The primary risks of UK spread betting involve leverage and market volatility while some secondary disadvantages include slippage and holding costs. We explore these disadvantages and how UK traders can manage risk when spread betting.

1. Leverage

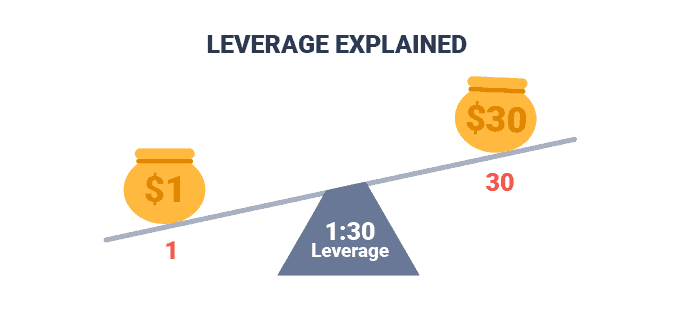

A major risk of spread betting is that leveraged trading can easily wipe you out if you are not managing your risk correctly. Leverage allows you to use margin to increase your capital but is a double-edged sword as it can amplify your wins or accelerate your losses.

If you bet (especially without a stop loss), you are exposing your entire account to the markets. If the markets suddenly drop 100 pips, this single move could potentially wipe out your account.

2. Market Volatility

Trading any financial instrument could involve market volatility due to the inherent nature of financial markets. A spread betting company will provide access to an extensive range of spread betting markets, allowing you to trade more liquid, lower volatility assets. Or you can spread bet more volatile and less liquid assets like forex majors that are more susceptible to market news and events.

We think it makes sense to bet on less volatile markets as they are cheaper to trade, easier to monitor, and more predictable regarding events that impact the price. Since financial markets are available 24 hours a day during the working week, markets can change while you are asleep, so implementing risk management is essential.

3. Slippage or Gapping

Slippage or gapping is the difference between the expected price and the actual execution price of a trade. In the case of spread betting, market gaps can cause slippage which means your orders could be executed at a worse price than you requested. In highly volatile market conditions, slippage is almost unavoidable so your best bet to avoid slippage is to trade during quieter, less volatile trading conditions.

4. Automated Account Close-Out

An account close-out risk to your trading account can occur when prices change rapidly due to high market volatility. When this happens, the broker forces you as the trader to close some open trading positions to avoid your account having a negative balance.

To avoid an account close out, try to ensure you not only have sufficient funds in your spread betting account to cover fluctuations in in the value of your account. You should also use risk management strategies such as a stop loss order to ensure you cap losses at a level you know can afford.

5. Overtrading

Because financial spread betting tracks the underlying asset price markets, it allows you to spread bet 24 hours a day. This is a temptation if you find yourself addicted to spread betting or having a bad day and need to turn a profit by chasing losses.

Technology can also play a role in overtrading, allowing brokers to execute your spread bets in milliseconds, making it faster than ever to bet on the markets. Unfortunately, if you have had a bad trading day, this makes it easier to chase losses and start to overtrade the markets.

However, overtrading isn’t necessarily only done by bettors chasing losses. Bettors who are performing well or bored because they can’t find an attractive opportunity can also find themselves overtrading.

6. Don’t Own The Asset

With spread betting, much like CFD trading, you don’t own the underlying asset. When you spread bet, you place a bet on the price movement of the underlying asset or security, that’s it. There is no contract or exchange of assets when making the bet.

While there are multiple tax advantages with spread betting, not owning the asset also means you don’t acquire any rights of control or influence on the underlying market. As such, you will have no voting rights, no impact on asset price and no direct role to play in the market, no matter how heavily you are exposed to it.

7. Trading And Holding Costs

Despite being free of stamp duty and capital gains tax, spread betting does incur both trading and holding costs. We have explained each cost below:

Spread Cost

The first cost is the spread cost (I.E. the difference between the buying and selling price of the asset). This is an unavoidable cost, so to minimise this cost, you need the market to move favourably by an amount equal to or greater than the spread to turn a profit.

Overnight financing cost

Given spread betting is a leveraged product, brokers charge traders financing charges for positions held for more than one day, which is called an overnight financing cost. These charges contribute to the overall cost of maintaining a position in the market.

