FP Markets Review: Fees, Safety, Platforms

FP Markets has low spreads and is regulated with ASIC, CySEC and FSCA. Our FP Markets review found this Forex broker has good trading platforms, a wide range of CFD markets as well as fast execution speeds.

Our spread bet content is supported and we may receive payment when you visit a partner site.

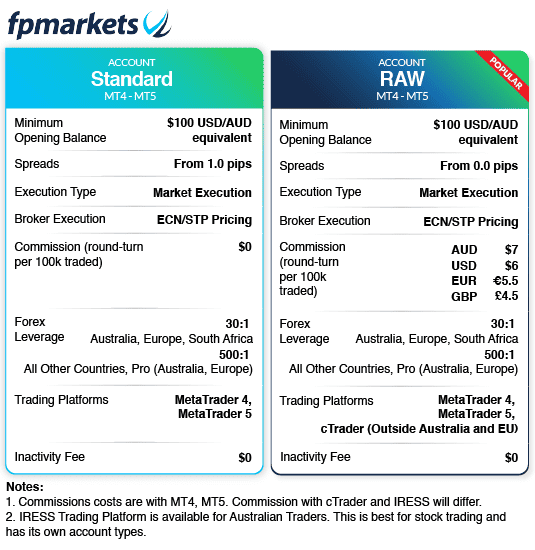

Account Types

Account Types

Spreads

Spreads

Leverage

Leverage

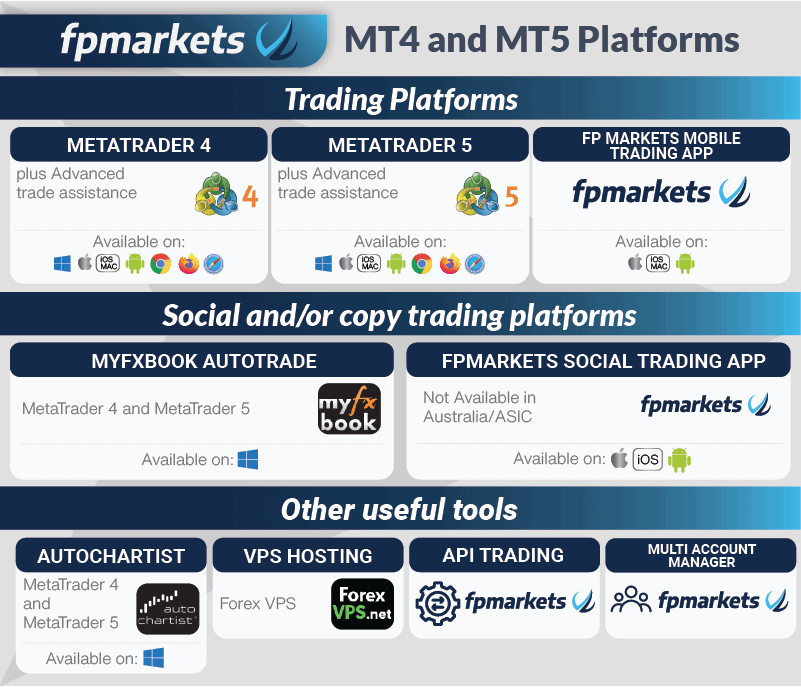

Trading Platforms

Trading Platforms

Forex Pairs + CFDs

Forex Pairs + CFDs

Minimum Deposit

Minimum Deposit

Regulation

Regulation

Customer Support

Customer Support

Ask an Expert

I’m in Spain, can i use a CySEC regulated broker here?

Yes you can. All regulators part of the European Union are part of the European Securities and Markets Authority (ESMA).

Regulators that are members of ESMA, are able to serve as the regulator to all other countries that are part of the European Union.

I’m outside Australia, can i use the IRESS trading platform?

FP Markets only offer IRESS for Australian clients. The main reason to use IRESS is to access FP Markets full range of stocks and to use DMA trading. If you are looking to trade stocks outside Australia with FP Markets then you are best to use the MT5 trading platform or consider TMGM who have IRESS outside Australia.

Hi David. I have opened an IRESS account while I was in Australia. Now that I am outside of Australia, just wondering if I can still trade using IRESS. If not, is it possible to use the platform through VPN? Thanks in advance!

Hi Clement, If you have an account with FP Markets Australia then I would expect you should be able to use the IRESS account. As I understand it, it’s only the FP Markets subsidiaries outside Australia that don’t offer IRESS, so in your case I don’t believe you should need to use the VPN.

In the Regulation section, you mention that customers of FP Markets outside Australia and Europe will have to join the subsidiary in St Vincent and the Grenadines instead, and that this will result in different liquidity access. Can you elaborate on this claim? Looking at FP Market’s FAQ pages for both international customers (non-regulated) and Australian customers (regulated under ASIC), they seem to suggest that he liquidity providers will be exactly the same. Perhaps this bit of the review needs to be updated? Would like to know more. Thank you, Mark

Hi Mark,

If you are in Australia you will need to join FP Markets Australian entity regulated by ASIC and in Europe you will need to join FP Markets Cyprus entity regulated by CySEC which is good fo countries in the European Economic Zone. I can see how what is written might be interpreted to mean FP Markets Grenada entity might be using a different source of liquidity to their other entities. I would suggest this is poorly phrased and have corrected it. Thank you for bringing this to our attention.

Thanks for the clarification David!

Hi can you permit me to tell my fellow traders how I recovered my money from a fake binary options broker?

No, our readers are not your fellow readers.