UK Spread Betting Demo Accounts

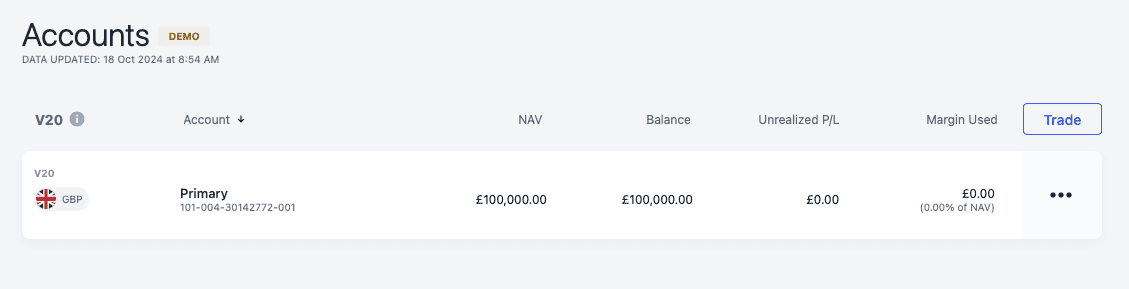

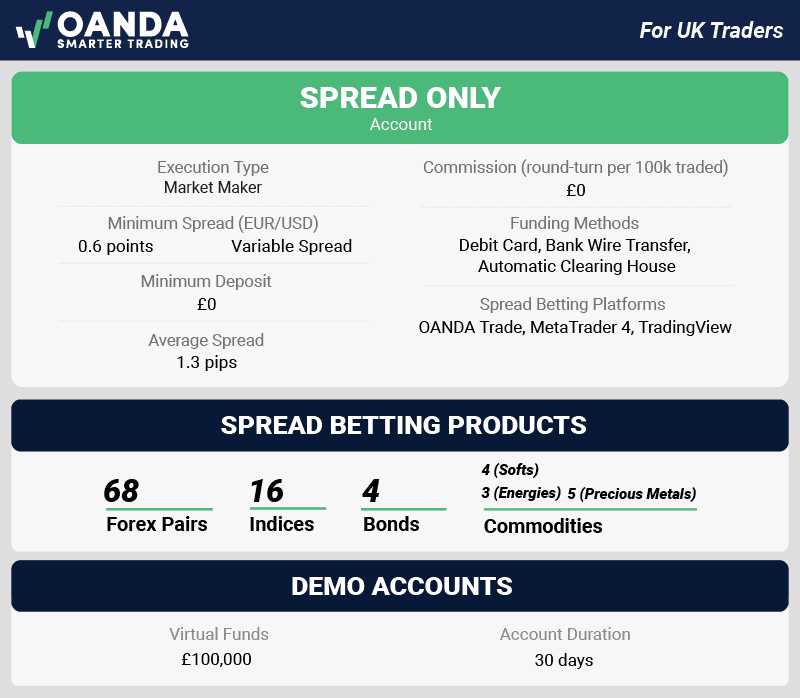

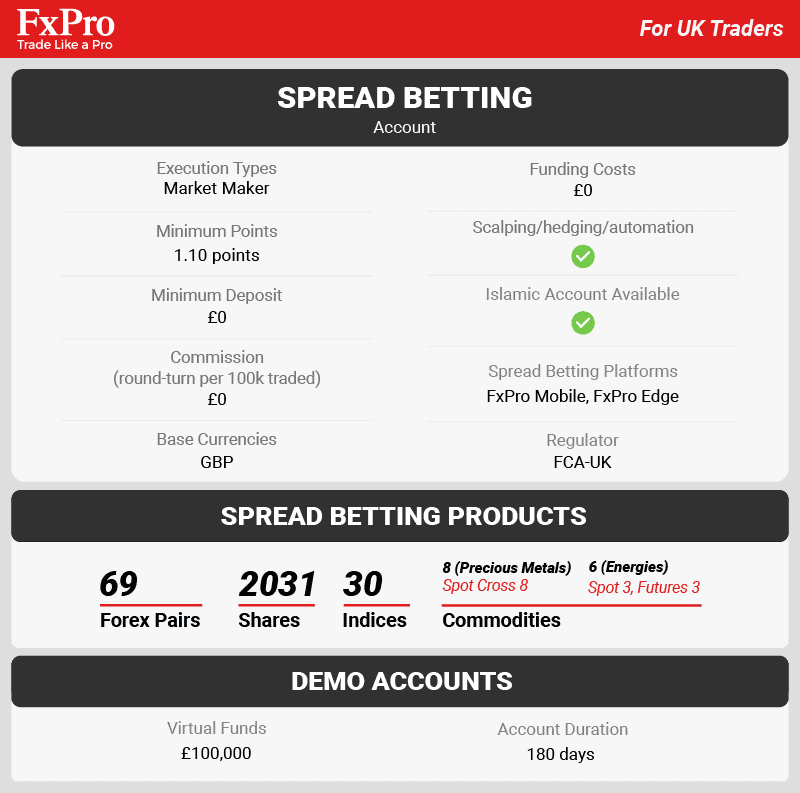

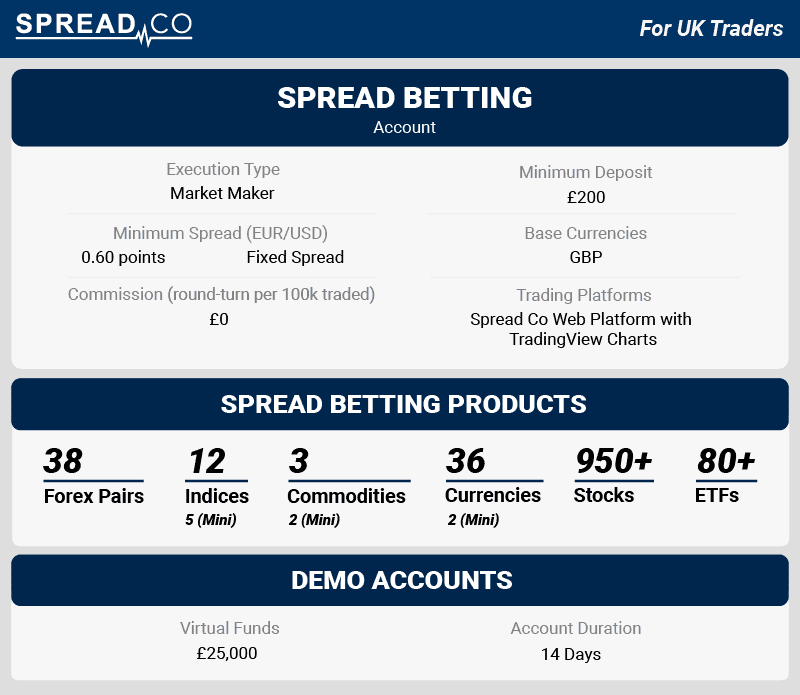

We conducted rigorous tests of 16 brokers, to help you find the best spread betting demo account to build your trading skills. To achieve this, we checked out a range of different features, such as trading tools, platforms, and spreads. The result is this list of 8 brokers with strong spread betting demo account options, and virtual funds up to £100,000.

