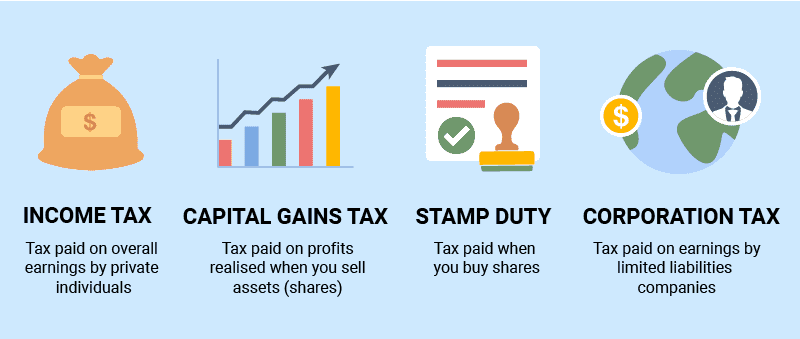

One of the big advantages we’ve found while spread betting in the UK is that it’s exempt from capital gains tax. An HMRC ruling defined spread betting as speculative gambling, rather than as a taxable investment.

Spread betting is also exempt from other taxes too. As you’re trading on a derivative, you never actually take ownership of the underlying asset, and so you won’t need to pay stamp duty. This makes spread betting’s tax implications different to other types of trading, like share trading.

HMRC’s guidance (BIM22015/BIM22017) and the long-standing Graham v Green case confirm that gambling profits are generally not taxable, even when a person earns their living from spread betting.

This is why we feel spread betting can be a more attractive method of financial market speculation in some cases, when compared to traditional forex or CFD trading.

What Are The Spread Betting Tax Benefits?

The HMRC has made three key rulings that impact you as a spread bettor:

1. No Capital Gains Tax

Your profits are exempt from capital gains tax, which can make it easier for you to manage the cost of your strategy. As you won’t be paying CGT, you could find yourself saving up to 20% on trading costs each year.

2. No Stamp Duty

Spread betting is a derivative product. As you never take ownership of the asset, you won’t need to register any ownership document, which means no stamp duty.

At current rates, we’ve found this should reduce your costs by 0.5% per trade.

3. Commission-Free Trading

We’ve already covered the tax implications, but there are other costs to consider too. You won’t pay any commission when you open a spread bet, so this is one less fee to worry about.

Instead, the cost of the trade is factored into the spread – or the difference between the buy and sell price of the instrument. So if the buy price of EUR/USD is 1.0604 and the sell price is 1.0605, the spread will be one pip.

For our senior analyst Ross Collins, these spreads are something to be aware of:

“You will need to keep an eye on these spreads as a trader,” Ross advised.

“However, the lack of commission, along with the other savings associated with spread betting, should help you manage your costs.”

Exceptions to the No-Tax Rule

The UK does tax spread betting in some instances, and there are some exceptions to the no-tax rule. We advise you to keep these in mind.

- HMRC does not normally tax spread betting profits, even if it is your main or full-time income. Tax would only arise in rare cases where the activity is shown to be run as a business rather than gambling.

- If you’re trading through your limited company, you’ll need to pay corporation tax – The HMRC will consider this speculative bet to be a trading activity of your company.

Pro and Cons Table For Spread Betting Taxes

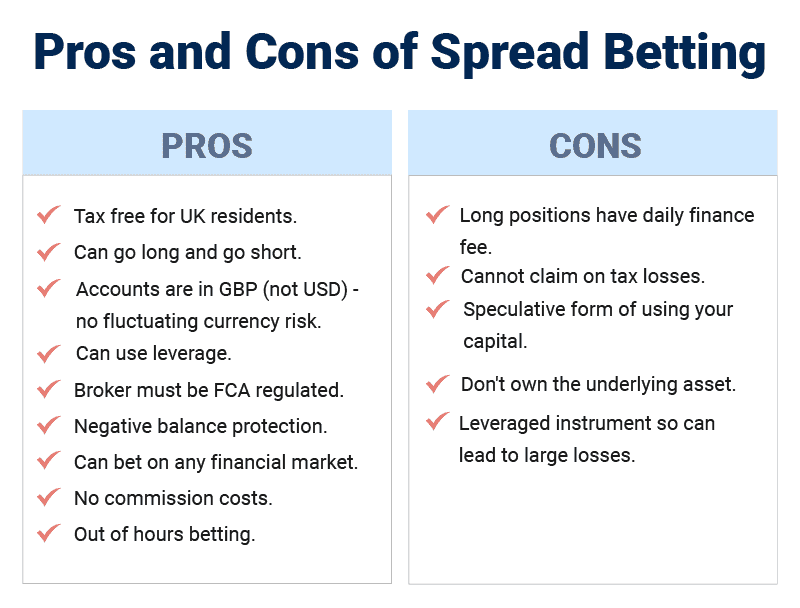

We have found a number of different spread betting advantages, such as leverage trading, a wide variety of markets to bet on, and low trading fees. One of the main benefits, we feel, is the exemption of capital gains tax and stamp duty.

