Vantage Spread Betting

After testing 16 spread betting brokers, I found Vantage’s performance underwhelming. In particular, the trading costs and product range let the broker down. In this Vantage spread betting review, I’ll share my firsthand findings, after testing the broker with my live account.

My Take

My Take

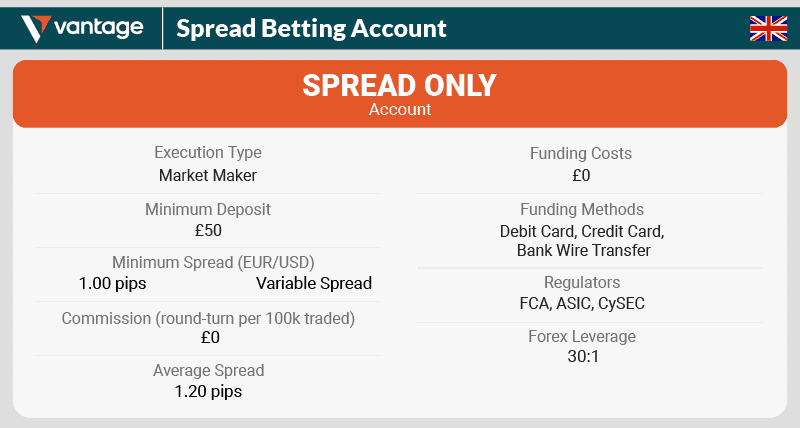

Fees

Fees

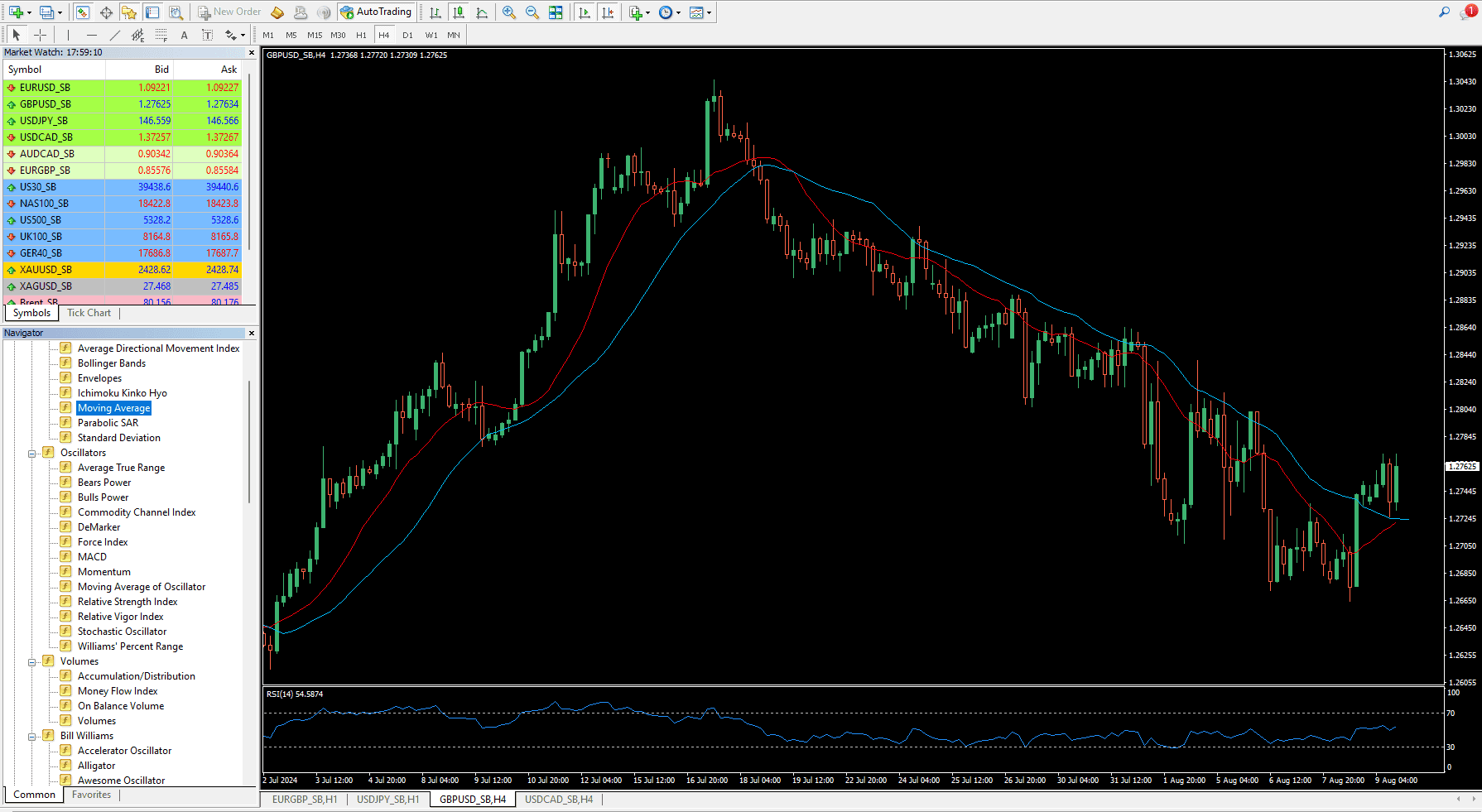

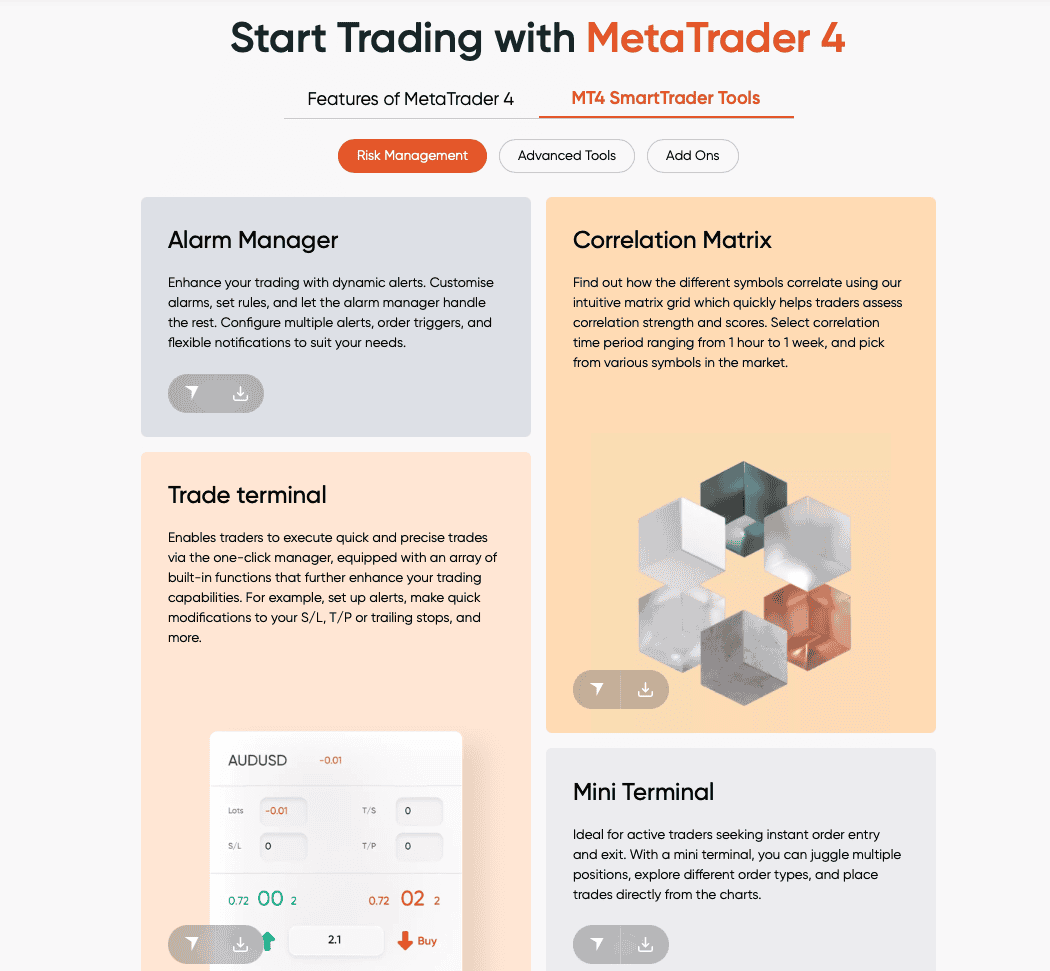

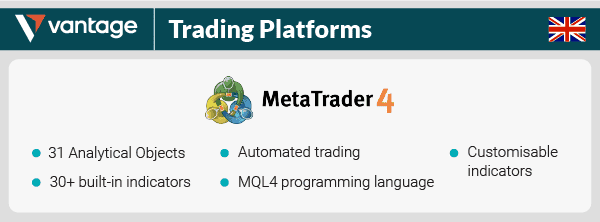

