Forex spread betting enables speculation on currency pair movements, without you having to worry about direct foreign exchange transactions.

Working with spread betting forex brokers lets you bet on potential rises or falls in value, offering a chance for profit based on market trends.

How To Spread Bet On Forex Markets?

Spread betting on the forex markets is a straightforward process, with a wide choice of currency pairs to bet on. Below, I’ve outlined the five steps you need to take to place your first spread bet on a forex market.

1. Choose The Currency Pair

Your first step is to choose the currency pair you want to spread bet on. Most brokers offer between 40 and 100 pairs to choose from.

If you are a beginner, I recommend choosing one of the major forex pairs, like EUR/USD or USD/JPY. These pairs are ideal, as they come with lower spreads and lower volatilty.

Alternatively, if you prefer to take on more risk when trading spread bets, you can bet on minor and exotic pairs. These pairs carry wider spreads, and larger market movements.

2. Determine If You Want Forwards, Options, Or Spot Prices

A spot price in forex is just the current market price. With this kind of betting, you are entering the market immediately, and it is the most common choice when spread betting.

If you are predicting market movements in the longer-term, then you should use a forex forward. With this method, spread betting companies reduce or remove their nightly rollover fees – which is why I recommend this type of betting if you’re going to keep your bet open past the end of the trading day.

Some of the best spread betting brokers – like IG Group and Spreadex – will provide forex options betting. An option gives you the right, but not the obligation, to buy or sell the forex pair at a specific price.

Here’s what my fellow Spread Bet co-founder, Noam Korbl, thinks about options:

“As a slightly more advanced form of spread betting, forex options can be a good choice,” Noam says. “They can generate larger spread betting profits in some cases, especially when the asset is volatile. They also limit your risk – you’ll only run the risk of losing the option contract price.”

3. Place Your Bet On Financial Markets

With the currency pair and type of bet chosen, you can place your first forex spread bet.

You’ll do this on your spread betting platform. Software like MetaTrader 4 or 5, or TradingView, are the best spread betting platform choices in my view. Now, you’ll select whether you want to go long (buy) or short (sell).

If you think the currency pair price movements are going to be positive, you’d buy. If you believe the opposite, you’d sell. Then, you’ll enter your bet size. The deal ticket will allow you to enter your stop loss and take profit orders before executing your bet.

When you are happy with the bet size and direction of the market, you can place your bet by clicking the place order button.

4. Monitor Your Position

After you’ve entered your forex spread bet, I encourage you to continuously monitor your position. The platform will show your running profit and loss, and keeping an eye on this will tell you how your bet is doing.

5. Close Your Position

When the market has reached your desired target, and you want to close the position for a profit, go to your trading platform and click the “close” button.

You will instantly exit the bet, and the profit generated will be added to your spread betting account. If you closed in a losing position, then the loss will be deducted from your spread betting account.

What Are The Advantages Of Forex Spread Betting?