The only way to avoid overnight financing costs is to close out your spread betting position before the end of the trading day. Alternatively, you could trade futures or forwards contracts which have the cost of leverage incorporated into the spread.

How To Manage Spread Betting Risks?

There are many ways to manage spread betting risks. Some of the main risk management strategies include calculating your risk, using stop-loss orders and coming up with a proven trading strategy. We have highlighted the main strategies for managing spread betting risks below.

Know How To Calculate Risk

Risk can be calculated in a few different ways. One way is through a risk-reward ratio, which allows you to gauge whether a bet is worth the risk. A risk-reward ratio is calculated by dividing the potential profit by the maximum risk you are willing to take. For example, you might opt for a risk-reward ratio of 1:2, meaning if you risked 10 pips, you’d like to have a profit potential of at least 20 pips. Each bettor and strategy has different risk-reward profiles.

To calculate your risk-reward ratio, we created a simple spread betting calculator for you to easily and quickly calculate your potential profit or loss and the margin required to place that particular spread bet, depending on the spread betting market.

Use Stop Loss Orders

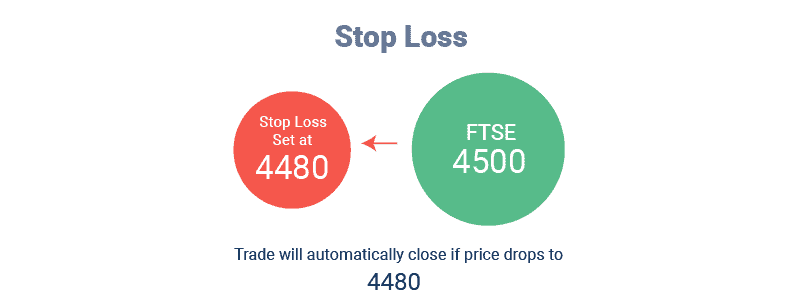

Using stop-loss orders will reduce your spread betting risk by automatically closing out a losing trade once the market passes a set price level. A standard stop-loss order will close out your trade at the best available price once the set stop value has been reached. For more information, you can check out our page explaining how to use a stop loss when spread betting.

Trailing Stop Loss

A trailing stop loss is a stop loss order that automatically adjusts to market movement. When you place a trailing stop-loss order, you will set a price that is a specified distance away from the market price, in line with how much capital you’re willing to risk on the spread bet. The stop-loss order will then remain this distance from the market price while the price moves in your favour.

The benefit of a trailing stop loss is that it is dynamic, meaning that at worst, you will simply exit your position at the original price and at best, you will exit your position at a higher price level than you originally set.

Stick To A Proven Strategy

While there is always a risk of losing money on a spread bet, coming up with a proven trading strategy and sticking with it is a good way to reduce your spread-betting risk.

There are many trading strategies to choose from, including reversal, trend market and breakout spread betting strategies. We highlighted the best spread betting strategies for you to check out, which we recommend testing using a demo account. Remember, developing a solid trading strategy takes time and practice, which may require many tweaks, so it’s vital that you test out a strategy first before implementing it live, with real money.

Arbitrage Betting

Spread betting risk can be mitigated by the use of arbitrage betting, which is betting two ways simultaneously. When the prices of identical financial instruments vary in different markets, an arbitrage betting opportunity arises. As a result, the financial instrument can be bought low and sold high simultaneously.

While rare, an arbitrage transaction takes advantage of these market inefficiencies to gain a risk-free return.

Set Alerts

Trading alerts reduce your spread betting risk by allowing you to set specific criteria and be notified immediately once those criteria have been met. As an example, you might set a price alert, which alerts you once the spread betting market you’re trading hits a certain price level. This can help you mitigate your losses if the market is falling away from you, or alert you to a potential take profit level.

Reduce Leverage

Given spread betting is a high risk leveraged derivative, you are gaining a larger market exposure without depositing extra capital. This opens up the risk of losing more money than you can afford, so it is a good idea to reduce your leverage ratio to limit your potential losses.

Alternatively, understanding what your spread betting margin is will help you know how much you need in your account to maintain your trading position.