However, there are a few cons to consider too.

| Pros | Cons |

|---|---|

| No capital gains tax | Cannot offset your losses against your tax |

| No stamp duty tax | In very rare cases, HMRC may tax spread betting if the activity is proven to be a business operation, but being a full-time bettor alone does not make profits taxable. |

| No dividend dividend tax |

It’s important that we stress these benefits are only for retail account holders. The situation is different if you are a professional spread bettor or if spread betting is your sole income.

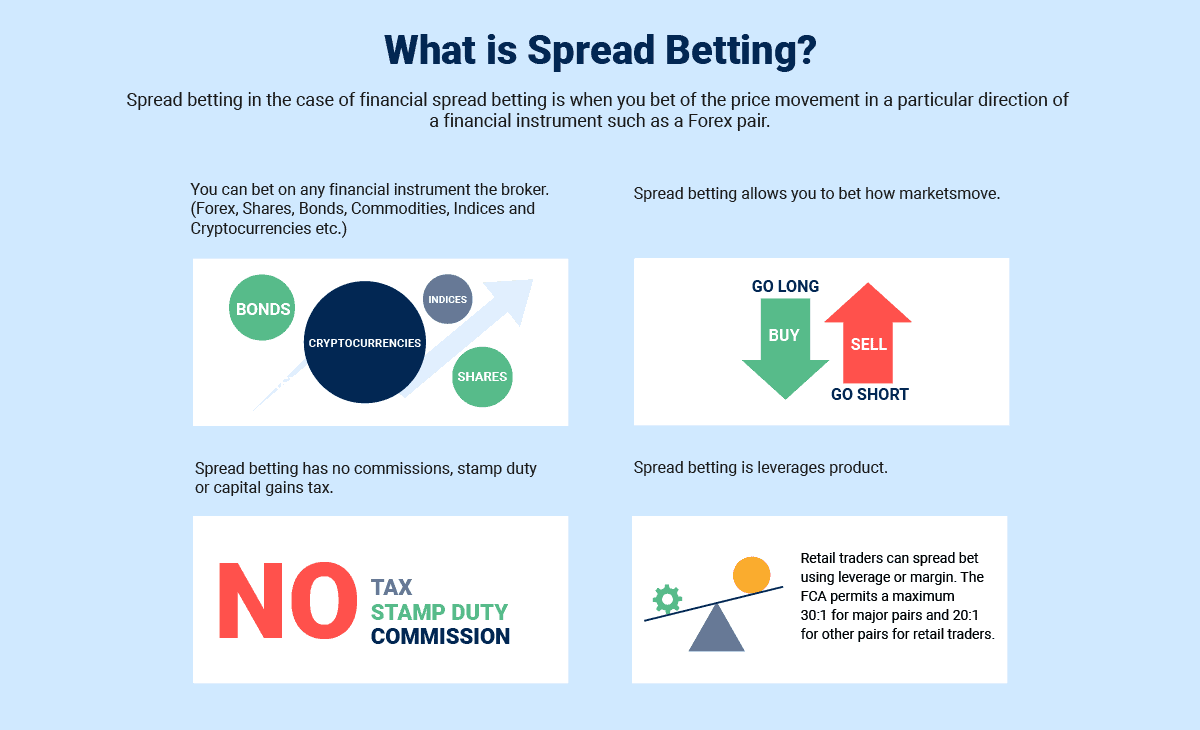

What Is Spread Betting?

Spread betting is a method of trading the markets. You are able to speculate on the price movement of a specific financial market, without actually owning the underlying asset.

You may decide to go long (or buy), and potentially profit from a rising market. Alternatively, you can go short (sell) and potentially profit from a falling market.

The opportunity to profit in both rising and falling markets makes this an attractive method for day traders.

View our full spread bet guide to learn more about this form of trading in the UK.

How Are CFDs And Spread Bets Taxed In The UK?

Spread betting and CFDs are very similar. But the main point of difference is how they are taxed. Trading

CFDs are classed as a form of investment, because there is an exchange of contracts.