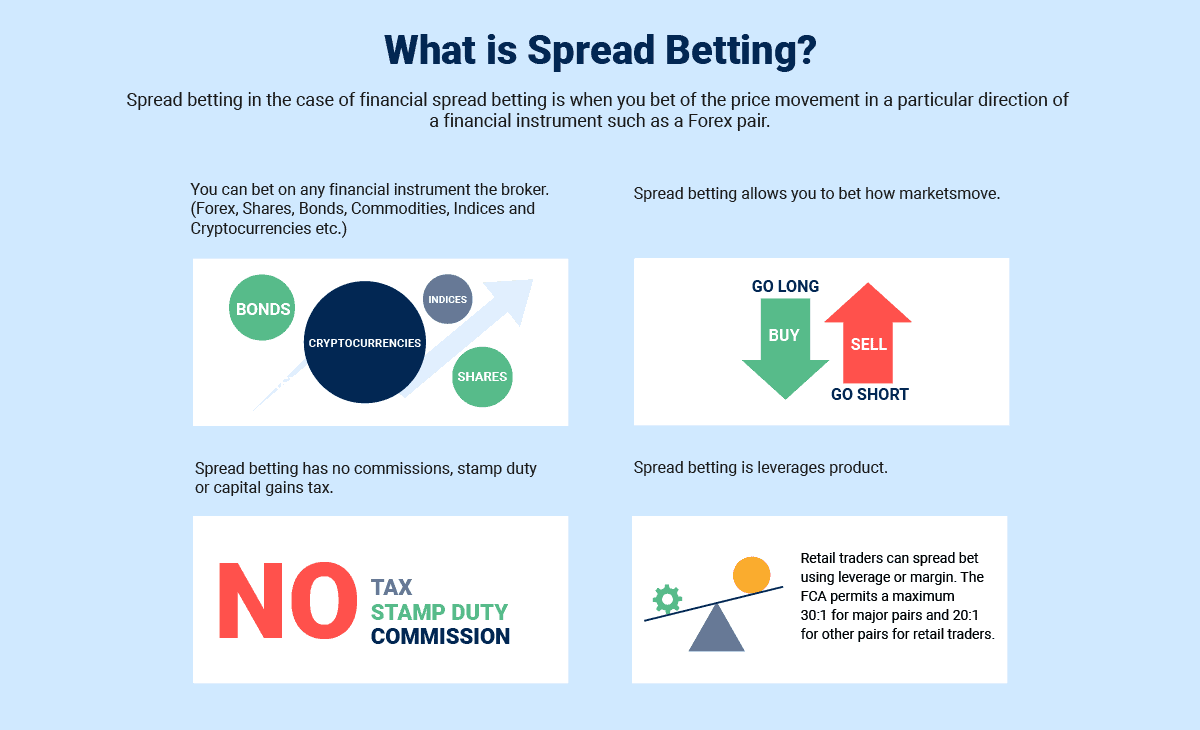

Spread betting forex has many advantages that are exclusive to UK spread bettors. The main benefit of note is that taxes are exempt on winnings. Below, I’ll break down the advantages so you can consider if forex spread betting suits you:

Spread Betting Is Tax-Free

If you spread bet on the forex markets, the profits you generate are exempt from capital gains tax, which can save you up to 20% extra profit. This exemption is because the UK’s tax authority, HMRC, classes spread betting as a gambling product.

Spread Bet Currency Is GBP

When you trade forex CFDs, your base currency will be converted into the forex pair you buy. For example, if your base currency is GBP and you buy EUR/USD, your trade gets converted into euros, and you will be charged a currency conversion fee.

With spread betting, you bet in GBP on all international markets. This means your profits and losses are exclusively in GBP too, and you don’t lose any money through conversion fees.

No Commissions When Trading

Forex trading is known to have low trading costs due to highly liquid markets, but some CFD brokers require a commission when you trade.

It’s different with spread betting. All spread betting firms offer spread-only accounts, with no commissions. This provides a simple pricing structure, and no direct charges applied to your spread betting account.

View our list of the best spread betting brokers in the UK where we compare the platforms based on their average spreads, software offered and trading conditions.

What Are The Risks Of Forex Spread Betting?

Like all methods of growing your capital, there are spread betting risks you should be aware of. Spread betting has built-in leverage on its bet sizes, magnifying your potential profits and losses.

Even small movements, like 20 pips, can take you out when leverage is applied. If you held the whole position with no leverage, you wouldn’t even notice the move. Take this as an example: you bet using a leverage of 1:30 on EUR/USD, at £1 per point. For this, you would need a margin of around £333 to open your bet.

With this margin, you would control a position size of £10,000. So if the market moves 1%, you would make £100 profit. If you deposited £333 as margin (your money), this 1% increase is actually a roughly 30% increase on your account. So you might only lose 1% on the £10,000 position, but you would be down around a third on your margin.

This is what our senior analyst Ross Collins has to say about leverage risks. “You can easily see how leverage accelerates your losses and profits from smaller market movements,” Ross says. “This is why so many people like spread betting, but it’s also why retail investors lose money quickly if their bet goes bad.”

What Is The Difference Between Forex Trading and Spread Betting?

Spread betting is a type of trading, a method. Forex refers to the instrument. So you can spread bet on forex, but you can do other things too. This means that forex and spread betting are not one and the same thing:

1. Forex Trading Involves Currency Pairs

Forex just refers to the currency pairs in the market. For example, EUR/USD, or USD/JPY.

