Exness Review

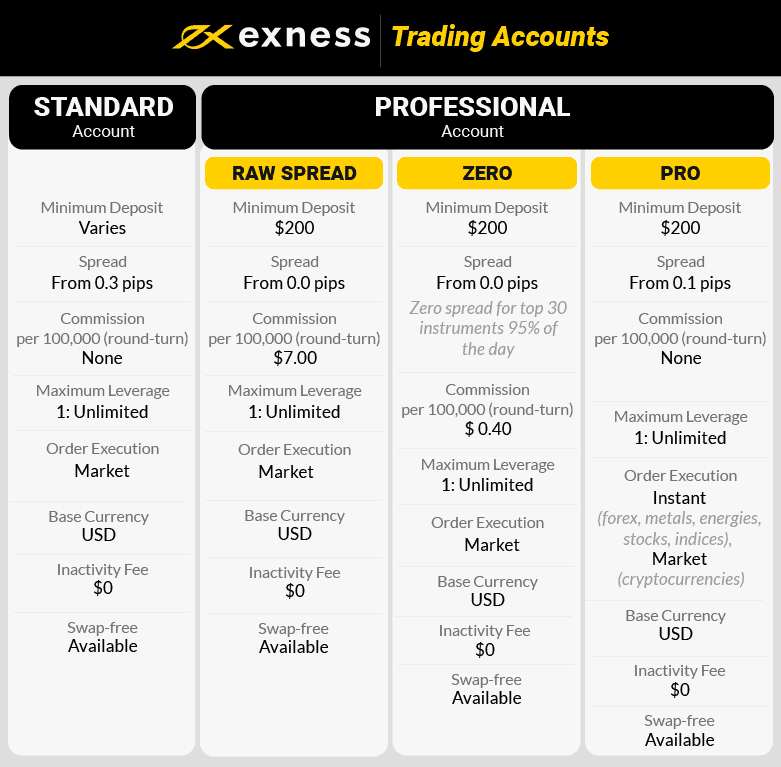

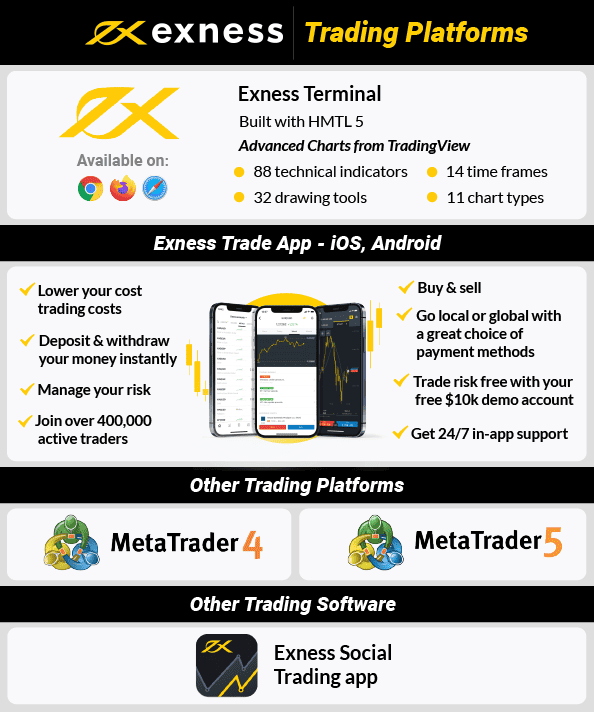

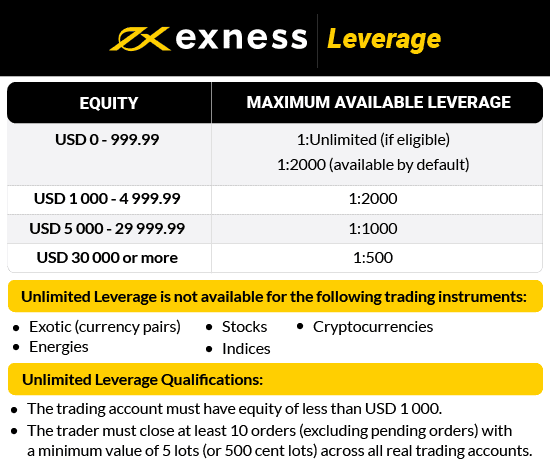

In our Exness review, we found the broker interesting mostly for their unlimited leverage and for the Forex markets they serve. Exness is a no-dealing desk broker with MT4 and MT5 trading platforms. Read what we think of them

Our spread bet content is supported and we may receive payment when you visit a partner site.

The Exness Academy offers various courses which run through key concepts from managing the risks, to analysing price action. Strangely, it wasn’t that easy to find the education section from the main homepage.

The Exness Academy offers various courses which run through key concepts from managing the risks, to analysing price action. Strangely, it wasn’t that easy to find the education section from the main homepage.