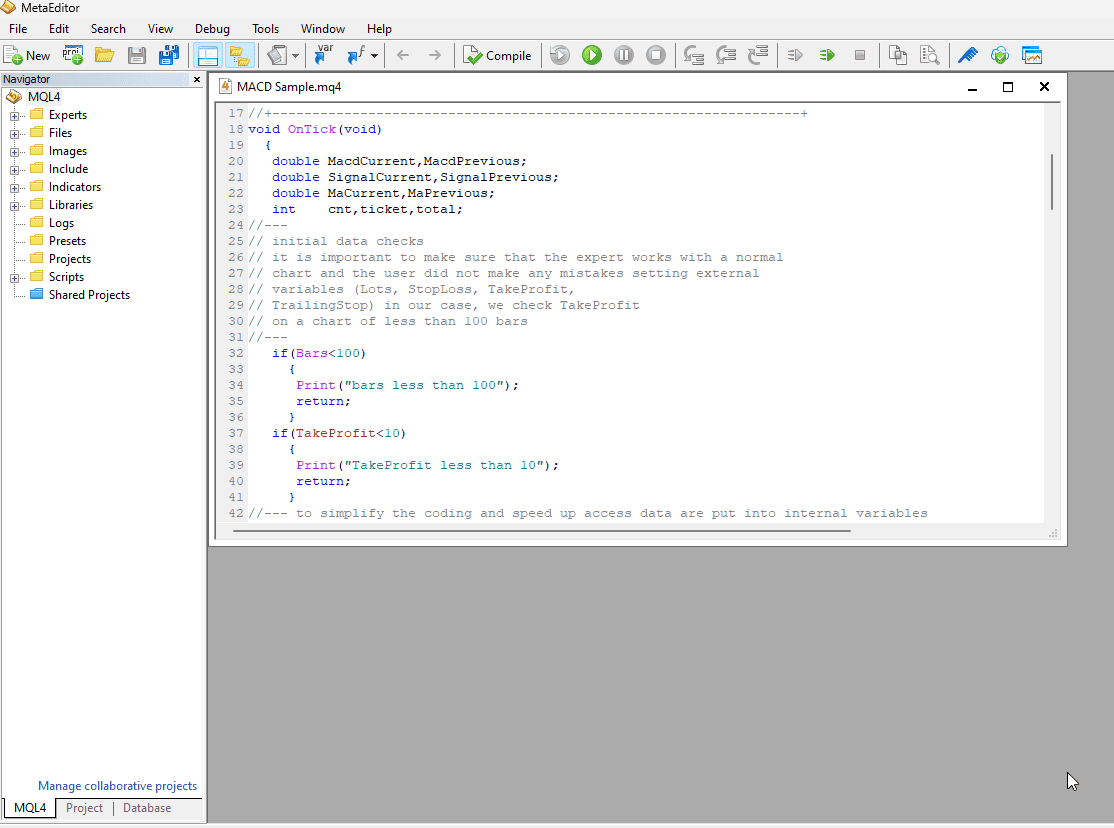

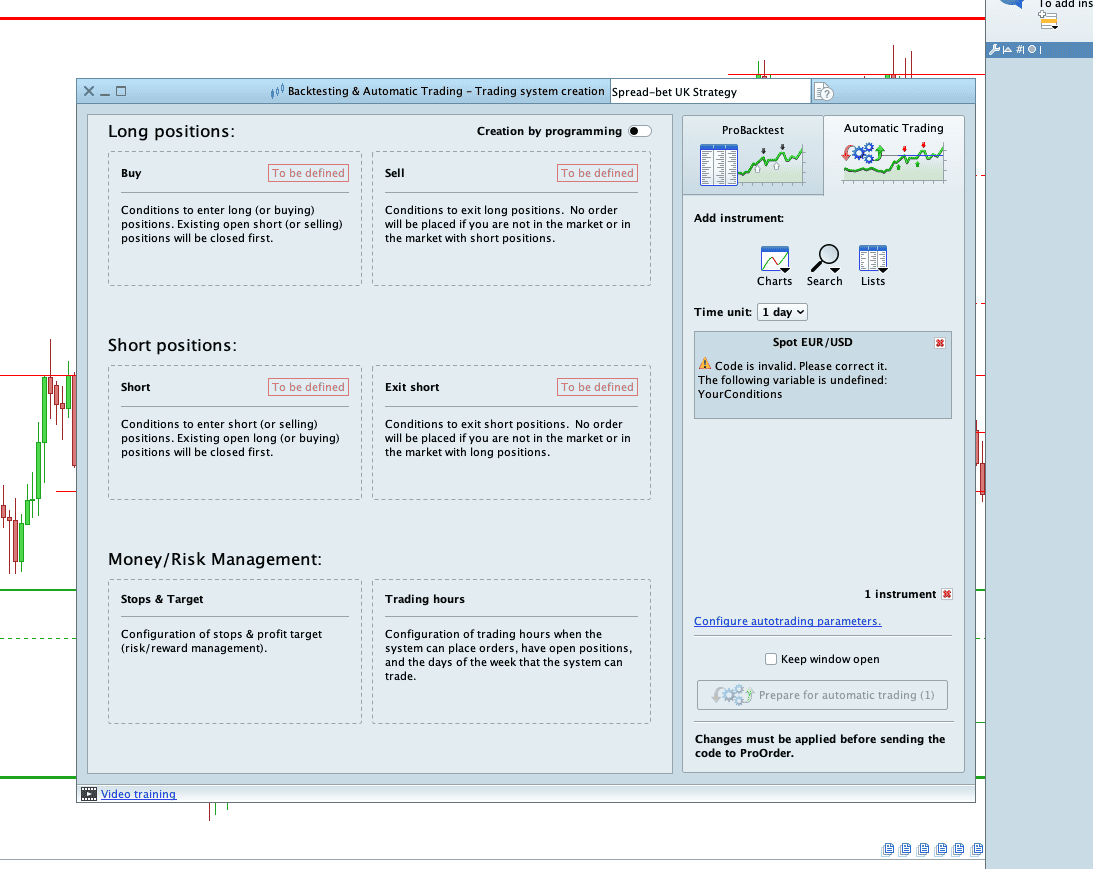

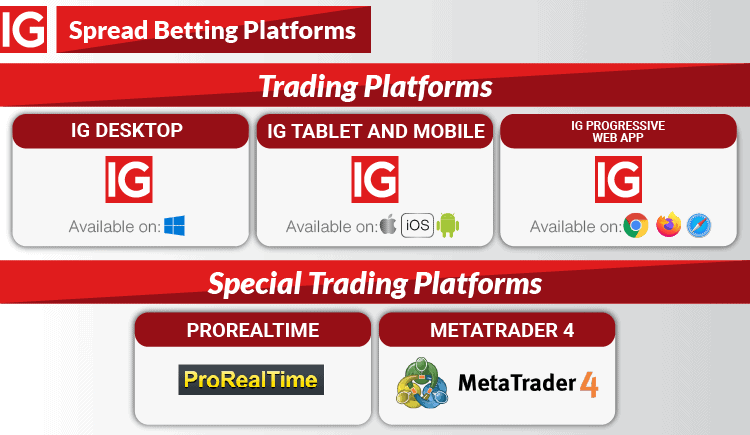

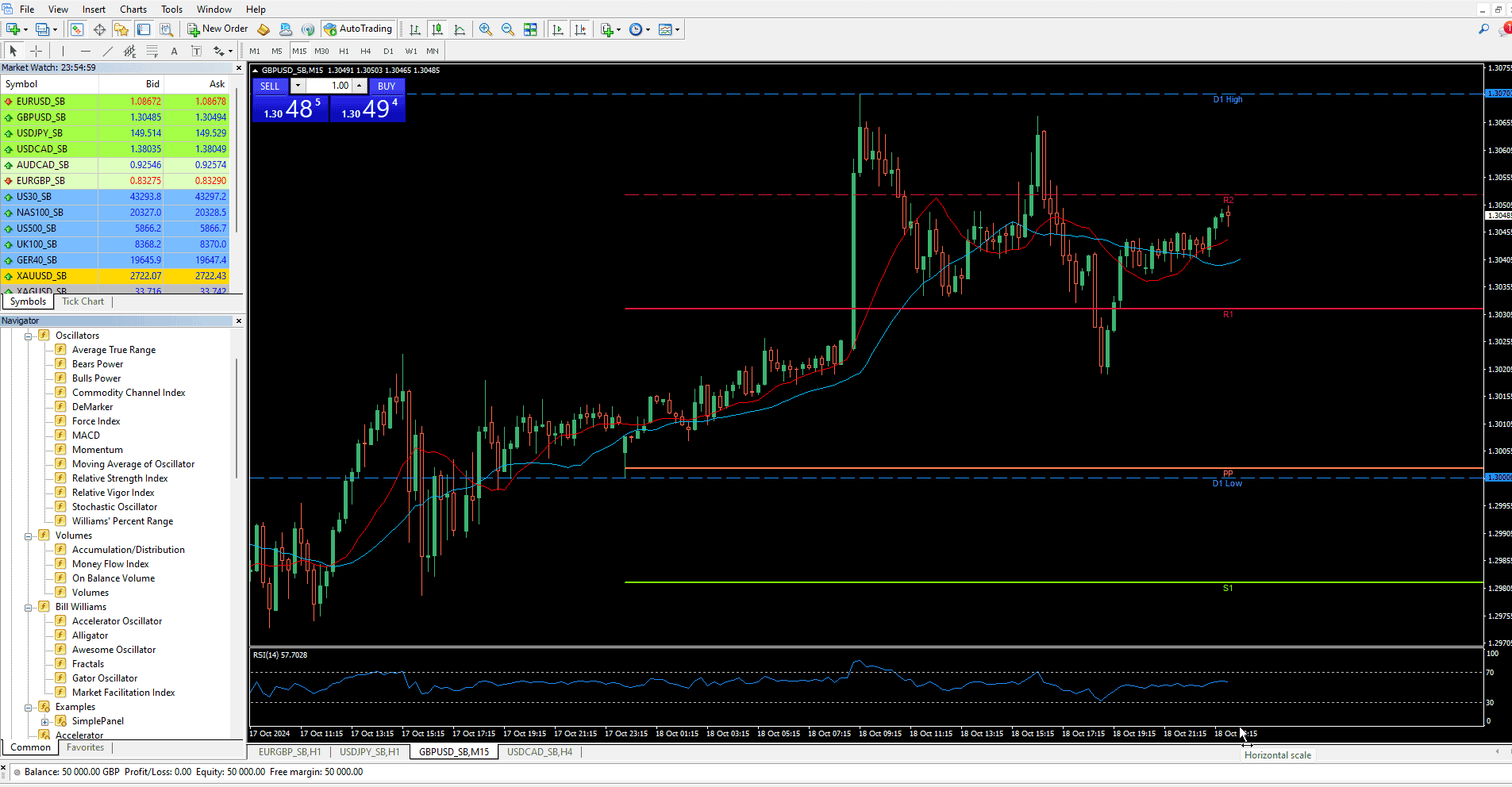

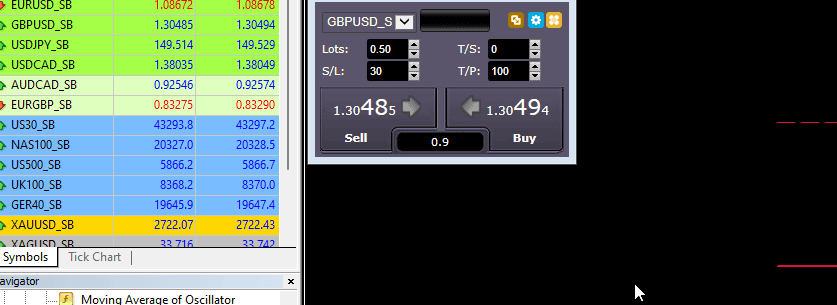

Our testing of IG Markets’ demo accounts uncovered two excellent automated spread betting platform options – MetaTrader 4 and ProRealTime.

Our testing of IG Markets’ demo accounts uncovered two excellent automated spread betting platform options – MetaTrader 4 and ProRealTime.