2. Spread Betting Involves Predicting Market Movements

Spread betting is a type of trading. You are trying to predict the market movements of an underlying asset. This underlying asset might be a forex pair, but it might be something else.

3. Forex can be traded in different ways

You don’t necessarily need to spread bet to trade forex. Instead, you can open up a contract for difference, or CFD. This is just one of the ways that forex traders try to profit in the market. I’ll look into this in a bit more detail below.

4. Spread Betting Can Be Applied to Other Markets

You can spread bet on lots of underlying assets, not just forex. Commodities, shares, indices, and ETFs, are all examples of markets that can be used for spread betting.

What Are Most Popular Forex Spread Betting Software Packages?

Forex markets are available from all of the brokers we’ve reviewed here on our website, and you can essentially use any spread betting platform to trade these markets. The actual trading platform you use is a matter of personal preference. This is going to be the control centre of your entire betting operation.

To help you narrow down your choice, I’ve rounded up some of what I believe to be the best forex spread betting platforms below:

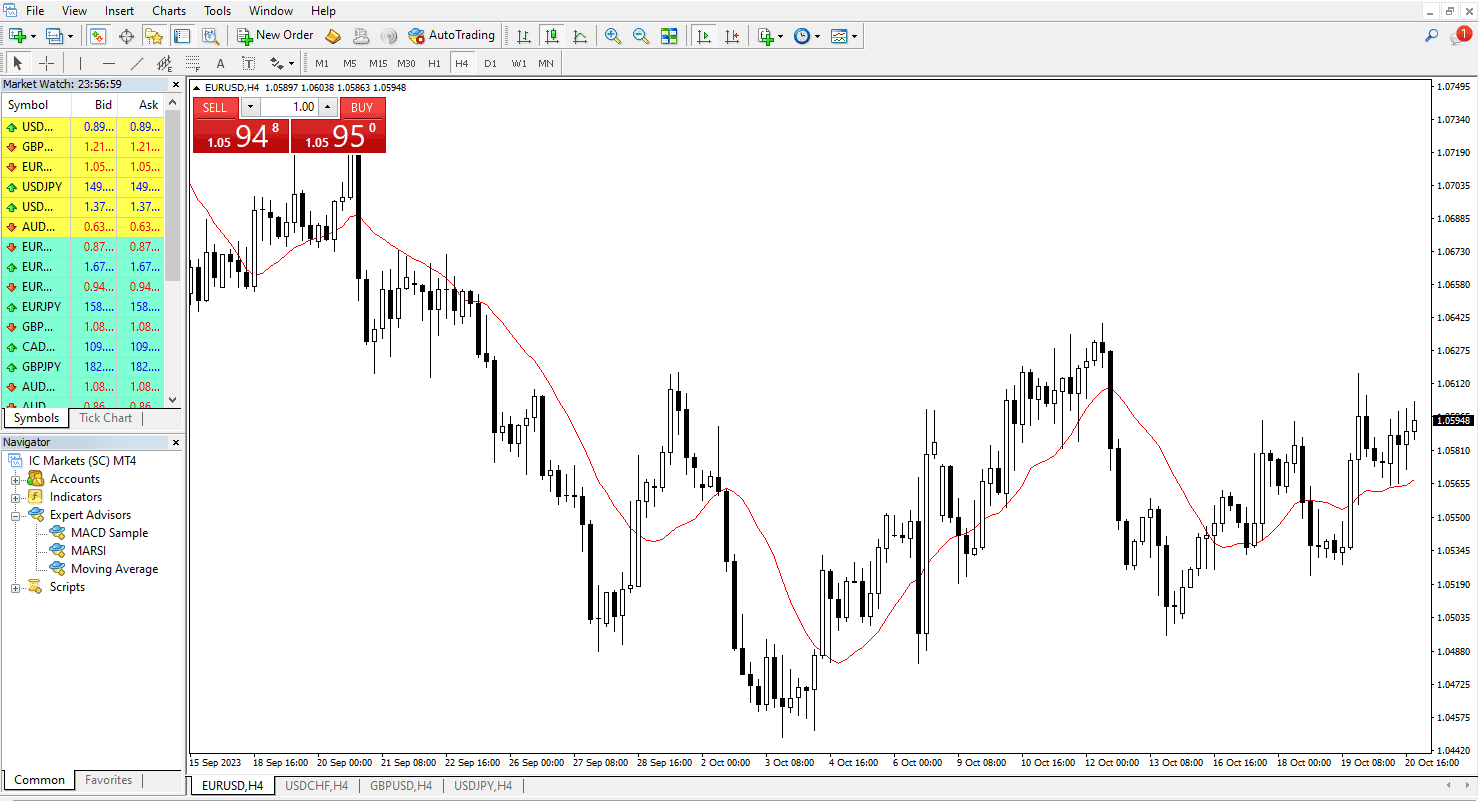

1. MetaTrader 4

MetaTrader 4 is a popular spread betting platform. It has an excellent interface that looks like a professional terminal, and lots of space for charting, but it remains easy to navigate.

The platform comes with a solid selection of technical analysis and drawing tools to help you analyse the markets. You can trade directly from the charts with the one-click trading tool, ideal if you are a scalper.

One of the key features MetaTrader 4 offers is its customisation. You can create your own technical indicators and automated trading robots (Expert Advisors).

It’s one of the few platforms that supports automated trading, so MT4 is a top choice if you want to automate your forex bets.