Negative Balance Protection

Some brokers, such as City Index and IG, offer Negative Balance Protection, which ensures that you cannot lose more than the balance in your trading account. Simply put, negative balance protection means that your losses can never exceed your deposits.

As an example, if you had £100 in your account and you place a spread bet that makes a loss of £120. In this scenario, your broker would reset your account to zero, so you wouldn’t owe the remaining £20.

Spread Betting Risk Examples

Given there are many spread betting risks, we have highlighted a couple of examples to give you a better idea of what they may look like.

Margin or Leverage Risk

Say you want to open a £100 spread bet on the FTSE 100, the broker may want you to have a margin rate of 5% to open the bet, meaning you pay £5. If the market moves against you by 10%, you will lose £10, or double your initial stake in the spread bet.

Market Volatility Risk

Let’s say you place a spread bet at 25p per point, meaning if the financial market goes up 10 points you will make £2.50. Equally, if the market drops 10 points you will lose £2.50. This may not look like a lot of money, but due to high market volatility, the GBP/USD drops by 100 points in minutes of trading, meaning you lose £25. If you had decided to increase your initial stake, your potential losses would add up fast if the market gets away from you.

What Is The Best Spread Betting Broker To Manage Risk?

Pepperstone is our highest-rated spread betting broker that we’ve tested this year, with fast execution speeds, spreads from 1 pip, and an excellent selection of spread betting platforms. In particular, Pepperstone is one of a few brokers offering spread betting on TradingView, so if you want advanced charting tools with low spreads, then Pepperstone is our top pick.

Of course, there are many other great brokers such as City Index and CMC Markets, which we’ve highlighted in our best UK spread betting broker page.

Best Spread Betting Broker For Beginners

There are many great spread betting brokers that are suited for beginners and who you choose comes down to personal preference. City Index has great risk management tools, while Pepperstone is our best low-spread broker for beginners. To find out more info, you can check out our full page of the best spread betting platform for beginners.

FAQ

Can You Lose Money On The Spread?

Like any form of trading on the financial markets, it’s possible to lose money on the spread. As such, we have provided our expert tips on how to spread bet successfully to help reduce your risk of losing money on the spread.

Is Spread Betting Worth It?

Yes, spread betting is worth it if you place your bets correctly and thus, yield high profits. Having said that, to be a successful spread bettor, it’s important to create a systematic trading plan following years of experience. To get started, you can learn how to make money spread betting, here.

Which Markets Are The Most Risky To Trade On?

Many markets are highly risky to trade on, including options, futures and penny stocks. These spread betting markets will provide you with substantial volatility, unpredictability, and big losses if you are not careful. One simplified form of spread betting that reduces your risk with fixed returns, capped losses and no commissions or leverage is binary spread betting.

Are There Currency Fluctuation Risks With Spread Betting?

Yes, because when you spread bet on a forex market, you are betting on the underlying asset of that forex market meaning you are subject to currency fluctuations that come with market volatility. Check out our helpful spread betting guide for beginners for more information.

Is Spread Betting Gambling?

Although it is regulated as a financial product by the Financial Conduct Authority (FCA) in the UK, spread betting is considered gambling and not investing. This means that while spread betting is exempt from stamp duty or capital gains tax, it’s important to be aware that any realised gains may be taxable as winnings and not capital gains or income.

If you decide to venture into spread betting, we advise you to keep records and seek the advice of an accountant before completing your taxes. As a UK trader, it’s important to read up on our UK spread betting regulation guide.

Is Financial Or Sports Spread Betting More Risky?

Both financial spread betting and sports spread betting are equally risky, simply given they’re both forms of gambling or investing. While it may seem that financial markets are more volatile, spread betting is just as uncertain. Betting on sports involves the use of odds that indicate which team is the favourite, it should be treated as a guide at best. Remember, a ‘sure thing’ doesn’t exist in any form of investing or betting.

Ask an Expert

Do brokers offer protection against losing more than your deposit?

Yes, regulated brokers usually offer negative balance protection to ensure you don’t lose more than your deposit.

Are there certain markets that are riskier to spread bet on?

Some markets, like cryptocurrencies or small-cap stocks, can be much more volatile and riskier to bet on.