Thousands of spread betting markets are available to speculate on, ranging from highly liquid assets like forex to single stock selections like Tescos. Spread betting is popular with both retail and professional UK traders based on lower costs, tax exemptions, and leverage to profit from small market movements.

What Spread Betting Markets Can You Bet On?

Spread betting is a financial derivative, meaning its price derives from an underlying asset such as a stock, index, or currency pair. This has opened up plenty of spread betting markets as the derivative may be created on any market type. However, I found that the brokers only offered major markets, these are:

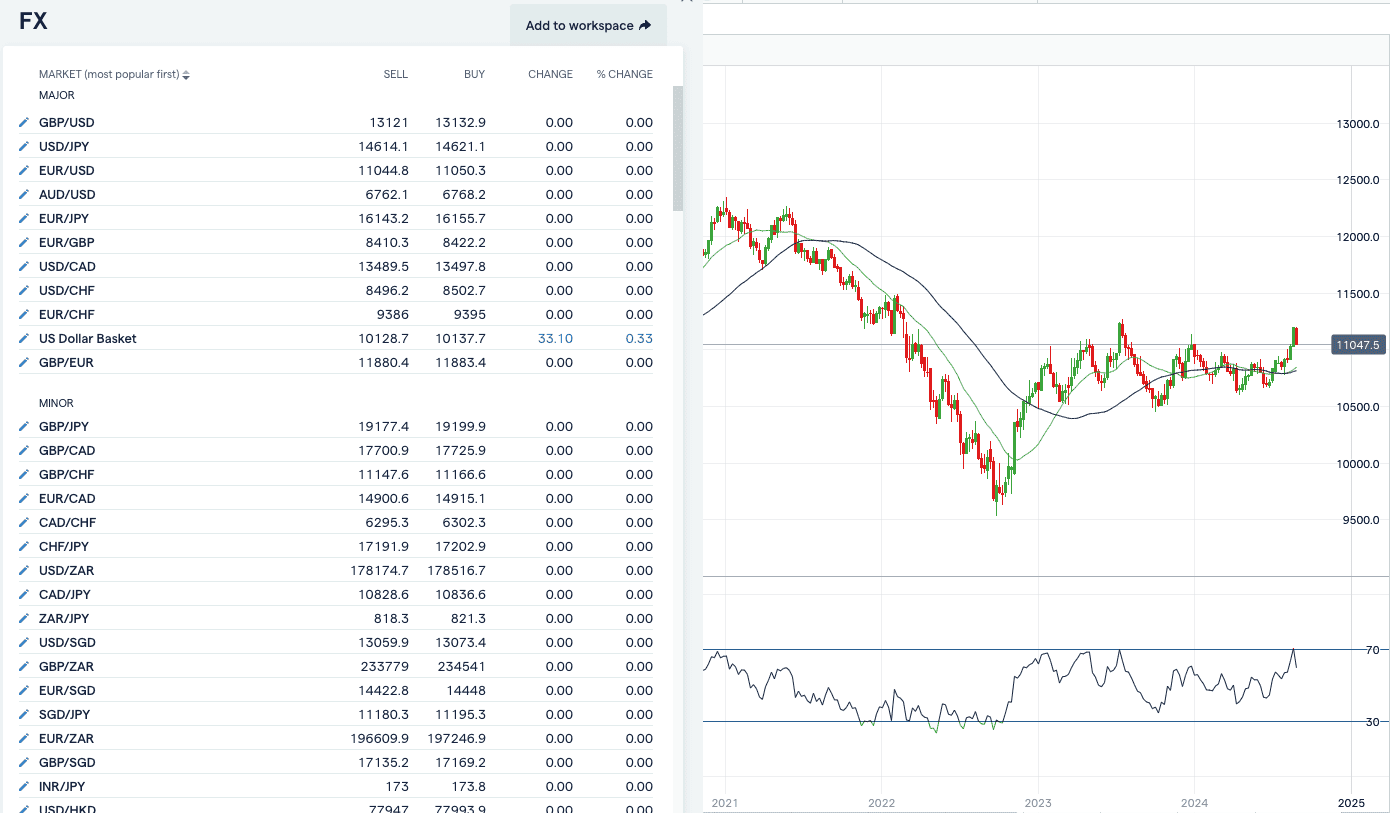

1. Forex

Forex spread betting is by far the most popular market for spread betting. The foreign exchange market is the most liquid in the world, making it cheaper to trade, trading in excess of $7 trillion daily. Being liquid means a lot of trading activity, so you can profit from smaller price movements with spread betting, making it one of the top assets for scalpers to trade.