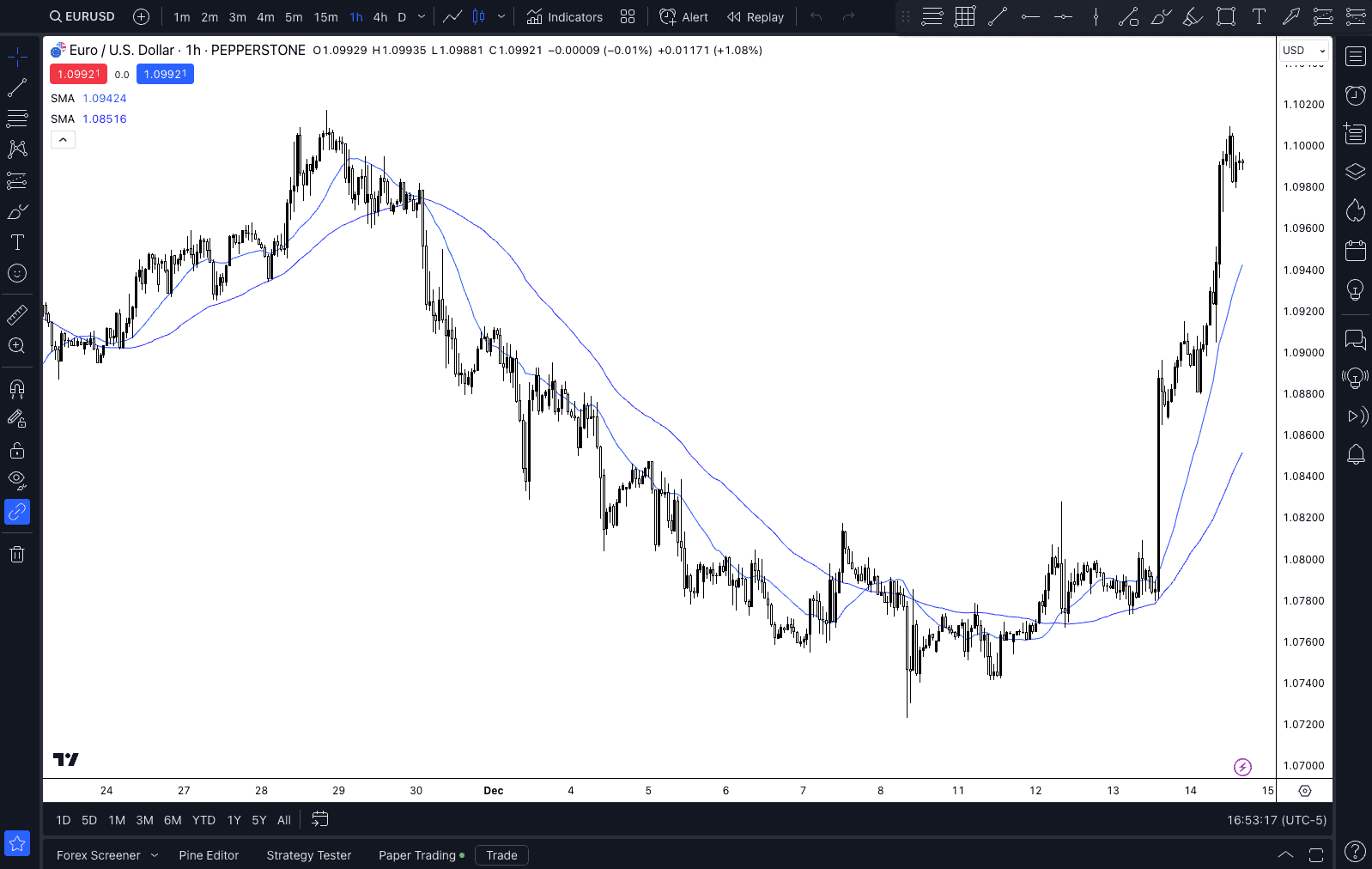

2. TradingView

TradingView is the (relatively) new spread betting platform on the block, and comes with the most advanced charting tools available. There are over 100 technical analysis tools built-in. If you like to use technical analysis and annotate your charts, then TradingView is a great candidate.

It’s consistently updated with new features, like automated Fibonacci levels and candlestick pattern scanners. You can also develop your own technical indicators. They also have a fantastic trading app that works across both Android and iOS environments.

I personally like TradingView a lot, as the charts sync across every platform. This means you keep your analysis with you, whether you’re operating on desktop or mobile – most other platforms won’t let you do this.