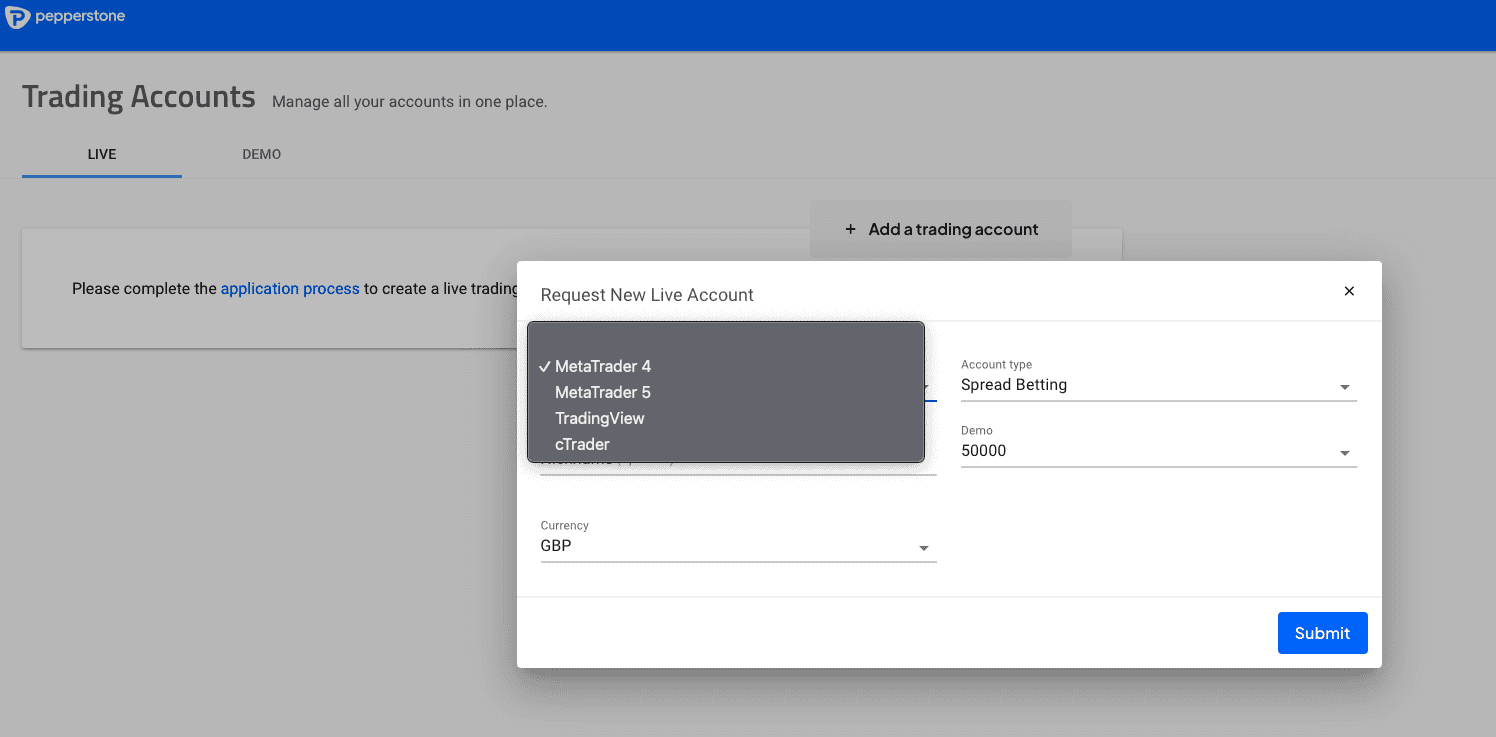

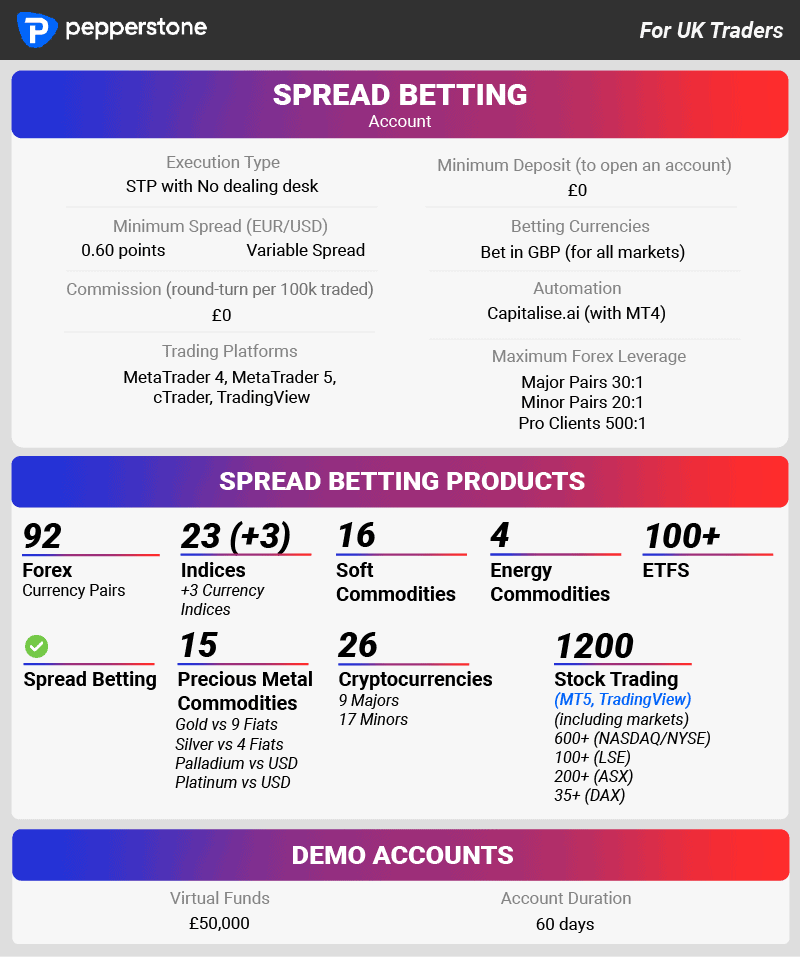

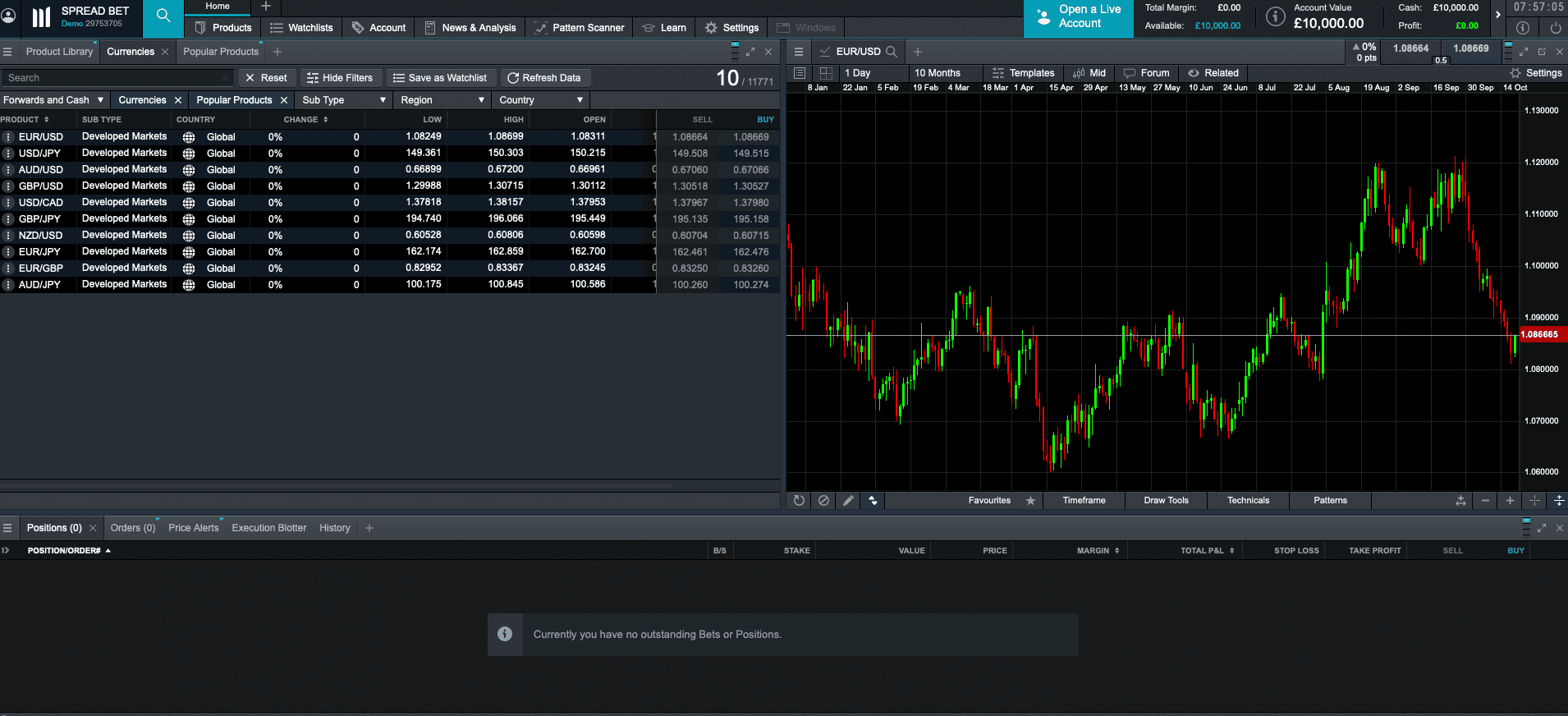

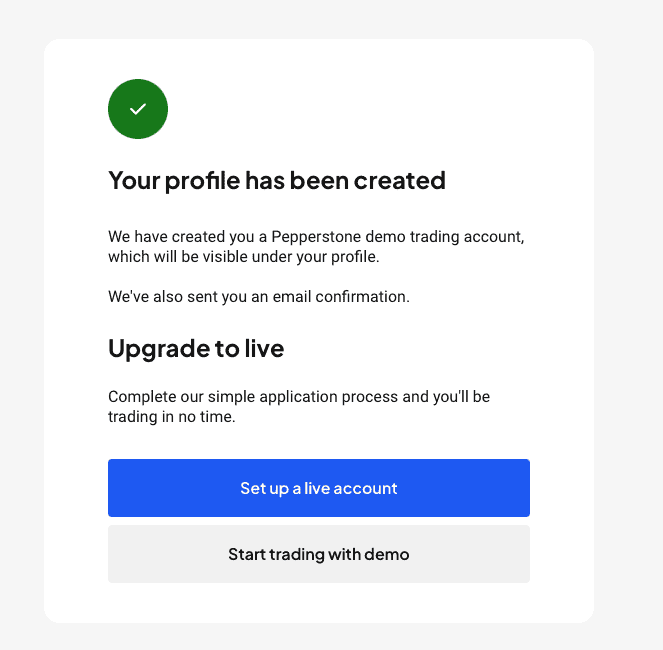