Another benefit of a spread bet on forex markets is that they are a 24-hour market during the trading week, giving you plenty of opportunities to take advantage of economic data releases as they happen.

Some of the major currency pairs include:

- EUR/USD (Euro vs. US Dollar)

- GBP/USD (British Pound vs. US Dollar)

- USD/JPY (US Dollar vs. Japanese Yen)

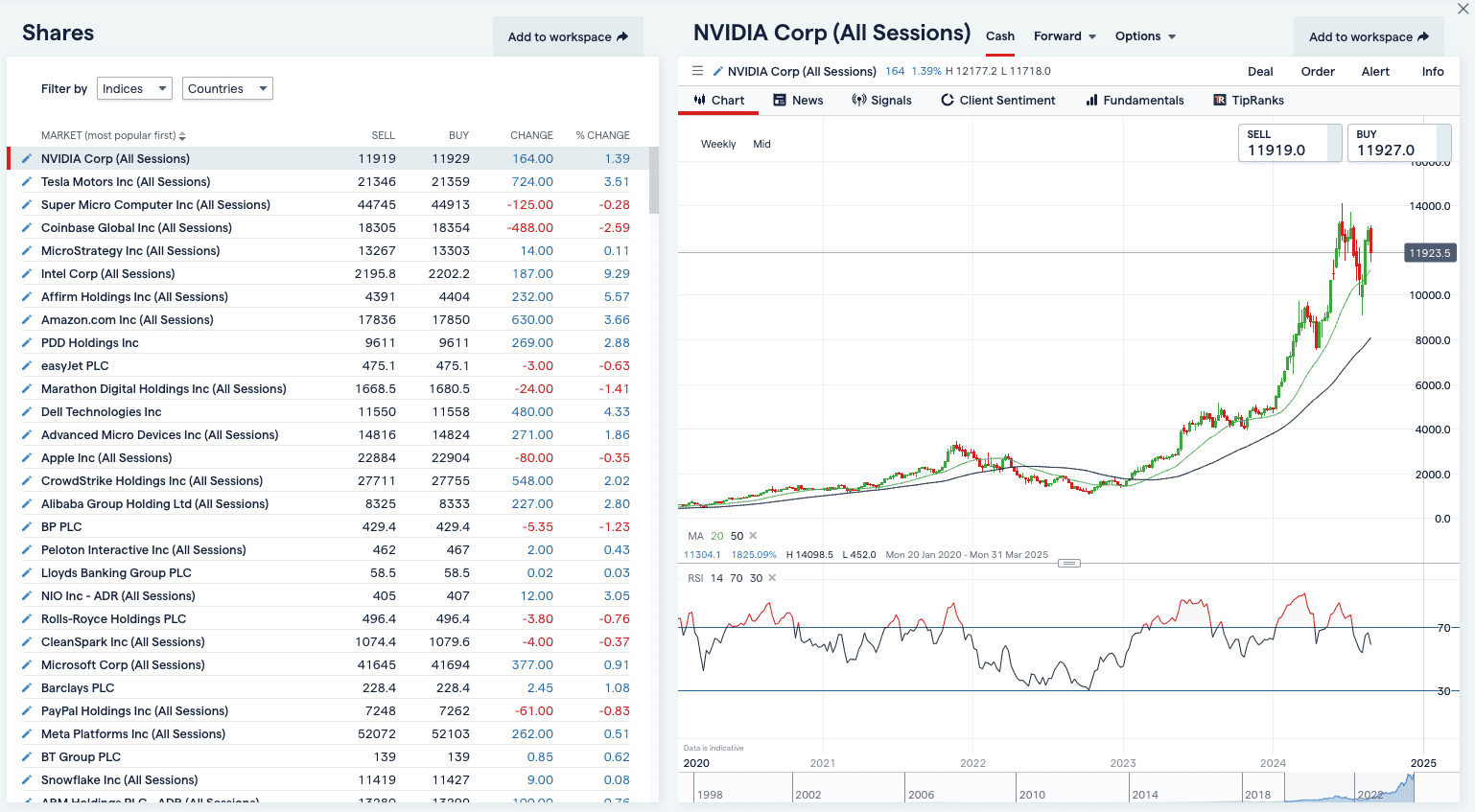

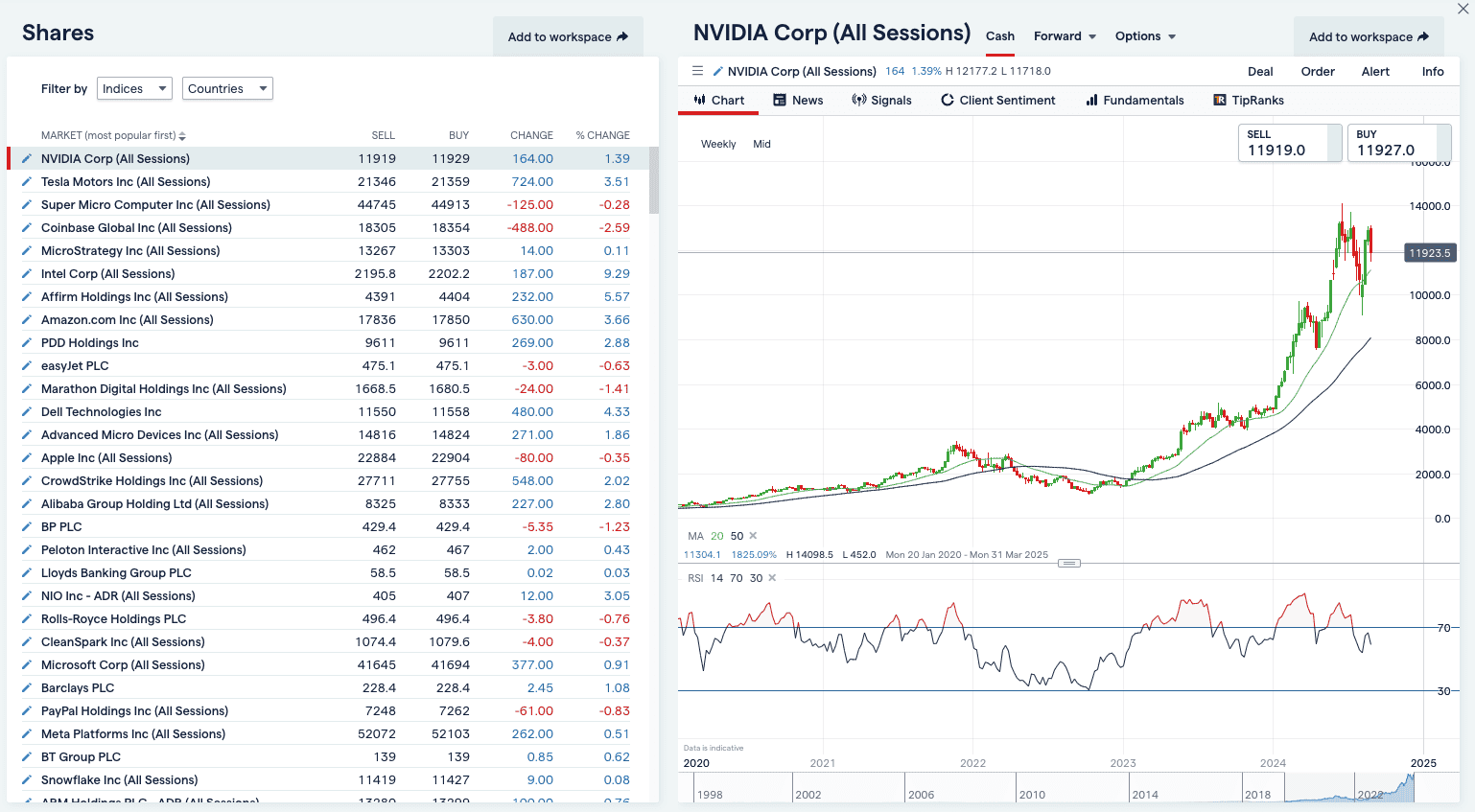

2. Shares

You can spread bet on individual company shares, allowing you to speculate on the price movements of stocks from major global exchanges without actually owning the shares themselves.