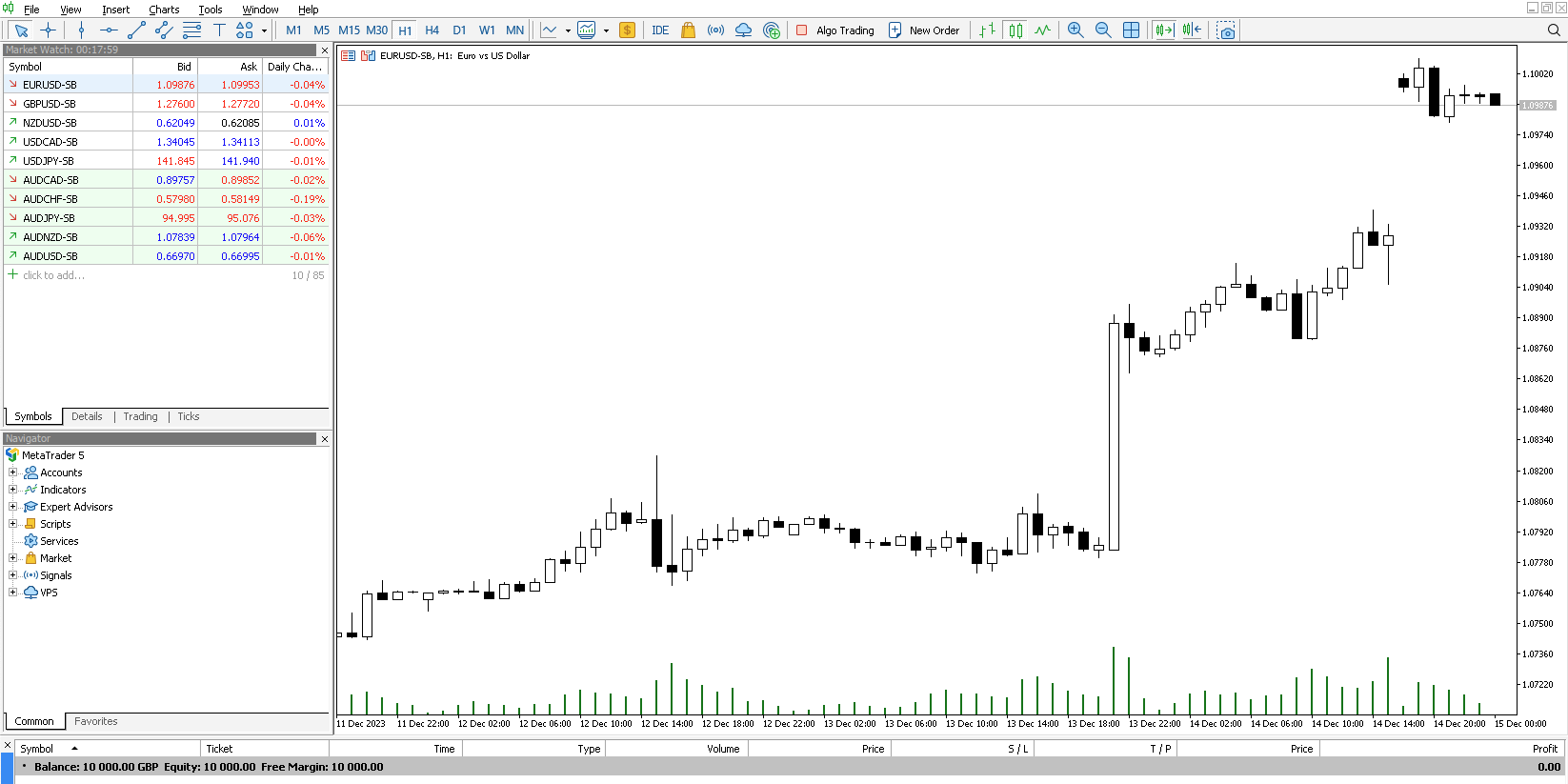

3. MetaTrader 5

MetaTrader 5 is the updated version of MT4. Its performance upgrades improve the speed of automated trading and introduce new features not found on the MT4.

For instance, you can use the Direct Market Access tool that displays market orders for a financial instrument at different prices, helping you understand its liquidity.

It also has more technical indicators and allows you to trade multiple assets. This is an improvement on MT4, which won’t let you bet on stocks. So, if you want the benefits of MT4, but need access to a range of markets, then MetaTrader 5 might work for you.

Forex Forwards Vs Forex Options

As a trader, you are never short on ways to speculate on the markets, especially with derivative trading. Forex is the underlying asset to both forex forwards and forex options. The current price of the forex pair is known as the spot price.

Forwards are contracts to exchange currencies at an agreed rate and date in the future. These work in a similar way to spot forex trading. Although you can speculate with forwards, they are geared toward businesses that need to hedge against currency risk.

Conversely, options trading provides traders with greater flexibility. It’s also easier to manage risk on options, compared with spot forex and forwards.

However, they are more complicated to learn. Options are contracts that give you the right to buy or sell an asset at a predetermined price, on or before a specific date – you are not obliged to go through with the option.

This obligation is the key difference between forwards and options. There’s no obligation on options, while there is on forwards. This is why options tend to be more expensive.

| Feature | Spot Forex | Forwards | Options |

|---|---|---|---|

| Ownership Of The Asset | Yes | Contract To Buy/Sell In Future | Right To Buy/Sell In Future (No Obligation) |

