The FTSE 100 is just one of many indices you can use for spread betting. We explain how FTSE spread bets works and identify the top UK spread betting brokers for UK traders

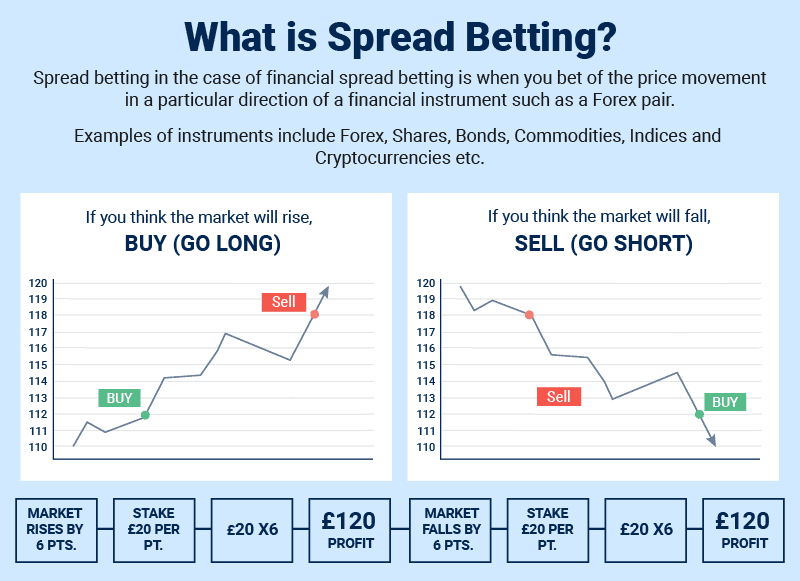

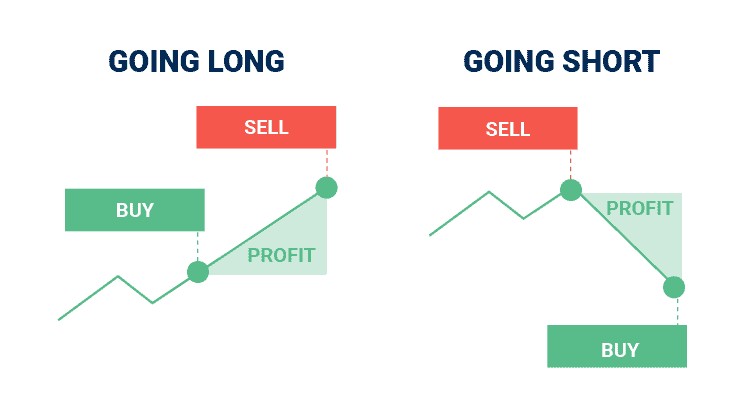

Spread betting on the FTSE 100 is a way of speculating on the price direction of the FTSE 100, allowing you to profit on rising and falling markets. To profit from spread betting on the FTSE 100, you can go long (buy) if you think the price will rise or short (sell) if you predict the price will fall.

What Is FTSE 100?

The FTSE 100 (Financial Times Stock Exchange) is an index of the top 100 companies in the United Kingdom based on their market capitalisation. Companies listed on the FTSE 100 are publicly traded, meaning you can buy and sell their shares, with companies like Tesco, AstraZeneca and Vodafone listed in the index.

FTSE 100 is a key indicator of the overall health of the UK’s economy and stock market; the better the performance, the better the overall economy is doing.

How Does Spread Betting FTSE 100 Work?

In FTSE 100 spread betting, you don’t buy or sell the underlying asset but rather bet on whether the price of a financial instrument will go up or down (in this case, the FTSE 100 index). If you think the value of the FTSE index will rise, you will buy the index. On the other hand, if you believe it will fall, you will sell the index.

Your profit or loss is determined by the difference between the price at which you buy the index and the price at which you sell it, multiplied by the bet amount.

Why Is Spread Betting With FTSE 100 Popular

The FTSE 100 is a popular spread betting market because it is the London Stock Exchange (LSE) benchmark index. It comprises the 100 most traded companies by capitalisation on the LSE.

Even if you are new to trading and live in the UK, you will have heard about the FTSE 100 and may even know some companies that make up the index. Companies that form part of the index include Unilever (LSE: ULVR), AstraZeneca (LSE: AXN), HSBC (LSE: HSBA) and Rio Tinto (LSE: RIO).

It is also popular because you can place spread bets on the index 24 hours a day, allowing for plenty of trading opportunities.

Example Of Spread Betting FTSE 100

To better understand how to profit on the FTSE 100, I’ll go through a couple of examples of financial spread betting on the FTSE 100 below.

