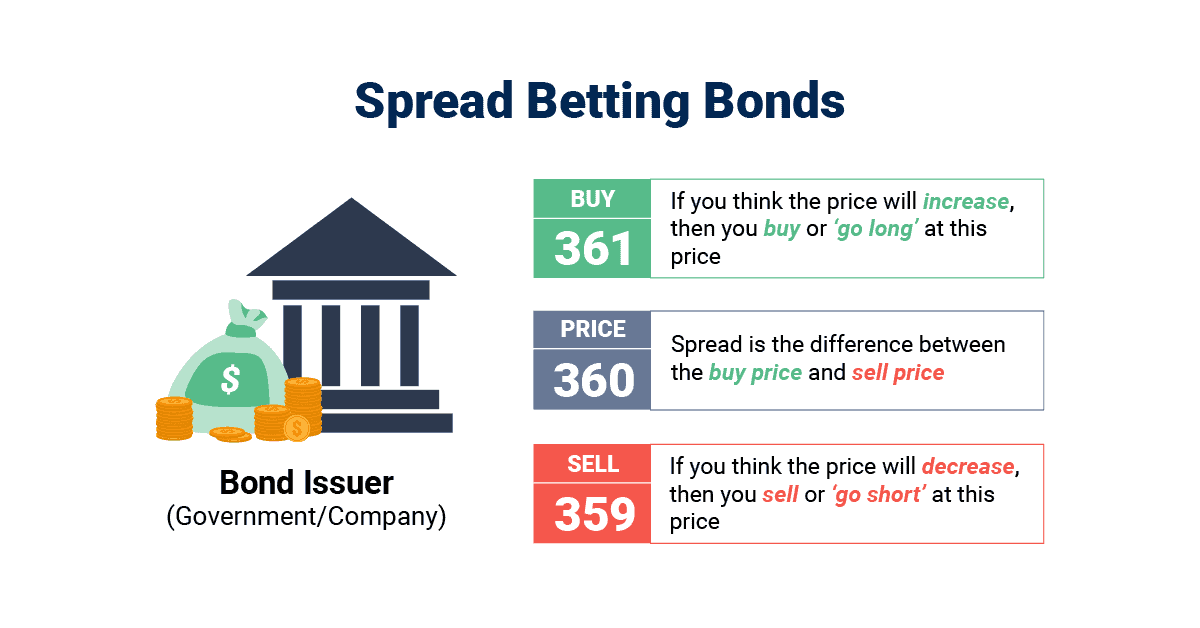

Spread betting bonds are a way of profiting from the price movements of bonds without owning the underlying bond itself.

The use of bonds is just another way to spread bet much like with any other type of financial instrument such as stocks, currency pairs, gold, commodities, or indices. The only difference is that you’re spread betting on the price movements of government or corporate bonds.

As spread betting is a derivative financial product, it allows you to go long (buy) and short (sell) so you can profit in rising and falling markets. On this page, I will look at some of the elements you need to know to spread betting with bonds.

Why Spread Betting With Bonds?

In my opinion, spread betting with bonds offers a flexible way to bet on the price movements of bond markets. The fact you don’t need to own the product makes it appealing for short-term trading as trades as you can enter and exit trades very quickly. You’ll also find that spread betting with bonds has the following benefits:

1. You Can ‘Go Long’ or ‘Go Short’

As spread betting is a derivative product (meaning you don’t own the underlying asset), you can speculate on the bond’s price rising (going long) and falling (going short). Being able to bet in both directions opens more potential betting opportunities for day trading and in bullish or bearish markets.

2. No Commission and Low Spreads

When you place a bet on a bond market, you will only be charged a spread, meaning you do not pay any commission or taxes that you would typically have to with traditional bond purchases.