Because you do not own the shares, you do not have to pay stamp duty tax, making the share spread betting markets an attractive alternative to traditional investing. It’s worth noting that you don’t receive any shareholder rights or dividends (because you don’t own the shares).

Another key advantage with shares spread betting is the ability to go both long and short, so you can potentially profit from rising and falling share prices. I think this makes it a great product for hedging your portfolio or for trading in any market condition.

From the brokers I’ve tested, you can spread bets on shares that are listed on the following stock exchanges:

- London Stock Exchange (LSE)

- New York Stock Exchange (NYSE)

- NASDAQ

- Frankfurt Stock Exchange (FSE)

3. Indices

If you have a broader view and want exposure across entire markets, you can use the indices markets with spread betting instead of betting on single stocks (like Apple). For example, if I think the UK’s GDP will grow in the next three months, you can go long on the FTSE 100 instead of choosing a single stock like Barclays.

The major indices markets available include:

- FTSE 100 (UK)

- S&P 500 (US)

- DAX 40 (Germany)

- Nikkei 225 (Japan)

4. Commodities

Commodity markets consist of supply-and-demand assets like gold, silver, and crude oil, which are all relatively cheap to spread bet with. Most brokers offer commodities spread betting markets, which have high liquidity similar to currency markets and are another popular option for day trading.

I found that the brokers don’t offer the broadest range of markets for commodity spread betting, but the most common ones are:

- Precious metals (gold, silver, platinum)

- Energy products (crude oil, natural gas)

- Agricultural products (wheat, corn, soybeans)

