FOREX.com Review 2024

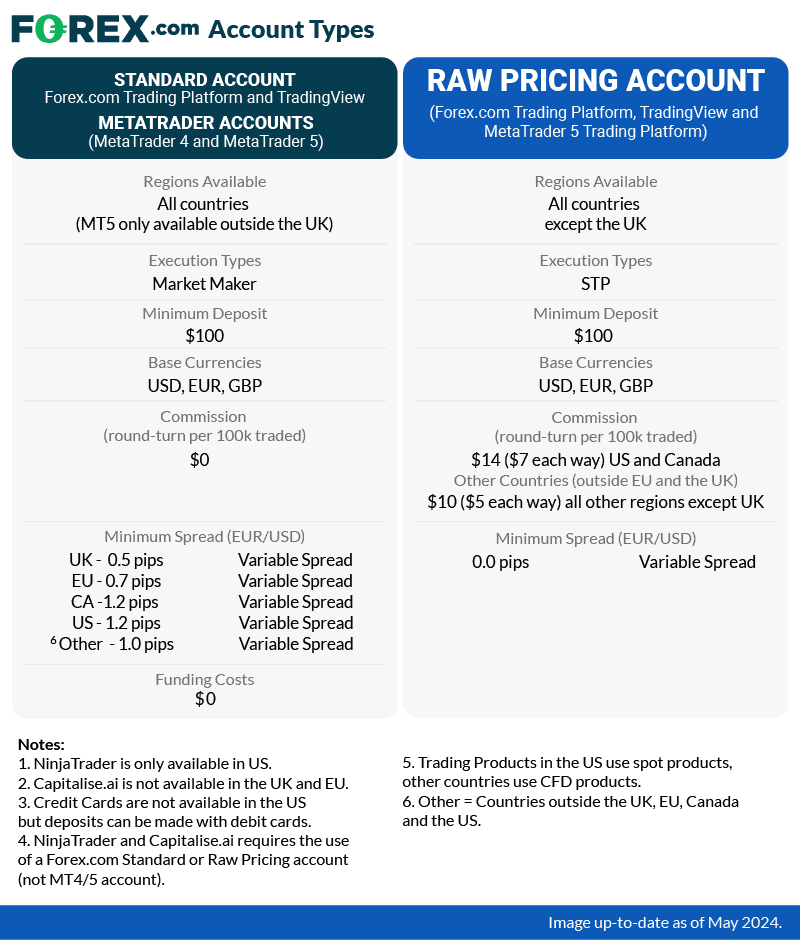

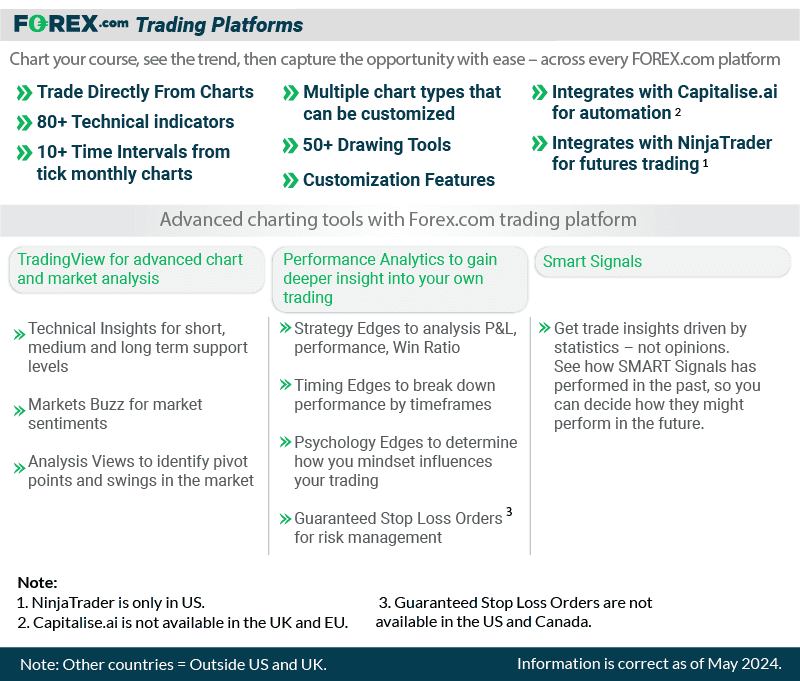

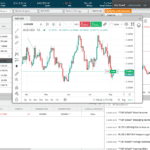

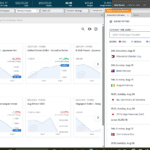

