IC Markets Minimum Deposit

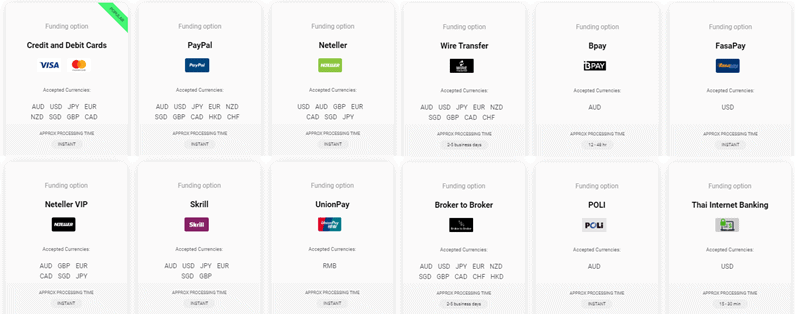

IC Markets require a minimum deposit based on the case currency selected when opening an account. We detail each of the funding requirements for each currency base.

Our spread bet content is supported and we may receive payment when you visit a partner site.

Ask an Expert