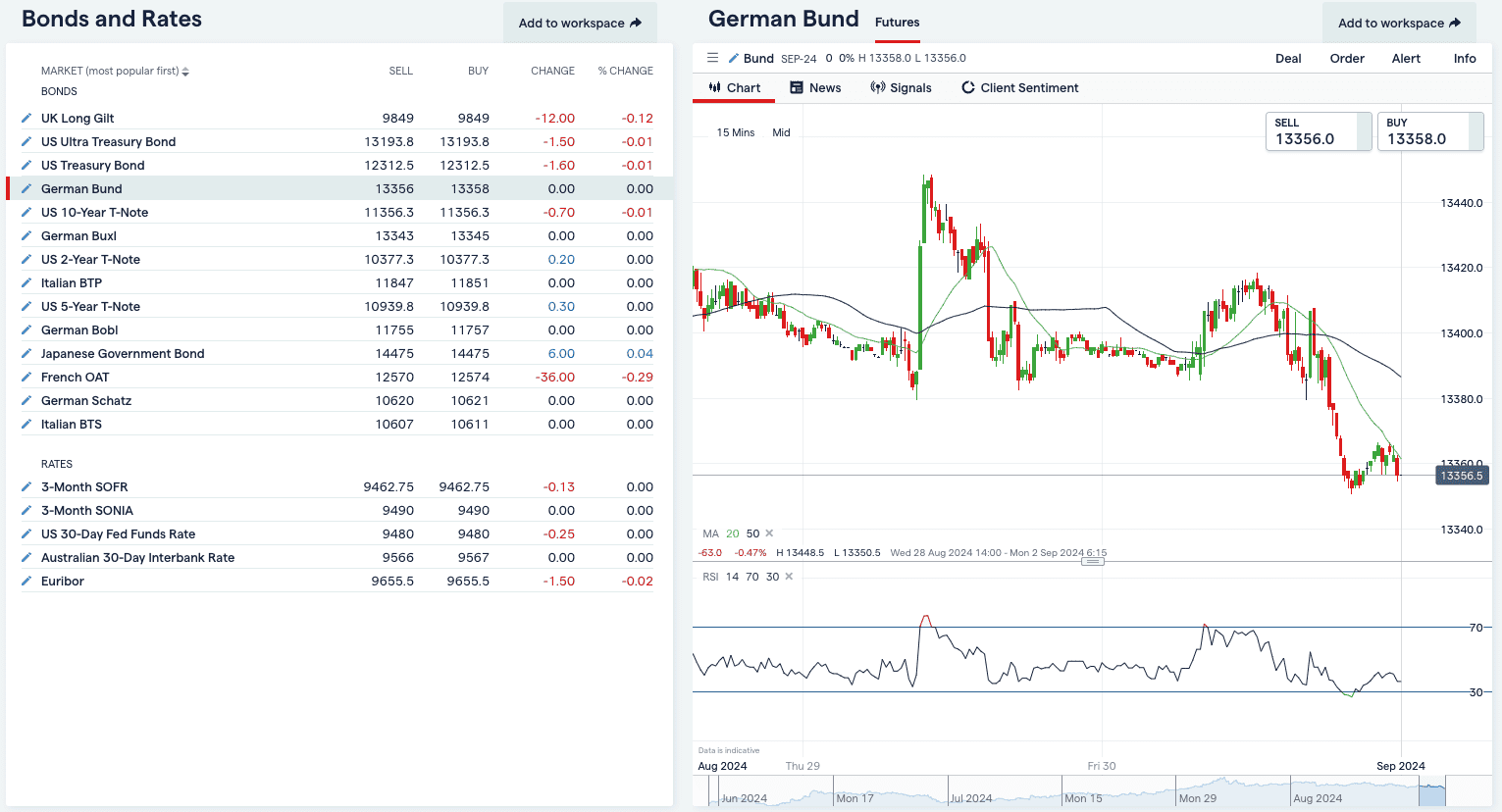

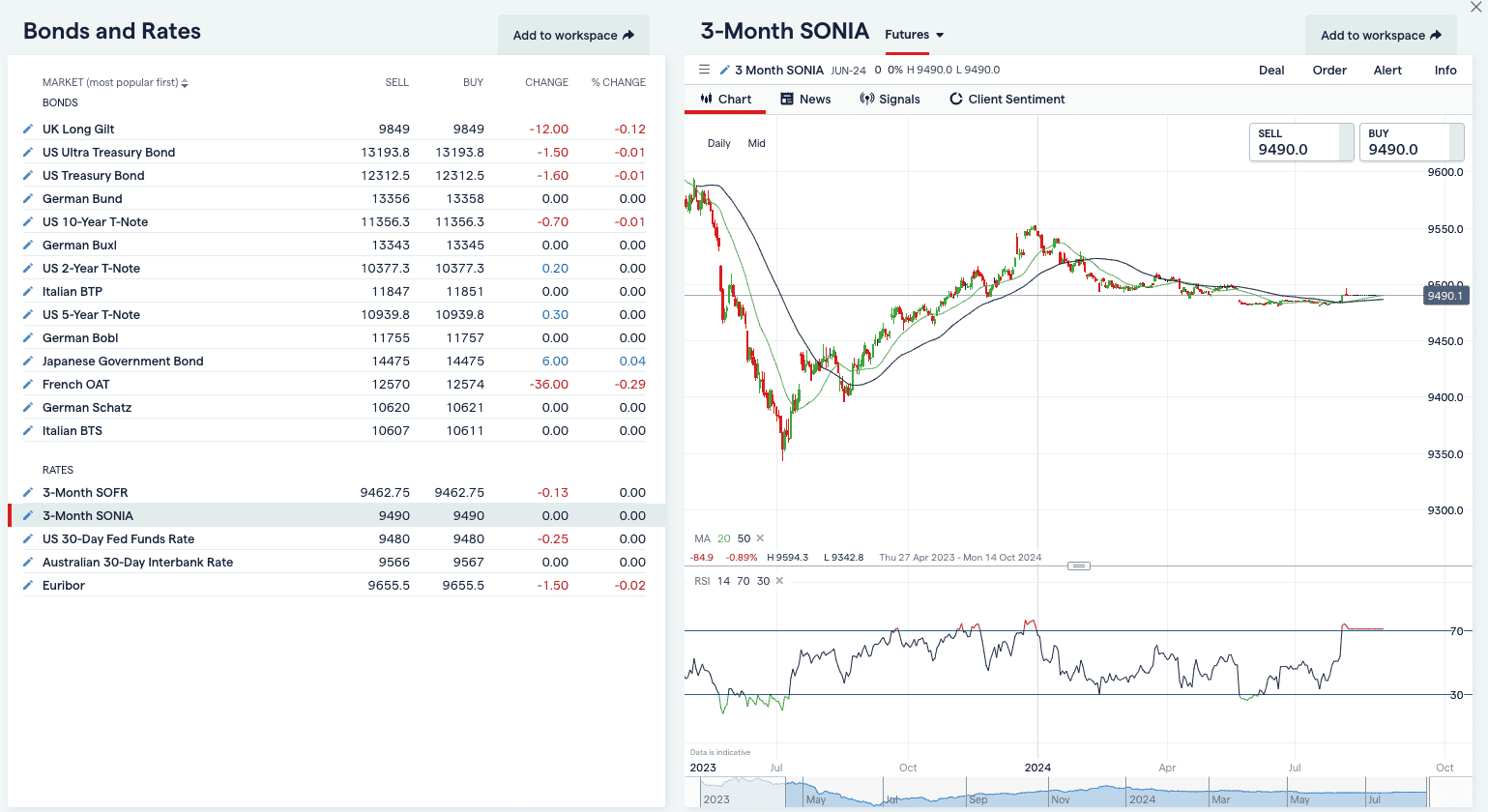

5. Bonds

Bond spread betting allows you to speculate on the price of government bonds and treasuries. Although not the most popular or exciting financial markets, spread betting brokers offer these markets as they can be quite lucrative if you know how to trade them. The bond markets are limited compared with the above, but you can still bet on the top treasuries and bonds in Europe, the US, and the UK. These include:

- US Treasury Bonds

- UK Gilts

- German Bunds

6. Interest Rates

Some brokers offer spread betting on interest rates, allowing you to bet on central bank interest changes. This market is closely tied to forex and bond markets, as interest rate decisions can impact currency values and bond prices.

The interest rates I found you can spread bet on are:

- 3-month SOFR (Secured Overnight Financing Rate)

- 3-month SONIA (Sterlin Overnight Interbank Average rate)

- US 30-day Fed Funds Rate

- Euribor

7. ETFs

Exchange trading funds are professional investment managers that manage a basket of assets ranging from bonds to gold, with different investment strategies that target specific market sectors.

I think these are the best markets to spread bet if you want exposure to certain sectors, such as artificial intelligence and tech companies or ETFs that track gold prices. Spread betting eliminates the commissions typically charged when buying ETFs.

- Some examples of ETFs you can bet on:

- SPDR S&P 500 ETF (SPY)

- iShares FTSE 100 ETF (ISF)

- Invesco QQQ Trust (QQQ)

Specialising in Spread Betting Markets

With so many financial spread betting markets available, I think it’s important to specialise in one or two markets, helping you keep your focus instead of trying to trade everything in sight. Here’s why I believe specialisation is crucial for success in spread betting.