Example 1: Winning FTSE100 Bet By Going Long

In this example, we will look at a long position on the FTSE 100.

You read that the Bank of England intends to cut interest rates and predicts that the FTSE 100 index will rise.

Then place a bet that the FTSE will rise at least within the next 24 hours and open a position at 7950 for £5.00 stake per point.

Fortunately, 5 hours later, the market moved in your favour, and the FTSE 100 index rose to 7970. You decide to take the profit and close the position after the 20-point move (7970-7950), making you £100 profit (20 points profit x £5 per point staked).

Example 2: Losing FTSE100 Bet By Going Short

In this example, we will look at a short position on the FTSE 100.

You believe that the FTSE 100 will fall due to a hike in interest rates, so place a short position of £5 per point at 7600.

Unfortunately, over the next 14 hours, the FTSE 100 increased to 7650. You cut your losses after the FTSE moved 50 points (7650-7600) against you and exit at 7650. This leaves you with a loss of £250 (50 points x £5 stake per point).

How To Start Spread Betting FTSE 100 in 9 Steps

If you want to start spread betting on the FTSE 100, the steps below should get you up and running. Be sure to carefully consider your risk appetite, trading experience and trading budget:

1. Open A Spread Betting Account

You can test the waters with different brokerages and trading platforms by opening demo accounts if you are just starting. These risk-free accounts allow you to simulate bets to get a feel for the betting platform’s interface, execution speeds, and trading tools.

2. Analyse The FTSE 100 Index Performance

You should analyse the index’s performance to spread bet on the FTSE 100 successfully. Use fundamental and technical analysis to analyse the performance, although if you are spread betting with a short-term view, then the technical analysis is best.

3. Decide To Go Long Or Short

After analysing the FTSE 100 performance, you will have decided if it is better to go long or short. If you think the price of the FTSE 100 will rise, go long; otherwise, you’ll be shorting the FTSE 100 if you think the price will fall.

4. Choose TimeFrame For Bet

Now you know if you are going long or short, you must choose the timeframe for the bet. You can use the standard daily funded bet if you have a short-term view of the market direction (less than three days). The DFB has narrow spreads but has a rollover fee (interest) that the broker charges you for the leveraged position overnight.

If you think the financial market may take longer to reach your target profit, then a spread bet on the future FTSE 100 contract would be ideal. You do not pay overnight fees for a future contract (the spread is wider, though).

Most of the time, you’ll be spread betting with a DFB and closing within the same day (therefore not paying any rollover fees).

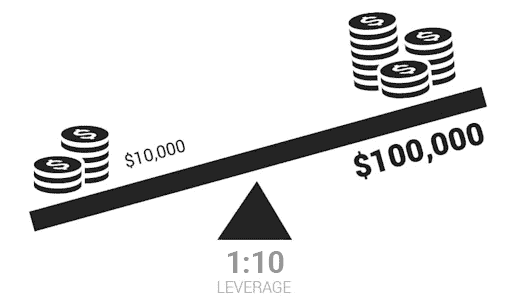

5. Set Your Leverage

The leverage on FTSE 100 is 1:20, meaning for every £1 in margin available, you can borrow £20. So, if you want to open a position worth £200, then you would need a margin of £10. The broker will let you know how much margin is required before placing a bet because you cannot open the bet if you do not meet this requirement.

6. Define The Position Size Of Bet

To define the position size of the bet, you simply enter how much you want to risk per point (also known as the stake). You should use a spread betting calculator to know your costs, risk, and profit potential.

7. Define Your Stops

It’s essential to define your stop loss order when placing a spread bet, as this can limit your losses should the financial market turn against you, especially if you are away from your betting platform.

You can set your stop loss while placing your spread bet, or amend your position and attach a stop loss order for free. The stop loss will automatically close your bet if the FTSE 100 price reaches the stop loss price.

8. Open Your Trade

With the bet size (stake), the direction of the bet (long/short), and the stop loss added, you can open your spread bet by clicking the “place bet” button on the deal ticket. This will execute your order exactly how you filled it, so ensure it is accurate.

9. Monitor Your Trading Position

While your trading position is open, monitoring the markets for signals that add confluence to your idea or signal that the market may be moving against you is best. Doing this allows you to lock in profits or avoid unnecessary losses, but if you have added a stop-loss order to your bet, this will limit your losses automatically.

Which Broker Has The Best FTSE 100 For Beginners

I think OANDA has the best spread betting platform for beginners with FTSE 100. The broker allows you to have the lowest stake sizes from 1p per point, which is ideal if you are nervous about risking your money switching from a demo account.