Spread betting, on the other hand, is classed as a form of gambling by the HMRC, and is tax exempt as a result – at least for most retail traders.

You can learn more about these tax implications in the table we’ve provided below.

| Tax Type | Spread Betting | Share Trading |

|---|---|---|

| Capital Gains Tax (CGT) | 0% | 10 - 20%* on profits |

| Claim Losses Against CGT | 0% | Yes |

| Stamp Duty | 0% | 0.5% |

| Dividend Tax | 0% | 8.75 – 39.35%* |

Why Isn’t Spread Betting Taxed in the UK?

The UK is one of the only countries worldwide not to tax financial spread betting. This is due to the product’s positioning and classification by the HMRC, which regulates spread betting taxes, and taxes from other sources.

1. The HRMC Considers It Gambling

According to HMRC tax law, spread betting is a form of gambling. The HMRC’s definition also states that “no assets [are] acquired or disposed of” – you are not buying or selling any asset, and are essentially gambling on the future direction of the price.

2. The HRMC Considers It A Derivative

Spread bets are derivatives. They are linked to an instrument, but they do not involve the actual purchase or sale of that instrument.

Whenever you register an asset in your name in the UK, you’ll need to pay stamp duty tax on the registration document. As there’s no transfer of assets, there’s no document – so you don’t pay the 0.5% stamp duty tax that you would with traditional share trading.

Spread Bet Tax-Free Example: Stocks

Below, I’ll quickly outline a spread betting example which highlights the tax benefits of spread betting, compared to other traditional market speculations.

Example of Spread Betting Stocks (Tax-Free):

You decide to open a spread bet on Vodafone (VOD) shares, and go long at the buy price of 82p per share. You stake £10 per point.

So for every 1p VOD rises above 82p, you’ll profit £10.

You aren’t actually buying the shares themselves, so you don’t need to pay any stamp duty on this position. There’s no contract or registration document involved.

There’s also no commission to pay, as the position is a spread bet.

Let’s say the prediction you made turns out to be accurate. VOD rises to 92p per share. The 10 point gain makes you £100 profit, according to the formula: “price movement in points x per-point bet size”.

While you have made a profit here, HMRC does not class this profit as taxable. You won’t need to pay capital gains tax or income tax on this, as long as you’re not a professional trader, or betting on spreads as your main source of income.

Now, let’s see how much you would have had to pay if you’d traded the shares in the traditional way.

Fees on purchasing shares:

- Stamp duty tax (0.5% of the asset value)

- Broker’s commission (typically 1.5% of the total trade size)

Fees on closing the shares in a profit:

- Broker’s commission (typically 1.5% of the total trade size)

- Profits liable to capital gains tax (up to 20% of the profits)

As you can see, you’ll be able to keep more of your spread betting profits than you would with traditional share purchasing.

This does depend on the individual broker’s fees, however. So we strongly recommend reviewing our UK spread betting platform page before you choose a broker.

FAQ

Which Countries Is Spread Betting Tax-Free?

You can only enjoy tax-free spread betting in the UK, due to the UK’s definition of spread betting as a gambling product.

Many countries do not permit spread betting. Those that do permit this form of speculation typically class it as an investment vehicle, so you’ll be paying taxes on your profits.

What Are The Costs Involved In Spread Betting?

While spread betting is free from taxation and commission in most cases, there are costs to think about.

There will be an overnight rollover fee charged if you keep your spread bet open at the end of the trading day. This is the interest fee applied to the funds you have leveraged.

If you close your position on the same day you opened it, you’ll only need to pay the pip spread. This can be as low as 0.5 pips for some brokers we’ve looked at.

Use this handy spread betting calculator to analyse the potential costs before you begin. This can give you better insight into trading costs, so you can see if the risk-reward is acceptable.

Are Taxes The Same For Shares Trading And Spread Betting?

No, they are not. Traditional share trading is subject to stamp duty and capital gains tax because you purchase a company’s physical shares and receive a certificate of ownership.

On the other hand, spread betting shares is exempt from both capital gains and stamp duty, simply because this position is a derivative – you do not physically take ownership of the shares, and there is no contract or registration to sign.

Is Spread Betting Illegal?

Spread betting is not illegal in the UK. The Financial Conduct Authority (FCA) permits and regulates spread betting for UK residents.

Outside of the UK, this depends on the laws of the local jurisdiction, but many other countries do indeed allow traders to spread bet.

Make sure you check that spread betting is legal in your country before you start trading – for example, spread betting is illegal in the United States, and in some other countries.