The fastest route to succeeding with spread betting is by thoroughly understanding what drives the markets and how they react. These “clues” are something you can only learn by monitoring a couple of markets at a time. By concentrating on a select few markets, you’ll be able to:

- Develop a deeper understanding of market-specific factors

- Recognise patterns and trends more easily

- Understand how markets react to certain events

The above factors give you an edge in the markets, which is why successful professional bettors focus on one or two markets and learn them like the back of their hands.

For example, by focusing on EUR/USD, you can develop a nuanced understanding of how various economic indicators, like non-farm payrolls, impact the currency pair, helping you make better predictions.

Markets Selection Spread Bet Strategies

There are thousands of markets to choose from, so how do you specialise in one? Below are the factors I’d consider to decide if the market is worth selecting.

-

- Find A Market That Interests You: It’s best to find a market that interests you as you are more likely to do your research and analyse the opportunities.

- Choose A Suitable Risk Tolerance: Not all markets are the same, so you’ll want to find a market that suits your risk tolerance. For example, if you enjoy volatility, you could try spread betting on the US 500, or something more stable, you could bet on the FTSE 100.

- Find What Suits Your Trading Style: Choosing a highly liquid market like EUR/USD will respond better to technical analysis and scalping opportunities. At the same time, markets that won’t move as much (less liquid), like the CHF/USD, can provide slow but more predictable returns.