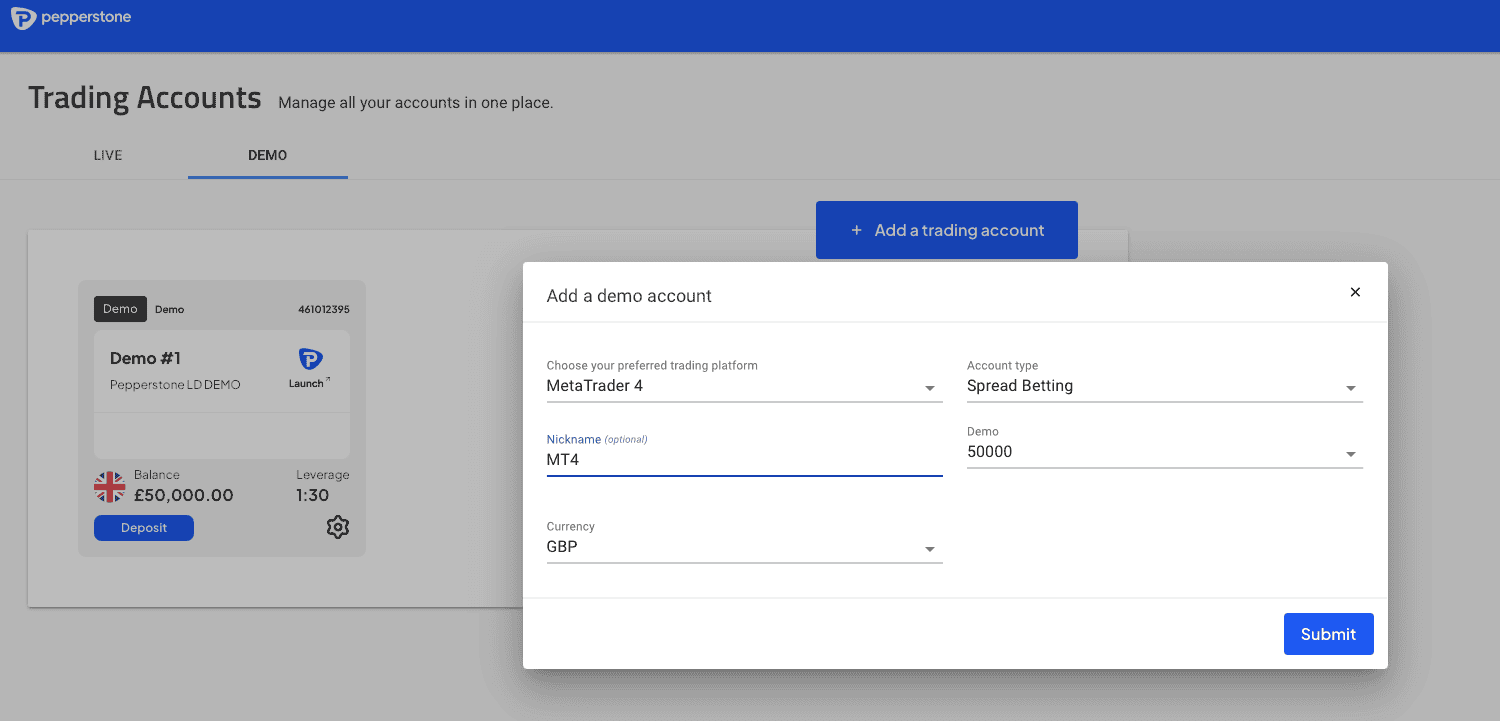

The first thing that impressed us as we tested Pepperstone’s free demo account was the choice of third-party spread betting platforms. You can trade with £50,000 virtual funds in real-time, over TradingView, cTrader, MetaTrader 4, or MetaTrader 5.