| Settlement Date | Immediate (on the spot) | On a future date | On a future date |

| Price | Current market price | Forward price in the future | Stike price |

| Risk | Market volatility | Market volatility | Limited to premium |

| Liquidity | High | Low | High |

Forex Spread Betting vs CFDs

Using Contracts for Difference (CFDs) and spread betting are two of the most popular ways to approach forex as a retail trader. CFDs offer the many of the same trading opportunities as spread betting.

With a CFD, you are buying into a contract and agreeing to pay the difference between the open price and the closing price of an underlying instrument.

This makes a CFD a derivative – its value is derived from the asset its associated with.

The CFD is used worldwide (except in the US) to trade all types of financial markets. This type of trading is especially popular with retail traders since it can be done at home via an online broker and an internet connection.

Spread betting is very similar to the CFD derivative product. Both allow you to profit from price movements on an underlying asset.

However, there are some key differences. Spread betting is not permitted in many locations around the world, for example. In the UK, you are permitted to spread bet, and your potential winnings are exempt for capital gains tax.

CFDs don’t enjoy this tax free status, but you can at least offset your losses against other taxable income. You can’t do this if you are spread betting.

Below, I’ve quickly summed up the differences between spread betting vs CFD trading.

| Features | CFDs | Spread Betting |

|---|---|---|

| Ownership of the asset | No | No |

| Fees to trade | Commission and spreads | Spread only |

| Tax implications | Capital gains tax | Tax free |

| Availability | Worldwide | United Kingdom |

FAQs

Why Spread Bet?

