IC Markets Review Of 2024

IC Markets is an ASIC and CySEC-regulated forex broker with solid forex trading platforms, low spreads and high leverage. The broker is a solid choice for traders looking for low fees using the MetaTrader 4 or 5 platforms.

Our spread bet content is supported and we may receive payment when you visit a partner site.

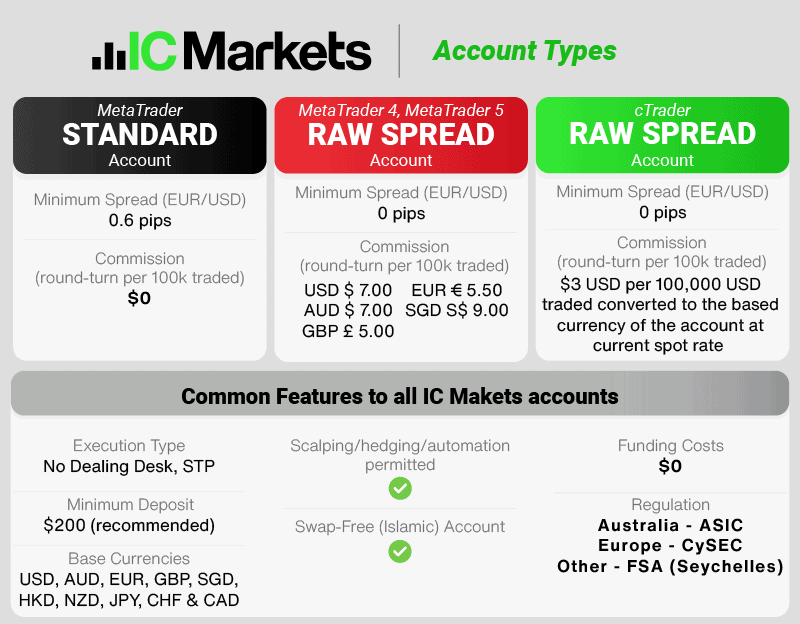

Account Types

Account Types

Spreads

Spreads

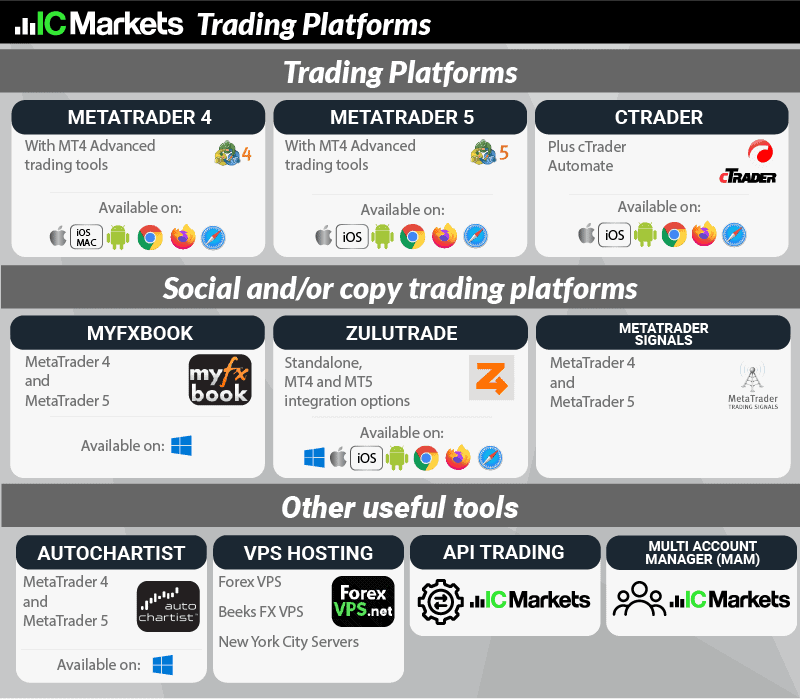

Trading Platforms

Trading Platforms

Minimum Deposit

Minimum Deposit

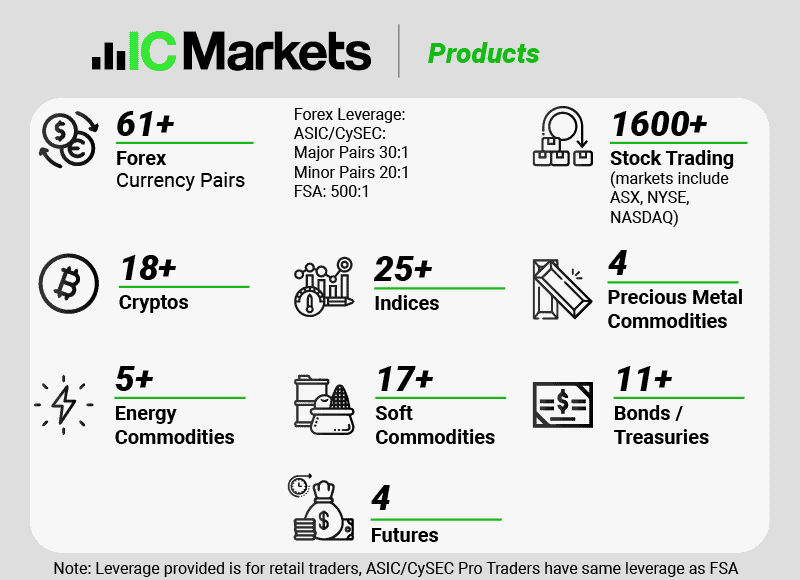

Forex Pairs + CFDs

Forex Pairs + CFDs

Regulation

Regulation

Research and Education

Research and Education

Customer Support

Customer Support

A multi-asset trading platform with share CFD trading is permitted.

A multi-asset trading platform with share CFD trading is permitted. A forex trading platform that provides an institutional-style trading environment.

A forex trading platform that provides an institutional-style trading environment.

IC offers various research tools and support when forex trading, including:

IC offers various research tools and support when forex trading, including:

Ask an Expert

Are IC Markets the cheapest broker?

There are various costs to consider when looking at brokers

1. Spreads – these are your largest cost. Generally, there are two types of accounts. Standard accounts and ECN pricing accounts. Standard accounts have wider spreads than ECN pricing accounts as they do not have a commission in addition to the spread. For this reason, the commission cost is included in the spread. IC Markets publish their average spreads for each type of account and we include a comparison of these spreads between brokers on this page Low spread brokers. Generally, IC Markets spreads compare very well with other brokers.

2. Commissions – if you choose a RAW or ECN pricing account, you must consider the commission costs. IC Markets commissions are generally in line with what you find with most brokers being $3.50 for each standard lot to open your position.

Should I trade with IC Markets or with Pepperstone?

Both brokers are excellent choices…we suggest you take a look at our Pepperstone Review and IC Markets vs Pepperstone pages to find out more.

IC MarketsI see that they use the excuse of AML to freeze your withdrawals, prevent deposits even though your bank is OK, excessive spread manipulation, trading against you, not putting your trades through to market and much more. Why they are cancelling being regulated by FCA UK completely what’s to hide? Why is seychelles just as good as not being regulated ?

Hi Yuur, there is some misinformation here. IC Markets is a no dealing desk broker that uses STP trading execution. This means all quotes are sourced from liquidity providers and the broker does not manipulate the prices. Also IC Markets have never been regulated by the FCA. Seychelles regulations is not as good as CySEC or ASIC regulation but it is acceptable if you can’t use a broker using the financial regulator for your country. Do however avoid any unregulated brokers.

Is IC Markets secure?

Yes,IC Markets is a regulated broker meaning your accounts are segregated.