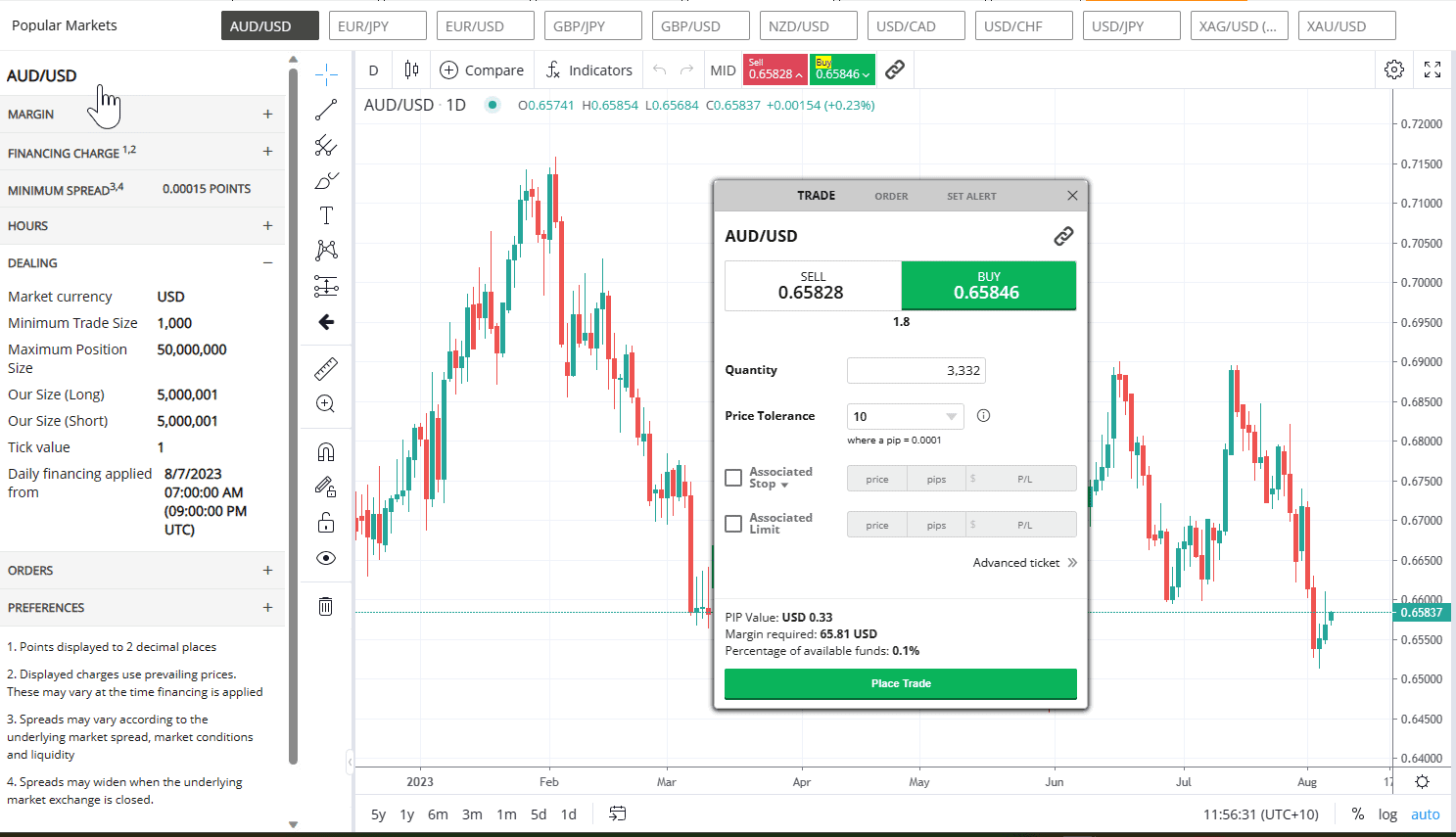

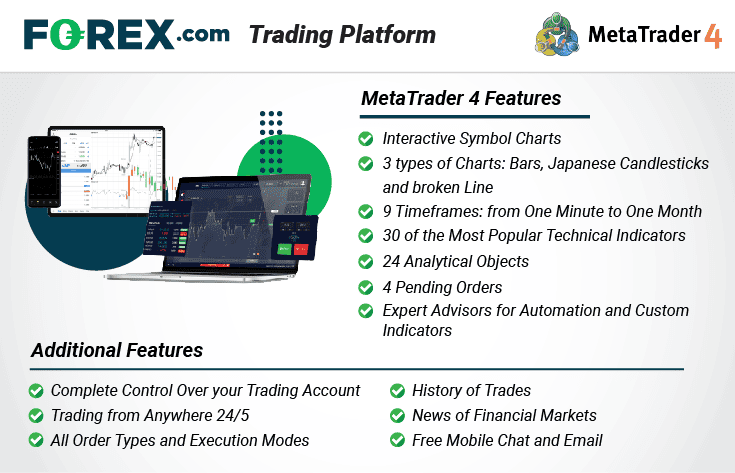

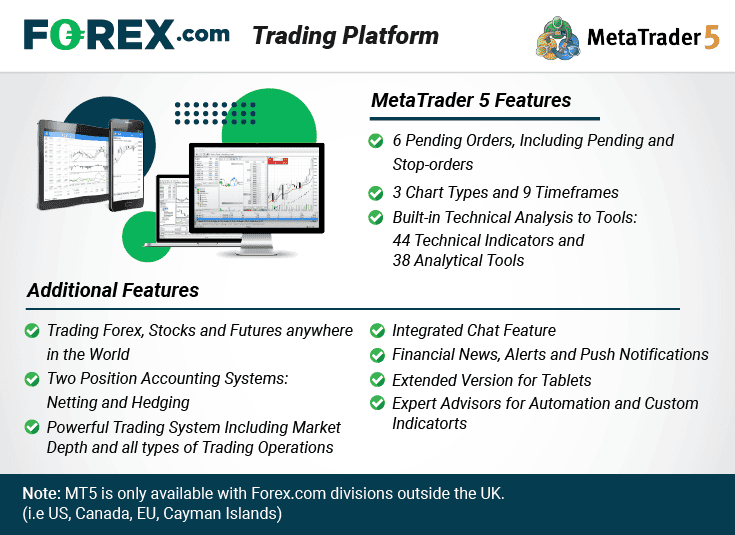

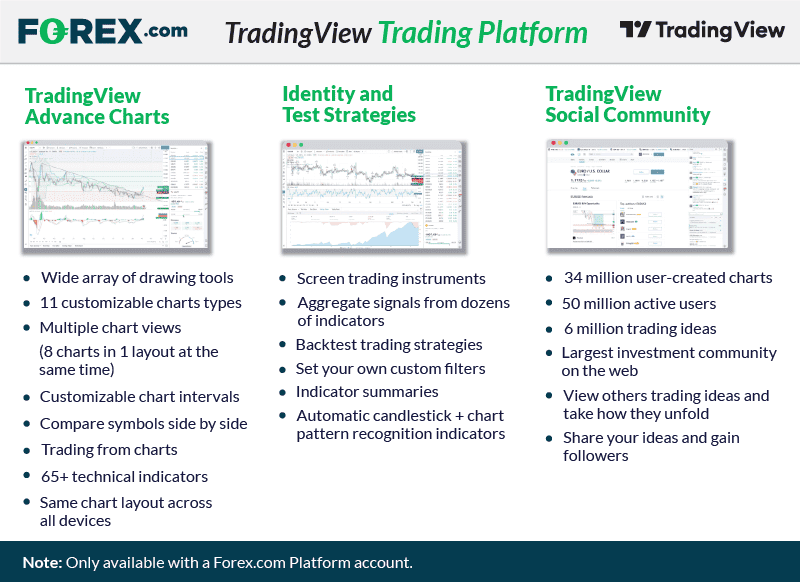

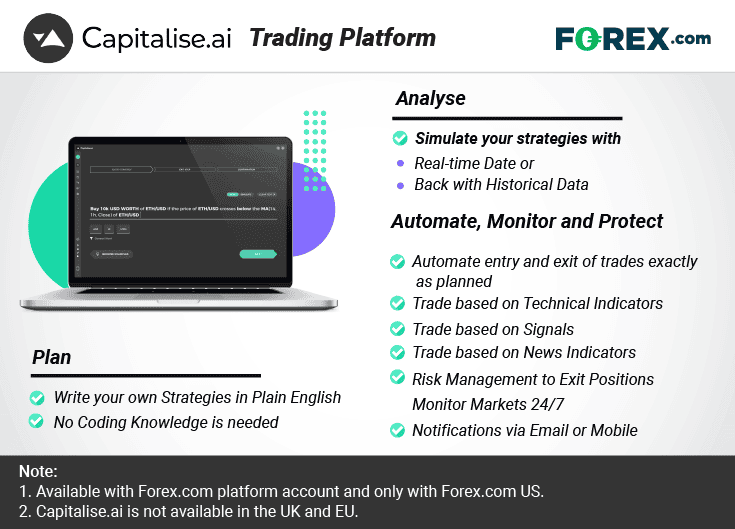