Platforms

Platforms

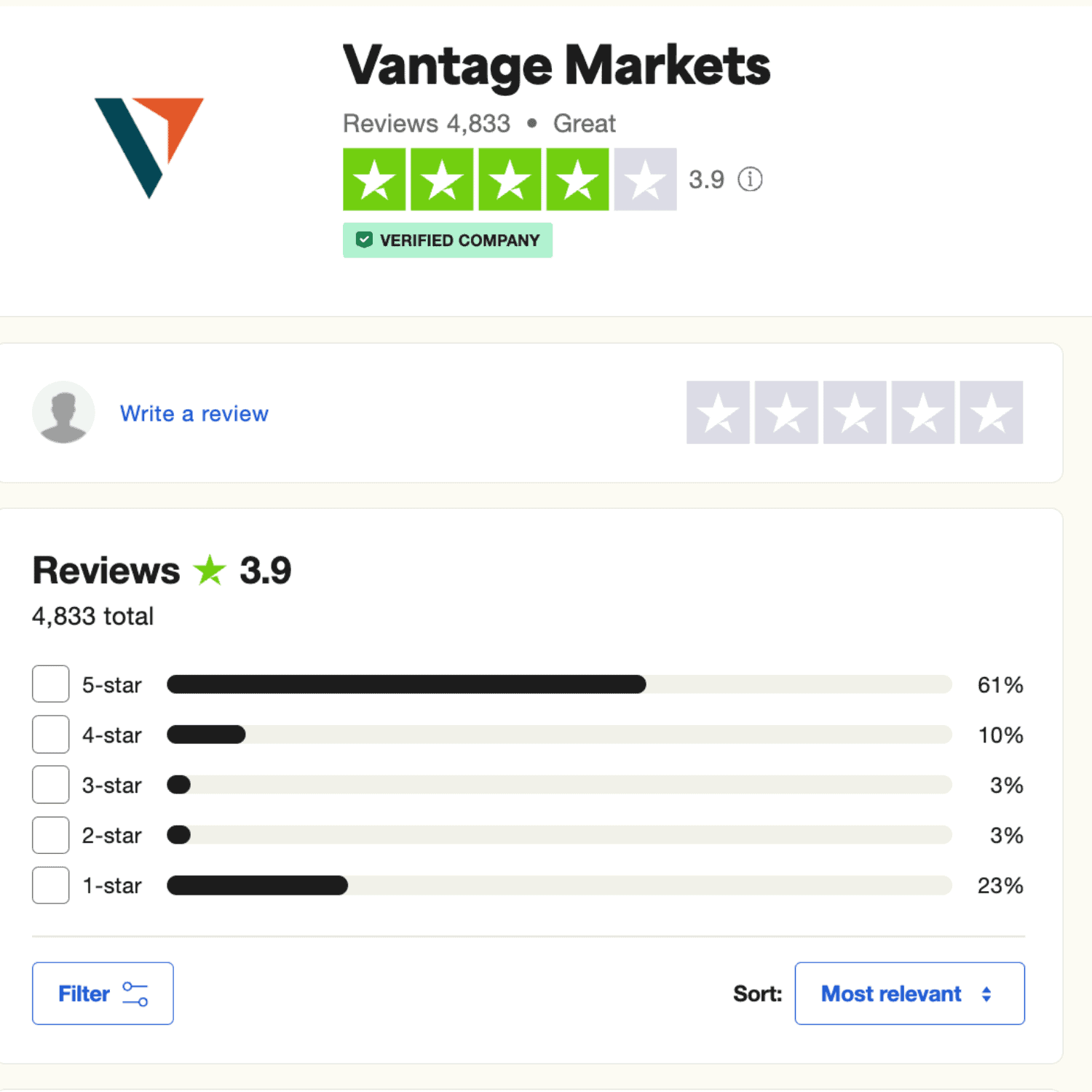

Trust

Trust

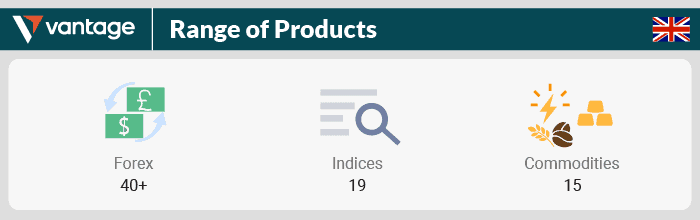

Markets

Markets

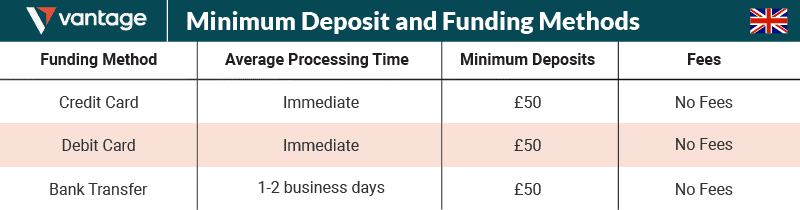

Funding

Funding

Customer Support

Customer Support