The reason spread betting is particularly popular in the UK is due to its tax-exemption status.

Ask an Expert

What happens if I’m spread betting while living abroad?

If you’re living abroad, you might be subject to local tax laws, so it’s best to check with a tax advisor.

I’ve heard that if that’s your only source of income, it can then be taxed. Can that be true…What if someone is so good they can make £1million+ a year, will it still be free of taxes?

It depends on your betting behaviour. HRMC need to be able to show that you betting conduct goes beyond simple hobby or speculative behaviour. If your betting is calculated, strategic and with commercial then it is likely to be with more serious intent.

By your words, HMRC don’t follow their own internal manual, then. BIM22017 states: “The fact that a taxpayer has a system by which they place their bets, or that they are sufficiently successful to earn a living by gambling does not make their activities a trade. (…) Having expertise or being systematic (‘studying form’) is not enough to create a trade of being a ‘professional gambler’.” So if I run a spread betting activity full time as an individual, without office structure, not having any social activity (e.g. promoting seminars, courses, books, etc.), trading my account only, not managing customer’s accounts, given spread betting is gambling, that’s considered commercial intent… Nothing makes sense.

HMRC’s own manual (BIM22017) states that even full-time, systematic, highly profitable gambling is not a trade, so spread-betting profits remain tax-free, even at £1m+ per year — as long as you only bet your own money and aren’t running a business for others.

Hi thank u I trade with fxcss. Mostly gold and the Dow jones. I day trade. It’s this still tax free

Yes as long as your betting behaviour is in line of that expected of a retail trader. That is, it does not appear to have commercial intent

The article says: “Professional spread bettors will need to pay income tax – This will apply if spread betting is your only or main source of income.”

Where did you get that concept from because HMRC state that gambling profits are not taxable full stop regardless of what form of regulated gambling it may be, there is no reference about it being a sole income and therefore taxable. Running a “place of supply” gambling service is taxable, but not the direct proceeds from the winnings from betting. If I’m wrong then please let me know where there is such a stipulation in any UK gambling taxation law. I don’t think you’ll find such a concept and it might be best to fix the accuracy your article.

No – HMRC can consider spread betting to be trading under ITTOIA 2005, Part 2. This occurs when your betting is systematic, orgnised with Commerical intent.

John, you are correct. Individual spread-bettors do not pay tax, even if spread-betting is the sole source of income. HMRC’s Business Income Manual 22017,states the following: “The fact that a taxpayer has a system by which they place their bets, or that they are sufficiently successful to earn a living by gambling does not make their activities a trade”. Additionally, Business Income Manual 22015 declares, “The basic position is that betting and gambling, as such, do not constitute trading”. Furthermore, in the case of GRAHAM v GREEN {1925} 9 TC 309, which involved a man whose sole means of income derived from horse-racing, his profits were not liable to tax. The same document explains “This shows that having expertise or being systematic (‘studying form’) is not enough to create a trade of being a professional gambler”. This case has stood the test of time. With regards to ITTOIA 2005, Part 2, it is clearly stated that these provisions do not tax “gambling winnings from wagers and bets” in overview BIM100101.

HMRC’s default position is that spread betting profits are not taxable, even if it’s your full-time income, as confirmed in BIM22015, BIM22017, and Graham v Green. My earlier wording was referring to the very rare situation where HMRC may treat someone’s overall activity as a business operation rather than gambling.

For ordinary individual bettors, spread betting remains tax-free, and I’ll update the article wording to reflect this more clearly.

Im about to receive my state pension. Will any spread betting profits interfere with my payments.?

In the UK, spread betting profits do not affect your State Pension payments.

My income is restricted to pensions. This being the case would any spread betting gains be taxable?

We don’t give financial advance so we can’t answer this specifically but generally speaking, spread betting is tax free unless the nature of your better appears too orgnised, systematic and commercial to be pure gambling in nature.

Does spreadbetting remain tax free if it exceeds my employment income?

Pretty much. How much you earn in spread better is irrelevant. HMRC guidelines make it clear that tax applies if your betting is organised, systematic and has commercial intent. Where these can be shown, spread betting will be considered as trading not gambling.

What is the specific source in law that says that spread betting isn’t taxable? What is the source in law for it being taxable if it’s your main income?

1. Spread betting profits are exempt from tax under ITA 2007, s. 615 (this says spread betting is treated as gambling, not investment).

2. Spread betting is Taxable if its your main income: If spread betting amounts to a “trade” under ITTOIA 2005, Part 2, then profits are taxable as trading income. This applies if you are a professional better for example.