The spread betting broker also offers low spreads and a decent choice of markets. One feature I must mention is that if you use their in-house developed OANDA Trade platform, you will be able to use a guaranteed stop loss order This is a good risk management tool I think all new traders should use to start with.

Other platforms I can recommend include Pepperstone, Capital.com, City Index, CMC Markets and IG Group.

Which Brokers Have The Best FTSE Spread Betting?

I recommend Pepperstone as the best spread betting UK platform for FTSE spread betting overall.

Pepperstone has average spreads from 1.12 pips on EUR/USD, below the industry average in our testing, and fast execution speed which reduces slippage risks. There are a wide and a wide selection of markets (including the FTSE 100 index).

I like that the broker allows you to choose from 4 trading platforms – MetaTrader 4, MT5, cTrader, and TradingView. TradingView is my recommended platform if you like technical analysis tools as the platform has 15+ chart types, 400+ built-in indicators and 110+ drawing tools.

Pepperstone ReviewVisit Pepperstone

75.1% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Is FTSE 100 Popular With Professional Traders

The FTSE 100 is a popular market for spread betting professionals as it is a highly liquid index with plenty of volatility for the price to move throughout the day. Combining these factors allows professionals to day trade the FTSE 100, knowing there will be enough price movement to profit from within a single day (sometimes multiple times).

You will need to meet some eligibility requirements but professional bettors have access to higher leverage, making it potentially more lucrative to bet on stable assets like the FTSE 100.

What Other Indices Can You Spread Bet?

Spread betting indices open a wide range of markets you can spread bet on; these can vary from broker to broker, but the most popular indices to spread bet on are:

- S&P 500 – an index that has the largest 500 publicly listed companies in the US, one of the most popular indices to bet on.

- NASDAQ – a US index that focuses on technology stocks

- Dow Jones Industrial Average – The DJIA tracks 30 blue-chip companies from the NYSE and NASDAQ.

- DAX 40 – German index with 40 blue-chip companies from the Frankfurt Stock Exchange

- Eurostoxx – this index represents the performance of the 50 largest blue-chip companies from the Eurozone and is a good indicator of economic health in the area.

FAQ

Is Spread Betting Legal In The UK?

Yes, spread betting is legal in the UK and Ireland. While spread betting is legal in several jurisdictions, it’s popular in the United Kingdom and Ireland due to the favourable tax exemptions. As a result, many of the most reputable spread betting companies offer retail investor accounts with spread betting products.

Spread betting is regulated by the Financial Conduct Authority (FCA) in the UK, which provides the licences for all spread betting companies to offer their services. The FCA ensures fair practices and protection for spread bettors from broker malpractice.

How Profitable Is Spread Betting?

Spread betting can be profitable if you have a trading strategy that is consistently reliable and uses sound risk management. Making money by spread betting should be viewed as a high-risk option for growing your money instead of a full-time job, and it should not be viewed as a “get-rich-quick-scheme”.

Do I Pay A Tax On Spread Betting?

The core advantage of spread betting is that you are exempt from paying taxes on it. Being exempt from taxes means you do not pay capital gains or stamp duty tax, dramatically lowering your trading costs.

What Impacts The FTSE 100 Index?

The performance of individual companies within the index are the primary long term drives of FTSE 100 movements. Then there are daily movements which are often impacted by macro events (eg GDP figures) which can impact interest rates and other economy metrics.

How Do You Spread Bet On The Stock Market?

To spread bet on the stock market, you need to choose the company you wish to bet on by analysing the stock’s performance to predict if the price will rise or fall. When you have your direction, enter your stake per point and execute the spread bet of the share at the current price.

If you predict the stock’s movement correctly, you’ll earn the number of points the market moves multiplied by your stake. Should the markets move against you, you’ll lose your stake multiplied by the number of points the market moved.

Is Spread Betting FTSE 100 a Good Spread Betting Strategy?

Spread betting on the FTSE 100 is a good spread betting strategy as it is a relatively stable market (the amount of points moved isn’t much per day). Being stable allows you to take small but frequent trade ideas without worrying the price will surge higher (or lower), risking your capital.

The stability of the FTSE 100 is an ideal choice if you are a beginner as it allows you to bet on a market that is easy to follow.

You should note that no market is guaranteed to return a profit. You should do your due diligence and market analysis before risking your funds.

Ask an Expert

How much leverage can I get when spread betting on the FTSE 100?

Leverage varies, but most brokers offer up to 20:1 for FTSE 100 spread betting.