Most traders choose to spread bet in the hope of making profits by successfully speculating on financial markets (or sports markets). Spread betting appeals to many types of trader, due to the lower spreads, tax exemption, 24/5 trading, and the wide range of markets available.

What Is Spread Betting?

Spread betting is a derivative product you can use to capitalise on the price movements of a financial market without owning it. You can use spread betting on a variety of markets (stocks, indices, forex, and commodities), and bet that the price will rise (known as going long) or fall (known as going short).

These features make spread betting an attractive financial derivative because you can take advantage of both bullish and bearish markets, giving you plenty of opportunities to bet during the day.

How Does Spread Betting Work?

Spread betting works on the principle of staking. You stake how much you want to risk per point the market moves. For every point the price moves, you’ll earn (or lose) your stake size. The result of the bet is the stake size multiplied by the number of points moved. So if the market moves by 50 points and your stake size is £10, you will make £500 profit.

When spread betting, you can go long and short in the markets. This means you can profit in either market direction, which allows you to capture opportunities unavailable via traditional trading methods.

If you think the markets will rise, you will go long (buy) the markets. If you think they will fall, you will go short (sell).

How Does Margin Work With Spread Betting?

Margin allows traders to open a larger position, increasing their exposure to currency movements.

This is important, as most currency pairs movements are only small. So it is rare to experience substantial profits or losses without leverage. We discuss this concept in greater detail on the margin spread bet page.

In spread betting, margin works by enabling you to open a much larger position than the capital you deposit. Essentially, your trading provider lends you the rest of the funds in a process known as leverage.

What Are Some Tips For Forex Spread Betting?

Forex spread betting offers many opportunities to bet every day, as forex includes some of the most liquid assets in the world. To take advantage of this, here are five tips on forex spread betting:

1. Start With A Demo Account

Using a demo account is free, and you can use virtual funds instead of risking your own capital, so it’s an ideal set-up if you are a beginner. You can open a spread betting demo account with any broker to test their platform and broker set-up, but more importantly, you can practice trading forex.

2. Develop Your Spread Betting Strategy

Don’t try to bet on a live account until you have a consistently profitable spread betting strategy. This should be a strategy you have tested on a demo account with reliable results. It’s essential to have a structure and understanding of the markets to help you find and have confidence in the trading ideas you find.

3. Use Stop Loss Orders

Adding a stop loss to your bets will help limit your losses, and safeguard you against sudden movements. If you trade without one, and a price spike hits your bet, you could lose much more capital than you intended. I always recommend being safe, rather than sorry.

4. Start Small

When you start a live account, you are both excited to earn money and anxious about losing it. So, I recommend starting with the minimum stake size when transitioning from a demo account to a live one.

This small start allows you to get used to having skin in the game, but lowers the amount you stand to lose. Over time, as you build experience and confidence, you can scale your bet sizes as you please.

5. Focus On A Few Currency Pairs To Begin With

There are over 70+ currency pairs to spread bet on, giving you lots of opportunities to profit. However, it is best to choose 2-3 currency pairs to focus on and work with them. This will allow you to become familiar with the personalities, patterns, and average trading ranges of each pair.

A few solid pairs to begin with are EUR/USD, GBP/USD, and USD/JPY, as these have high liquidity and tight spreads.

Key Takeaways

- Financial spread betting is only legal in a few places, including the UK.

- Spread betting on forex markets allows a trader to speculate on price movements, without owning the currency pair.

- The direction, size and spread are the key components of a financial spread bet.

- Leverage is used in spread betting to increase exposure. It makes modest price movements more profitable (or costly).

- Spread betting is tax-free in the UK.

- You should only choose an FCA-regulated broker if you are in the UK.

Ask an Expert

What’s the difference between spread betting on forex and CFDs?

With spread betting, you don’t own the asset like in CFDs. Also, spread betting is tax-free in the UK, while CFDs aren’t.

How do brokers set the spread when trading currency markets?

Every spread betting company factors in the natural spread of each currency pair initially. Generally, the more popular the forex pair, the smaller the spread is but it also depends on the timing. The broker then averages this out and marks-up the spread (to account for their brokerage). When we compared these spreads, Pepperstone marked-up the average spreads the least making them the cheapest spread bet company.