- Fits Your Trading Hours: You should choose a liquid market where you can spread bets. For example, if you work shifts or 9-5, you may not have access to the markets, which means you’ll miss the London trading session. If this is the case, you can trade the US markets, which will be running until 9 p.m.

At the end of the day, you should choose what you like, and the above are suggestions, not recommendations. The fun part of trading is finding something that works with your spread bet strategy, as not everything works in the same market.

FAQs

What Is Spread Betting?

Spread betting is a financial instrument that lets you speculate on the asset’s price direction in an underlying market without owning the market. You can profit from rising (going long) or falling (going short) prices, with gains or losses calculated per point of movement. The core advantage of spread betting is that it’s tax-free, so you don’t pay capital gains tax or stamp duty when you spread bet.

How Does Spread Betting Work?

Spread betting works by placing a stake (bet) on the direction you think the market will move, and for every point the market moves in your favour, you’ll earn a multiple of your stake size back, while if the market goes against you will lose a multiple of your stake size.

Let’s say you think the FTSE 100 index will fall below the current price of 7500 and place a stake size of £1 per point. If the price moves against your prediction and, the market falls to 7490 (10 points), and you close the bet, you’d profit from £10 (£1 x 10 points).

View our page on how spread betting works to learn more.

Can I Open A Spread Betting Demo Account?

Yes, all spread betting providers offer demo accounts, allowing you to test the broker’s trading conditions and practise spread betting with virtual funds on its trading platform. Demo accounts are the best way to gain trading experience without risking your money, helping build confidence before transitioning to a live trading account.

When you are ready to start trading with a live spread betting account, choose a broker with a low initial deposit and trading costs. Of course, this will depend on individual circumstances, and you should only deposit the amount of money you can afford to lose.

Spread Betting Vs CFDs

Spread betting and CFDs (Contracts for Difference) are derivative trading products that allow speculation on price movements, offering leverage and the ability to go long or short on the underlying asset. However, there are some key differences:

| Feature | Spread Betting | CFDs |

|---|---|---|

| Capital gains tax treatment | Tax-free on profits | Profits are subject to capital gains tax |

| Bet size | Bet per point movement | Trade in standard lot sizes |

| Markets available | Primarily UK and major international markets | Full access to global and UK markets |

| Trading Costs | Spread-only | Spread only (Standard), Tighter Spreads + Commission (Raw) |

| Currency Traded In | GBP, not subject to currency conversion fees | Asset’s currency, subject to currency conversion fees |

What Are The Best Spread Betting Markets

The best spread betting markets are down to personal choice. Still, the most popular are the forex and commodity markets, as they provide 24-hour market access, have low trading costs, and are volatile enough to profit from smaller market movements. With that said, depending on your spread betting strategy, you may choose alternative markets like indices and equities.

How Profitable Is Spread Betting?

Spread betting can be as profitable as CFD trading and traditional investing. You can profit in any market condition, whether it is consolidating or trending (up and down), making it a great option for day trading. Your profitability is dependent on your trading strategy and experience, as well as your risk management. There is no guarantee of making money with spread betting, but it has unlimited upside potential.

What Is The Best Spread Betting Company?

The best spread betting company is Pepperstone, based on my review after testing the broker’s live trading conditions. The broker provided the best trading conditions with tight spreads and fast execution speeds (less than 100ms), making it a top choice. Additionally, it provides three top spread betting platforms, TradingView, MetaTrader 4, MT5, and cTrader, which give you access to its full catalogue of 1,200+ markets.

Is Spread Betting Illegal?

Spread betting is legal in the United Kingdom. The Financial Conduct Authority (FCA) regulates it as a financial activity in the same category as CFDs and other leveraged products like options trading. The derivative is also exempt from tax laws in the UK, which is why some may consider it an illegal activity.

Ask an Expert

What markets are available for spread betting?

Spread betting offers access to a variety of markets, including forex, commodities, indices, stocks, and cryptocurrencies.

Can I spread bet on forex markets?

Yes, you can. Forex is one of the most popular markets for spread betting, allowing traders to speculate on currency pairs.