Best Beginner Spread Betting Platforms

We tested 16 of the UK’s spread betting brokers, to find the best spread betting platform for beginners. In order to help you identify the best option for your strategy, we looked for tight spreads, easy-to-use platforms, and strong risk management tools. From this research, we created a shortlist of 6 excellent brokers for you as a beginner.

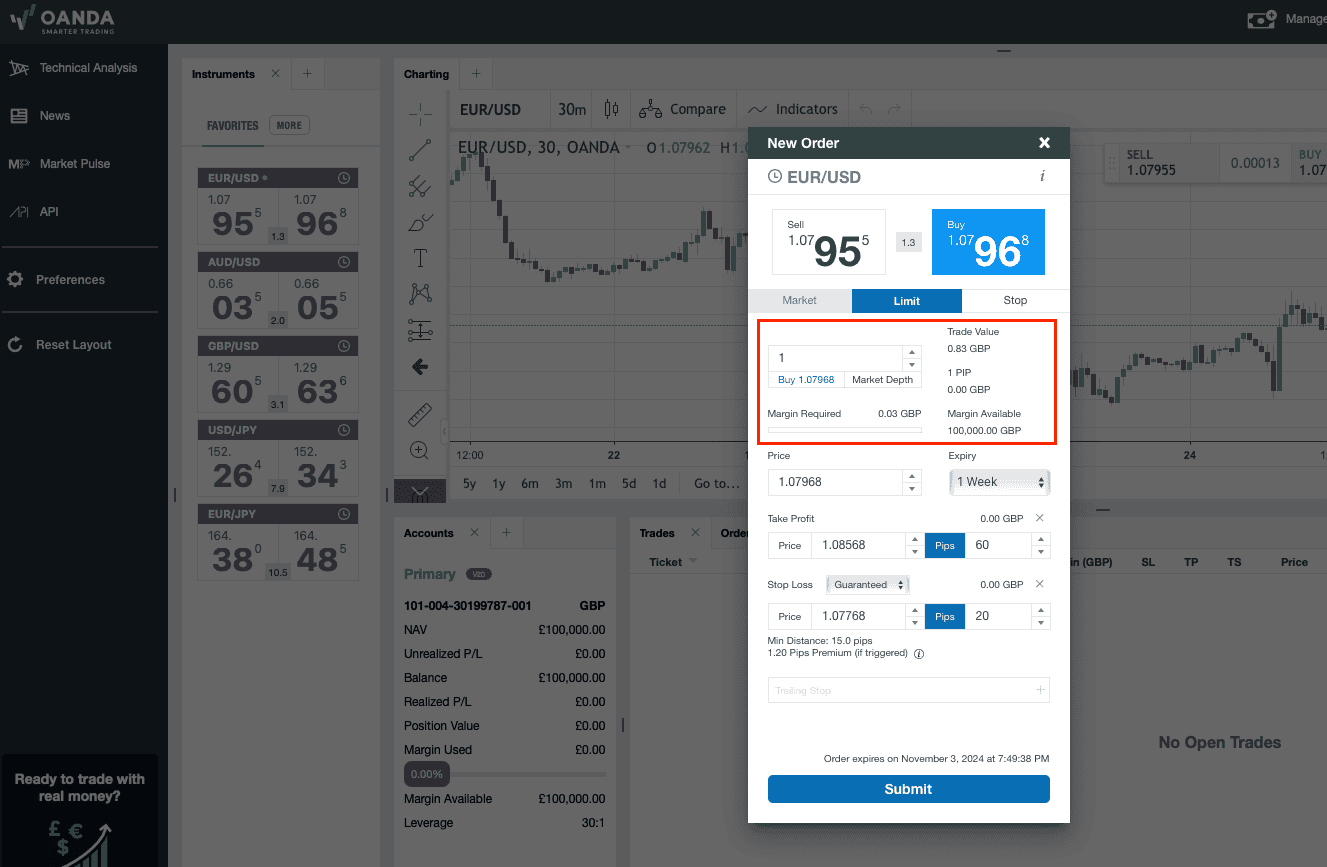

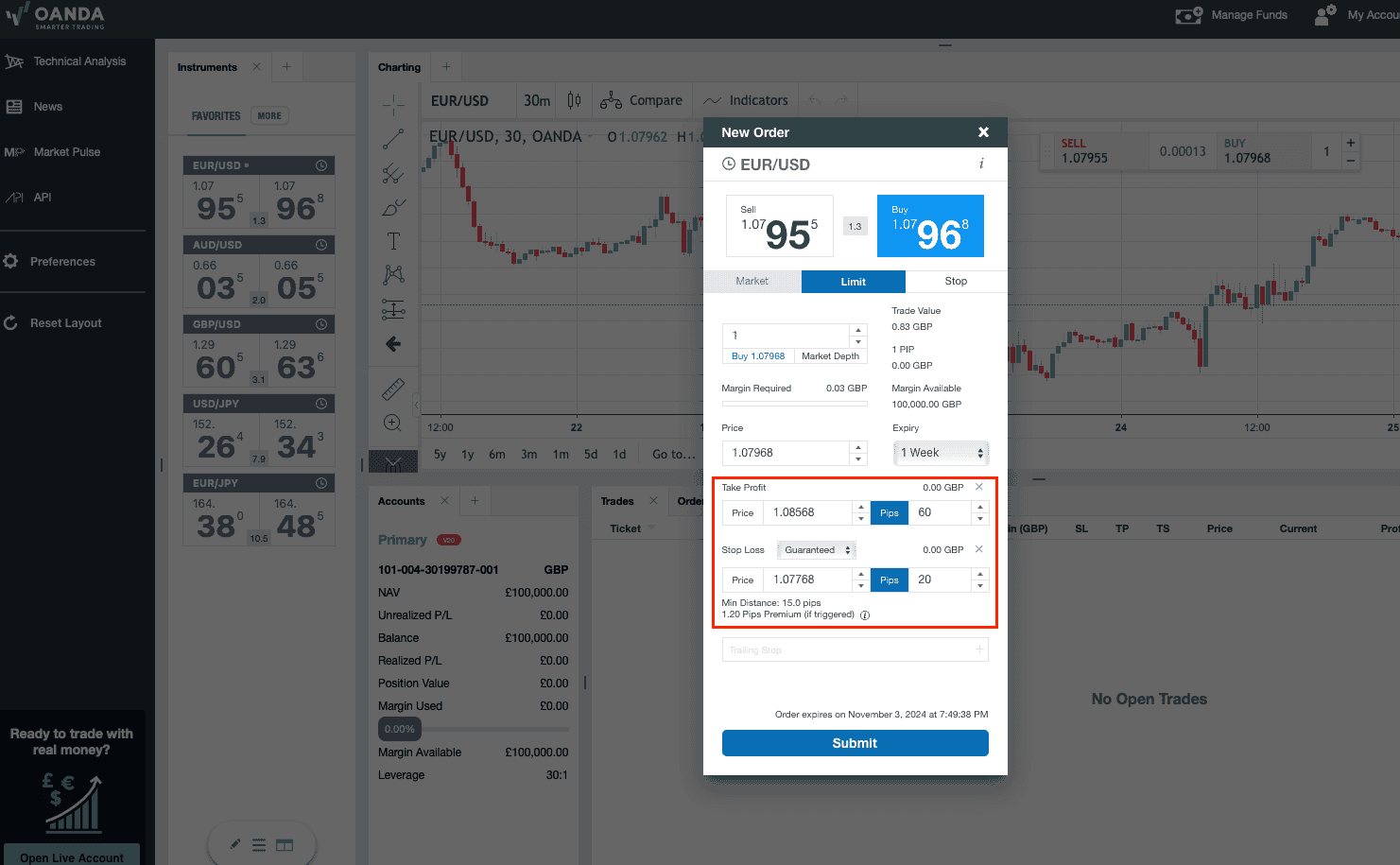

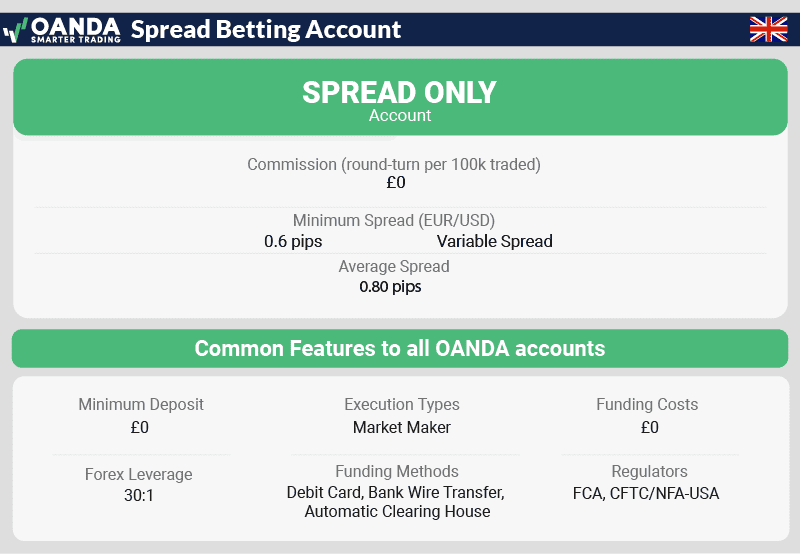

Across our recent review of the best spread betting broker options, it was OANDA’s Trade platform that stood out to us. OANDA Trade offers strong features for managing risk, and low stake markets starting from just £0.01p per point – the lowest stake size on our list.