FOREX.com offer spread-only and commission-based trading with tight spreads. We were most impressed with their range of trading platforms which comes with great analytical tools

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert

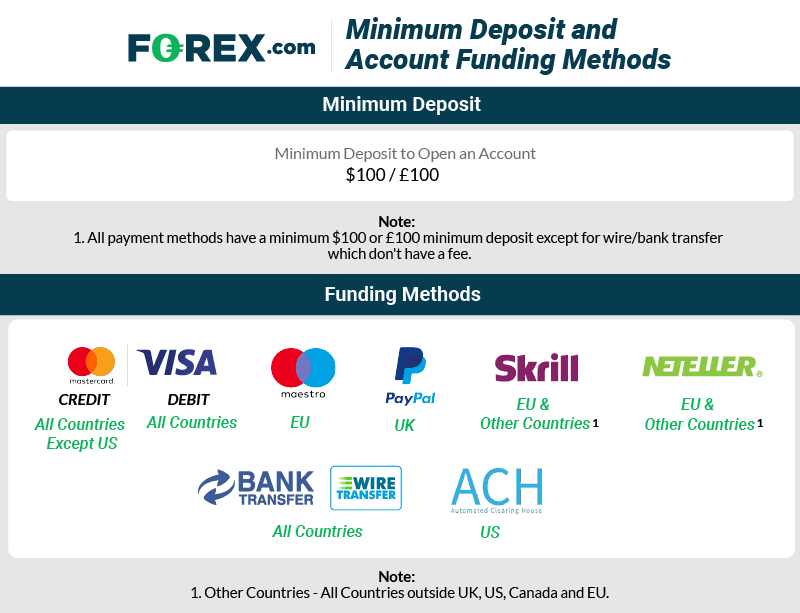

What is the minimum deposit for Forex.com?

The minimum deposit to open an account with Forex.com is $100.