3. Tax Benefits

With spread betting being a derivative product, you’ll find that you do not have to pay capital gains taxes or stamp duty tax on bond purchases. This is because you are not purchasing the bond, all you are doing is betting on the price direction, which is why taxes are not charged (unless you are a professional trader). Being exempt from these two taxes can reduce your trading costs further.

| Feature | Spread Betting Bonds | Traditional Bond Trading |

| Asset Ownership | No | Yes |

| Trading Costs | Spread | Spread + Commission + Stamp Duty on Purchase |

| Leverage | Yes | No |

| Market Direction | Long and Short | Only Long |

| Stamp Duty | No | Yes |

| Capital Gains Tax | No | Yes |

4. More Stable

Government bonds in particular are considered to be one of the most stable types of securities. Bond price movements are much less volatile than other instruments such as currency pairs or stocks. In my opinion, this makes spread betting on bonds a safer choice compared to spread betting on other types of securities.

5. Leverage

Leverage is a tool that allows you to control larger positions by depositing a fraction of the total asset value. This means you don’t need to have large amounts of funds in your trading account to make notable profits.

For example, if the leverage was 1:10, you could control £1,000 worth of bonds for just £100. You can use leverage to magnify your potential profits, but it can also amplify your losses if the financial market moves against you.

Leverage can also be referred to as margin requirement.

6. Diversify Your Betting Portfolio

I use bonds to diversify my betting portfolio. Not only can it be a useful hedge against other financial instruments but you can spread bet using a wide number of bond markets such as government bonds and corporate bonds.

Spread betting works in various bond markets across major countries like the US, Japan, and the UK. Because you are speculating on the bond’s price, not the yield it will generate, paying attention to factors like interest rates, economic data releases, and geopolitical events is essential. These fundamental events will have the highest impact on the bond’s price.

Below, I’ll share the most common bonds available with spread betting companies:

- US Treasury bonds: The US government issues these, considered the safest bonds in the world.

- UK gilts: These are bonds issued by the UK government.

- German Bunds: These are bonds issued by the German government.

- Japanese government bonds: These are bonds issued by the Japanese government.

What Are Bonds?

Bonds are a type of financial security issued by companies or governments to raise money. In exchange for your money, the bond issuer promises to pay you (as the bond holder) interest at a fixed rate (called the coupon).

How Do You Trade Bonds?

The process of spread betting on bonds is relatively straightforward. Here are the basic steps:

1. Choose the bond you want to bet on.

Your broker will have access to various bonds available to spread bet on. I recommend you choose one and get to know the market. I find that the bond markets are easier compared to spread betting on the stock market or forex, because it respects technical analysis better in my opinion.

2. Decide whether you think the price of the bond will rise or fall.

After choosing your market and completing your analysis, decide whether you think the market will rise or fall.

3. Set your stake.

On your deal ticket, set the stake you wish to risk per point, and you will profit (or lose) every time the market moves. Populating the stake field will show you how much margin is required to open the bet.

4. Place your bet.

Execute your bet by clicking the “Buy” or “Sell” button, which will make your bet live. You’ll receive confirmation of the price you entered and notice your Profit/Loss moving up and down.

5. Monitor your position and close it.

While the bet is open, you should continually monitor your position and judge when you should exit the position at the sell price at either a loss or a profit before expiry. Alternatively, you can enter a stop loss and take profit orders that automatically close your position if the financial market reaches the order levels.

How Does Spread Betting With Bonds Work?

How you profit in spread betting is similar to how you profit from traditional investments and CFD trading. If you believe the asset’s price will rise and you went long (bought) a spread bet, you will profit for every point the price rises and lose every time it falls.

Alternatively, if you believe the market will fall and you went short (sold) a spread bet, you will profit for every point the price falls but make a loss every point it rises. The profit or loss on a spread betting position is calculated by multiplying the size of the bet by the difference between the opening and closing prices of the asset.

To calculate profit from a long spread bet on UK Gilt:

- Gilt Open Price: 96.50

- Stake Per Point (Bet Size): £10

- Gilt Closing Price: 96.75

- Point Increase: 25 points ( 96.75 – 96.50)

- Stake Per Point (£10) x Point Increase (25) = Profit (£250).

