To help you accurately calculate your profit and loss when you spread bet, we created this handy UK spread betting calculator.

Our spread betting calculator uses industry average spreads drawn from more than 40 brokers and their end-of-day market prices. When using the calculator, you can choose one of the six major currency pairs used in forex trading.

Or, if you prefer, you can select the ‘other’ category to simulate a spread bet on an alternative spread betting market – such as the FTSE 100.

As we’re using real market data to power this spread betting calculator, you can gain accurate insight into the potential profit and loss of your spread betting strategy without opening a trading account or using a trading platform.

Our spread betting calculator

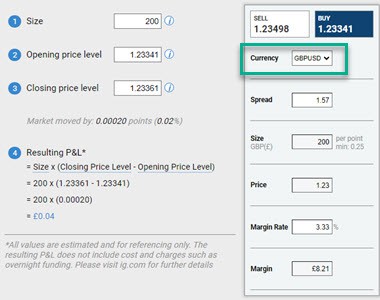

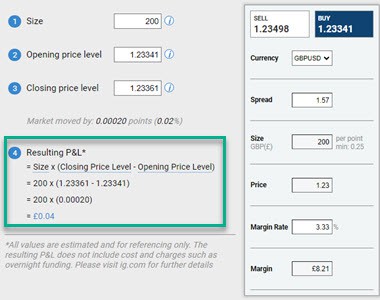

You can take some of the guesswork out of spread betting. Use our example below to explore how margin requirements, as well as profit and loss, are calculated on spread bets.

Market moved by: points (%)

= Size x (Opening Price Level - Closing Price Level)

= x ( - )

= x ()

=

*All values are estimated and for referencing only. The resulting P&L does not include cost and charges such as overnight funding.

SELL

BUY

GBP(£)

min: 0.25

Currently, the spread betting calculator covers only a few commonly-traded markets. Over time, we plan to enhance the value of the calculator, with new financial markets and trading instruments.

How To Use Our Spread Bet Calculator

Follow these basic steps as you use the spread betting calculator.

1. Choose Your Currency Pair

First, choose a currency pair from the forex pair drop down.

We preloaded our calculator with data for six major currency pairs. This means you can you simulate an accurate spread betting scenario.

To provide a real-life trading environment, the buy and sell prices for these six forex pairs are generated based on industry average spreads and end-of-day market prices. These average spreads are continuously updated and sourced from over 40 of the best brokers worldwide.

To trade other assets or currency pairs, you can choose the ‘other’ option from the deal ticket dropdown. From here, you’ll need to input the spread data yourself.

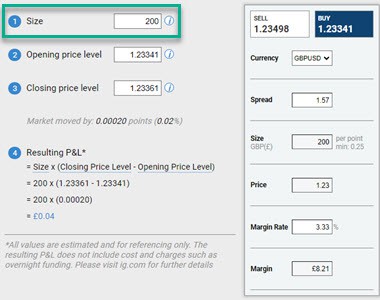

2. Choose Your Positions Size

In the size field of the calculator, enter the amount per point you want to trade.

When you choose your bet, you’re specifying how much you will gain or lose with each point the market moves. For instance, if you would like to bet £1000 per point, you would simply enter 1000 in the size field.

In this example, if the market moved two points in your favour, you’d make £2,000. If it moved 10 points in the opposite direction, you’d incur a £2,000 loss.

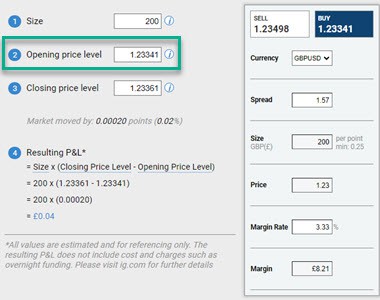

3. Check Opening Price And Change If Needed

The next step is to update the opening price. This is the initial price of the market you you want to spread bet on.

You’ll see a default opening price in our calculator. This is the current industry average for your chosen pair, and it will give you an idea of the market conditions right now.

But if you want to test out different trading strategies and market environments, you can set this to any value you like.

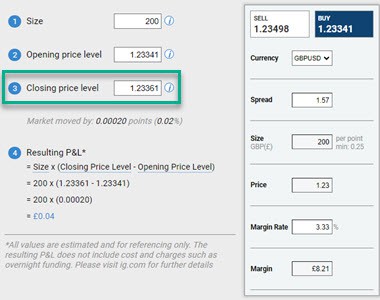

4. Check Closing Price And Change If Needed

In the next field, you can enter your desired closing price.

The closing price point is the price at which you want to test your profit and loss.

For example, if the EUR/USD pair is trading at 1.20 and you want to speculate that the market will drop by 0.18 points, you would enter 1.02 in the closing price field. The calculator will show you the profit you would make on this short position.

The default closing price for the calculator is a rise of 0.00020 points on four of the five currency pairs, and 2.00000 on the USD/JPY pair.