Across our recent review of the best spread betting broker options, it was OANDA’s Trade platform that stood out to us. OANDA Trade offers strong features for managing risk, and low stake markets starting from just £0.01p per point – the lowest stake size on our list.

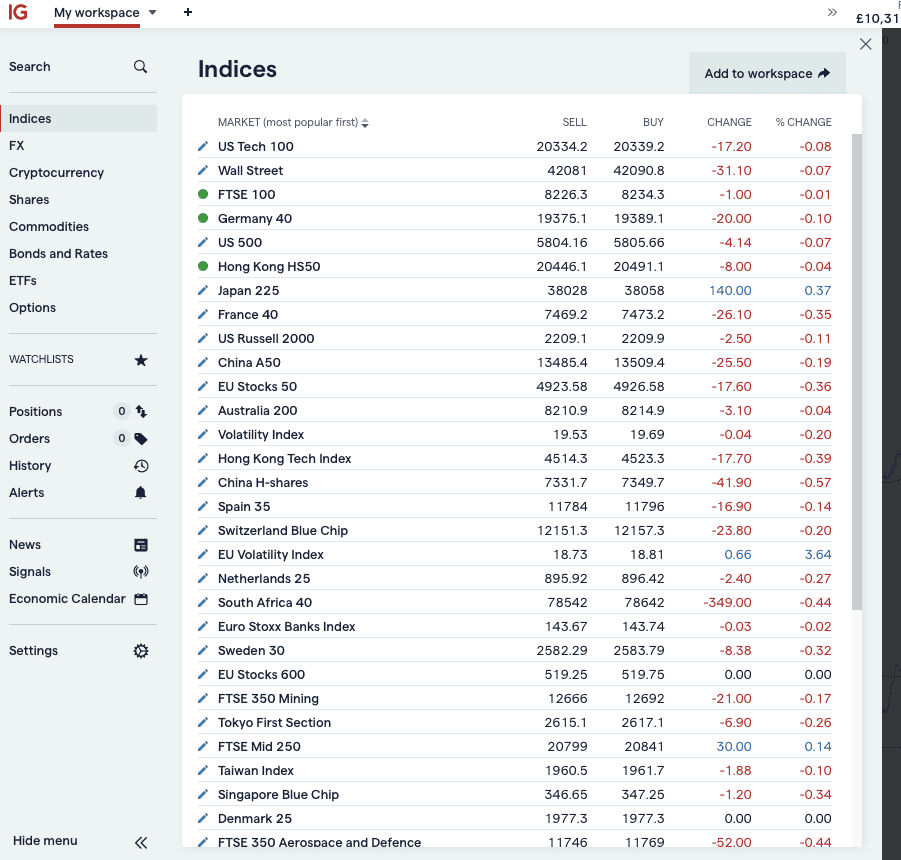