The first thing that impressed us as we tested Pepperstone’s free demo account was the choice of third-party spread betting platforms. You can trade with £50,000 virtual funds in real-time, over TradingView, cTrader, MetaTrader 4, or MetaTrader 5.

Ask an Expert

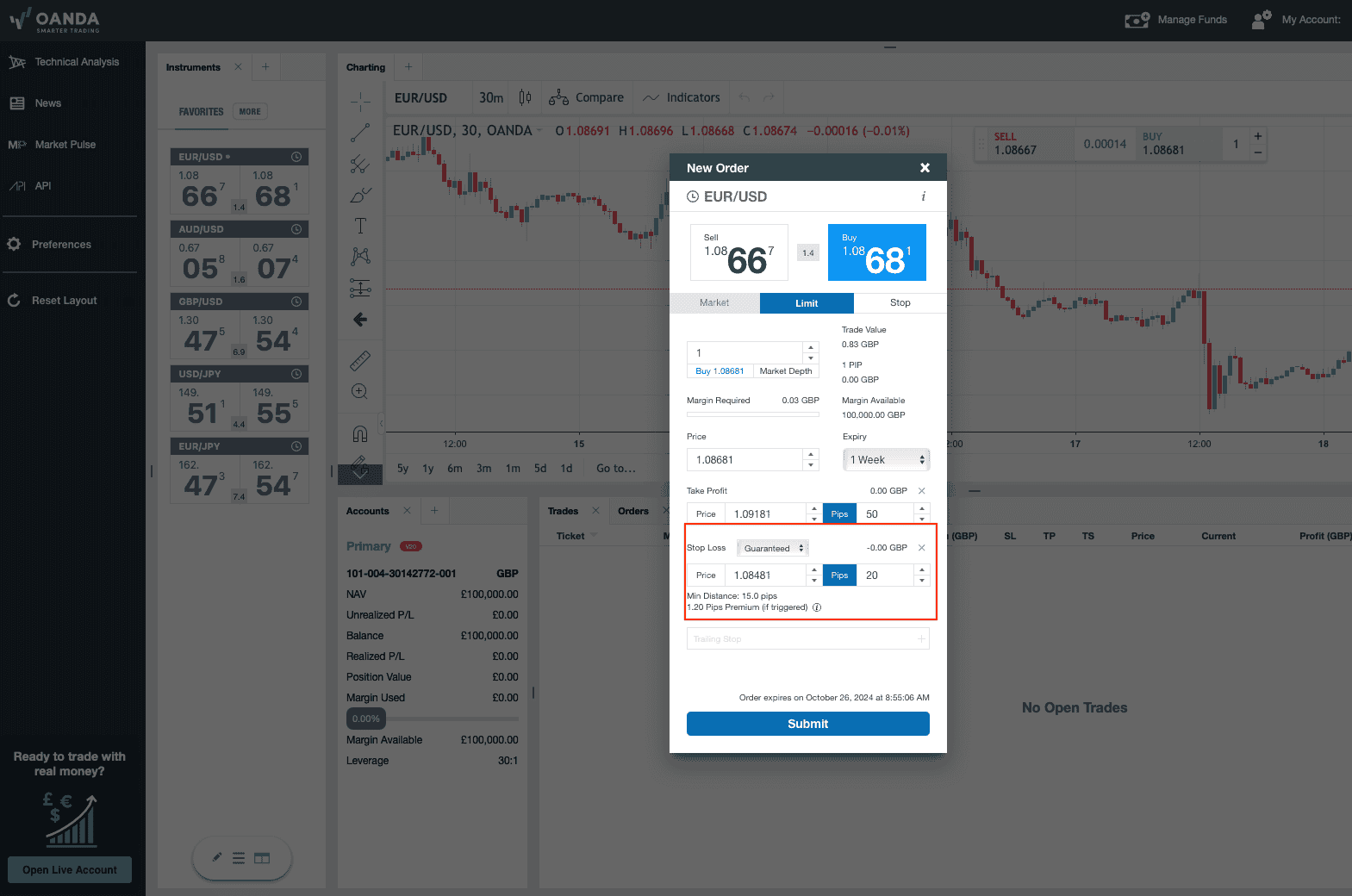

Why should I use a demo account for spread betting?

Using a demo account helps you practice trading without risking real money, so you can learn how it works.

Can I test different strategies with a demo account?

Definitely. Demo accounts are perfect for testing different strategies without any risk.