5. See Your Margin Requirements

To determine your margin requirements for the bet, enter the assets margin rate in the deal ticket.

As an example, if the margin rate is 3.33% for EUR/USD, you would enter 3.33 in the margin field. If the bet size is 1000, the opening price is 1.20, and the margin rate is 3.33%, then a £39.96 margin will be required.

Margin Rate = Bet Size x Opening Price x Margin Rate Margin Rate= 1000 x 1.20 x 3.33% = £39.96

If your original prediction was correct and the market price decreased to 1.02, the result of your spread betting strategy would be £180 profit. Alternatively, if the market moved 0.18 points in the opposite direction, and increased to 1.38, you would experience a £180 loss.

6. Review Your Profit And Loss

Once you’ve entered your position size, opening price, and closing price, the spread betting calculator will automatically calculate your potential profit and loss. This is shown in the ‘Resulting P&L’ field.

Why Use The Spread Betting Calculator?

When I trade, I use the spread betting calculator in two ways:

Firstly, I use the tool to calculate my potential profit from a position.

And secondly, but equally importantly, I used it to calculate calculate the potential risk.

The spread betting calculator gives me insight into the total points, target price, and my stop loss, all of which helps me to improve my betting odds.

This is why I recommend you use this calculator too. Inputting the details of your trade into the calculator will help you decide if the position is “worth it” or not.

Personally, if the potential loss outweighs the potential profit (or payout), I wouldn’t make the bet. Or, I’d make sure that I closed the bet long before the loss was incurred.

SpreadBet’s co-founder, Noam Korbl, had this to say about the calculator usefulness:

“I feel this spread betting calculator is a great tool for both beginners and experts alike,” Noam said.

“Whatever your background it will help you learn more detail about how spread betting works, and how you can develop your own strategy.”

Please note that this calculator only works for financial spread betting, not sports betting such as football, cricket or horse racing.

How Is The Spread Bet Calculated?

Imagine you are developing a spread betting strategy for the EUR/USD forex pair (remember that spread betting strategies are different from CFD trading strategies).

Your online broker’s pricing is 1.1150 to sell EUR/USD, and 1.1152 to buy EUR/USD.

You believe the Euro will strengthen against the dollar, so you buy at 1.1152 with a bet size of £10 per point. The market moves in your favour. Then, when the sell price reaches 1.1172 and the buy price reaches 1.1174, you decide to close out your position.

- Opening price level: 1.1152

- Closing price level: 1.1172

As the market moved 20 points in your favour from 1.1152 to 1.1172, your result is £200 profit.

According to the following formula, your profit would be:

Points the market moved = (1.1172 – 1.1152) = 0.0020 = 20 points

Profit = 20 points x £10 = £200

Take a look at some of the other examples I’ve provided to discover more about calculating spread betting profits on instruments like forex currency pairs, gold and stocks.

How Does Your Margin Affect Your Calculator?

Use the following margin calculation when spread betting:

Margin = total exposure x margin factor.

As a practical example, if the margin offered by a broker was 5% (known as 20:1 leverage) for an exposure of £100,000, then you would need to put down £5,000 to open the trade. This is simply 5% of £100,000.

Learn more about the role of leverage at our margin spread bet page.

forex profit calculator

forex profit calculator

Estimates profit in pip value and base currency from trade details.

lot size calculator

lot size calculator

Determines position size in various lot units to manage risk.

forex pip calculator

pip value calculator

Calculates the value of a pip in the deposit currency for risk management.

broker fee comparison

broker fee comparison

Compares spreads and commission fees across major forex pairs and brokers.

margin calculator

margin calculator

Calculates required margin using leverage, trade size, and forex pair.

time zone converter

time zone converter

Shows trading sessions and volumes in major global markets.

FAQs

Is Spread Betting Profitable?

Yes, spread betting can be profitable if your predictions are correct. However, you need to keep in mind that there are risks involved, so you could end up losing out.

I advise you to develop a robust betting strategy before you start opening large spread bets. Also, you’ll need to use effective risk management techniques.

Our co-founder Noam Korbl shared some of his own strategic insights as he targets profitable spread bets:

“For me personally, I tend to diversify my bets across different securities. This improves my chances of scoring an overall profit, even if one or two of my bets don’t come in,” he said.

“But the most effective way to manage your risk is to limit your bets. Never bet more money than you can afford to lose.”

Which Brokers Can I Use For Spread Betting?

In our opinion, the best broker for spread betting in the UK is Pepperstone.

This is because they offer the highest execution speeds, which is essential for reliable spread betting. They also offer an excellent trading platform with more than 100 charts and technical indicators, so you’ll be able to apply advanced technical analysis to your strategy.

Other strong brokers you might want to consider include City Index, IG, and FXCM. Make sure the broker you choose is properly regulated by the Financial Conduct Authority (FCA) – all the brokers I’ve mentioned here are.

I also advise you to try the broker’s demo account before you make a final decision.

Ask an Expert

Can I use this calculator for stocks or crypto too?

no