To calculate profit from a short spread bet on UK Gilt:

- Gilt Open Price: 96.50

- Stake Per Point (Bet Size): £5

- Gilt Closing Price: 96.45

- Point Decrease: 5 points ( 96.50 – 96.45)

- Stake Per Point (£5) x Point Increase (5) = Profit (£25).

Spread Betting On Bonds Examples

Below I cover 2 examples of a spread bet using bonds, in the first example I ‘go long’, and in the second example I will ‘go short’.

1. Spread Betting On US T-Bond Market

Let’s say that you believe the interest rates will fall, meaning you expect US T-Bond prices to rise. You ‘go long’ when opening a spread bet on the at 116.37 and risk £10 per point.

The interest rates did fall as expected, increasing the US T-Bond price to 116.50 (a 13-point move). You will have made £130 profit from this move (£10 risk per point x 13 point move).

2. Spread Betting German Bunds Example

In their upcoming announcement, let’s say you expect the German central bank to hike interest rates. You ‘go short’ by opening a spread bet amounting to £1 per point at 94.76 to take advantage of this knowledge.

Your prediction was wrong, the German central bank decreased the interest rates, which sent the rate to 94.90, making you 14 points loss or £14 (14 points x £1 per point staked).

Which Spread Betting Brokers Is Best For Bonds Trading?

Not all brokers offer bond and interest markets, so I’ve gone through our best spread betting brokers list and shared some of the ones that have bond markets available to spread bet on.

I believe the best spread betting broker for bonds trading is OANDA because they have low spreads, a wide range of bonds, and they offer 3 platforms for spread betting which are OANDA Trade, MT4, and TradingView. If you use OANDA Trade you can use a guaranteed stop-loss order as well.

Other brokers you can consider who offer good spread betting for bonds include City Index, IG Group, FXCM, CMC Markets, Spreadex, and Market.com.

Ways To Trade Bonds?

Bonds can be traded in the secondary market just like several other types of financial instruments. Some bonds may even be available to trade through an exchange. However, most bonds are traded over-the-counter. I believe the best way to trade bonds is through your broker who may offer bonds as a trading instrument to retail investor accounts.

You can start trading bonds through CFDs, bonds spread betting, spot, options, and bond futures contracts.

Are Bonds Good For Day Trading?

Yes, I think bonds are a good instrument for day trading. This is because bond prices are relatively more stable when compared to other instruments and also have enough liquidity. This can decrease the risk associated with your trading activity. Further, there are several types of bonds available for you to choose from on trading platforms.

FAQ

Is Spread Betting Profitable?

Spread betting can be profitable once you have learnt how do it properly. Just like with any form of trading, spread betting also requires effective risk management. The key to profitable spread betting is to minimize your losses through risk management and find ways to gain healthy profits by making calculated decisions.

Do You Pay Tax On Spread Betting?

Spread betting is not subject to capital gains or stamp duty tax in the UK which means it’s essentially tax-free. However, you may be liable to pay income tax on your profits if you spread bet as a business or if it is the majority of your income.

Is Spread Betting Legal In The UK?

Spread betting on bonds is legal in the UK and the Financial Conduct Authority (FCA) regulates all UK spread betting companies, including those in London, that must follow a strict framework. The FCA is the gold standard when it comes to regulations, which should give peace of mind when choosing a broker.

What Are The Risks Of Spread Betting?

I consider two important types of risk when spread betting: leverage and the volatility of the market. Leverage can increase the risk of outsized losses when price movements are unfavourable since you have borrowed large sums to make the bet. Volatility can increase losses when the price moves too far in the direction against your prediction.

What Other Spread Bet Markets Are Available?

There are six additional spread bet markets in addition to bonds. These includes stocks, forex, commodities, indices, interest rates and commodities.

Ask an Expert