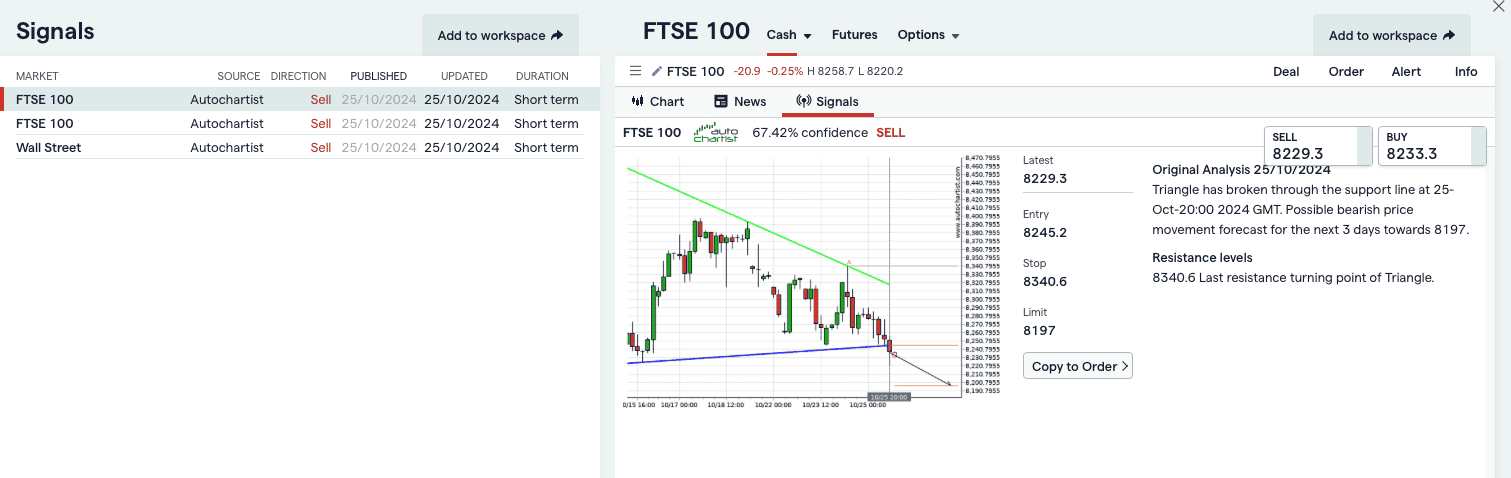

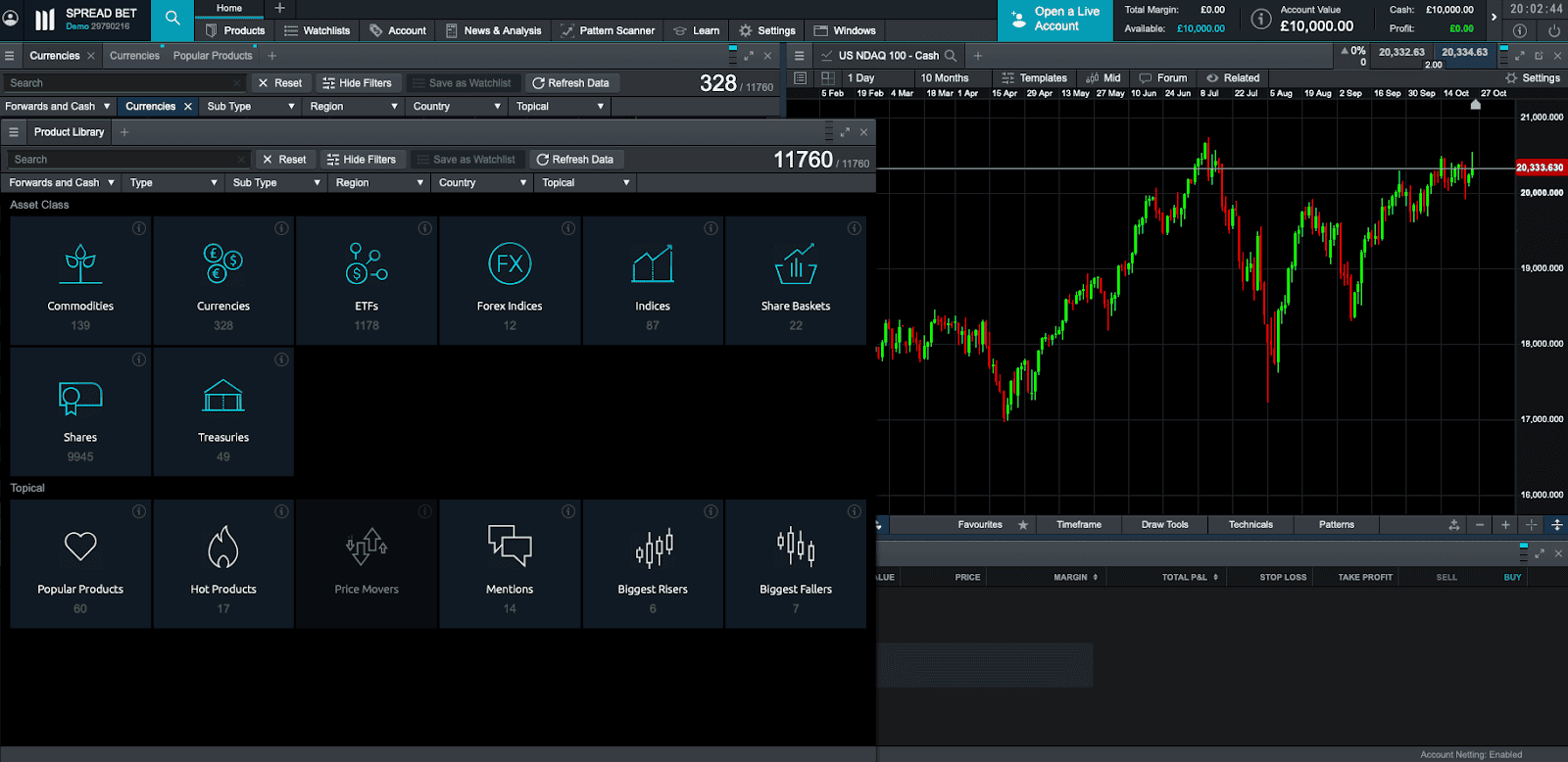

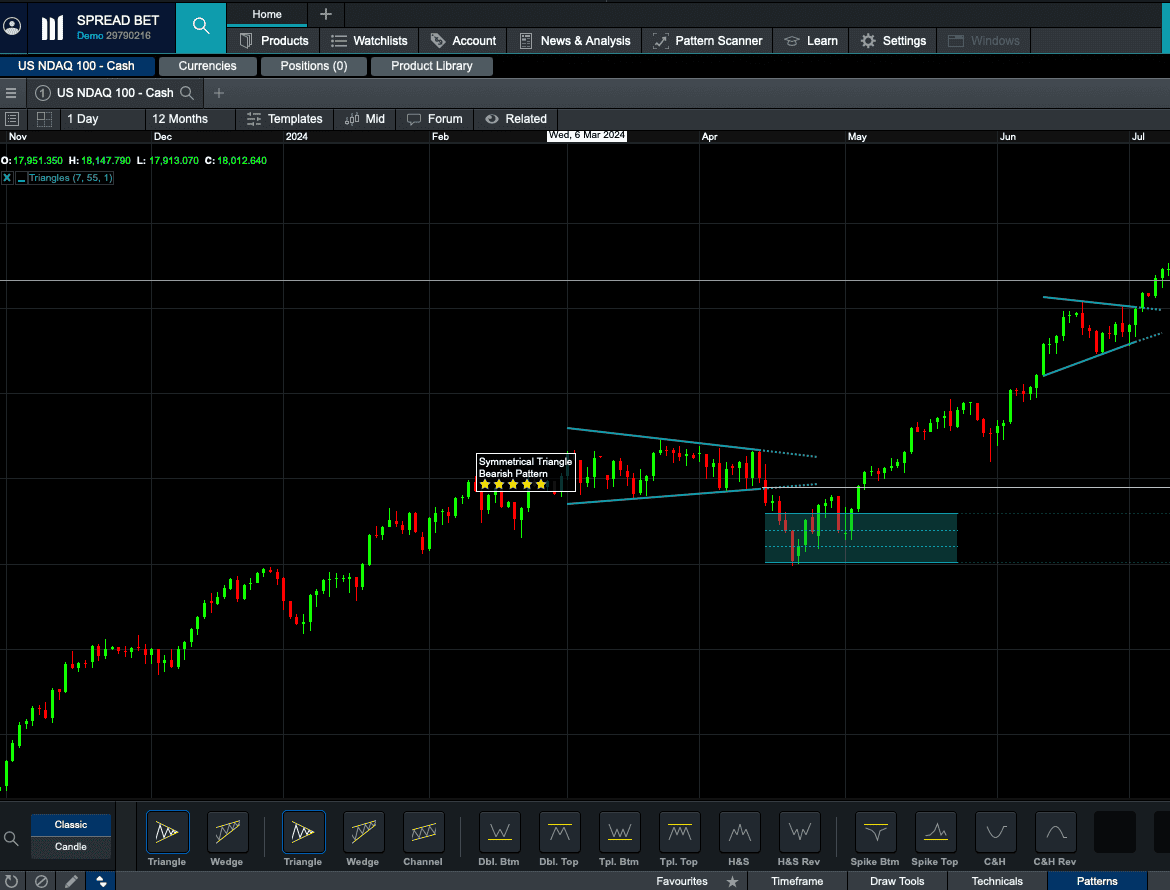

IG Markets is one of the oldest brokers currently operating, with a long history of supporting traders of all backgrounds. As you might expect, the long-standing broker offers a huge range of markets to choose from.

IG Markets is one of the oldest brokers currently operating, with a long history of supporting traders of all backgrounds. As you might expect, the long-standing broker offers a huge range of markets to choose from.

Ask an Expert