Spread betting leverage allows you to open large positions with a small amount of capital. Leverage can amplify both potential profits and losses, making it an attractive but risky option to speculate on the markets. Learn more about how leverage impacts spread betting and how to manage its risks in this article.

What Is Spread Betting Leverage?

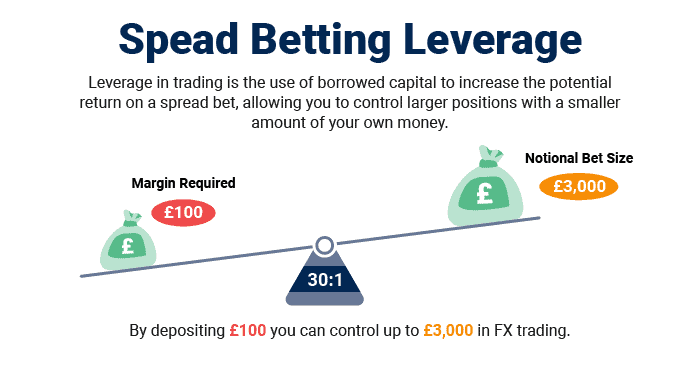

Spread betting leverage allows you to use a small amount of your own capital to control a much larger position size and potentially amplify your profits (and losses).

For example, if a broker offers 30:1 leverage, you can open a £30,000 trade with just £3,000 in your account. If the market moves in your favour, you’ll earn profits based on the full £30,000 position, which is why leveraged-based trading is a popular option for UK traders. However, it’s crucial to remember that leverage is a double-edged sword. While it can amplify your gains, it can also magnify your losses by the same amount.

You will find that your broker expresses leverage as a ratio, such as 30:1, 10:1, or 5:1. So if a broker is offering a 10:1 leverage, this means for every £1 you put up as a margin (collateral) the broker will loan you £10 to open the position.

The higher the ratio, the less capital you need to open a position. In spread betting, the leverage available varies depending on the market, with the most liquid markets offering the highest leverage:

- Forex pairs often have the highest leverage, up to 30:1 or more

- Stock indices and commodities typically offer leverage between 10:1 and 20:1

- Individual stocks usually have the lowest leverage at 5:1

How Spread Betting Leverage Works

Leverage is a key feature of financial spread betting, allowing you to control a larger position with a small amount of capital, known as the margin. For example, a 10% margin means I only need to deposit £500 to control a £5,000 position. If the market moves in my favour, my profits will be based on the full position value (£5,000), not just my deposited amount.

While leverage can drastically increase potential profits, it equally heightens the risk of losses. I can’t stress enough how paramount effective risk management is for safeguarding my capital. If I open a position with 200:1 leverage and the trade goes against me, my losses can accumulate rapidly.

What is the maximum leverage available in UK for spread betting?

The maximum leverage for a retail spread bettor is 30:1, which you can get on the major currency markets like EUR/USD and GBP/USD. The FCA capped leverage for spread betting since 2019 to protect retail investors from overleveraging their bets and causing larger losses.

If you are an elective professional, you can waive your retail trader status and the FCA’s consumer protections in favour of higher leverage. This professional status allows you to access leverage of up to 300:1, depending on which broker you spread bet with.

Margin Requirements In Spread Betting

To open a leveraged spread bet, you must meet the minimum margin requirement, which is a percentage of the full trade value called the initial margin.

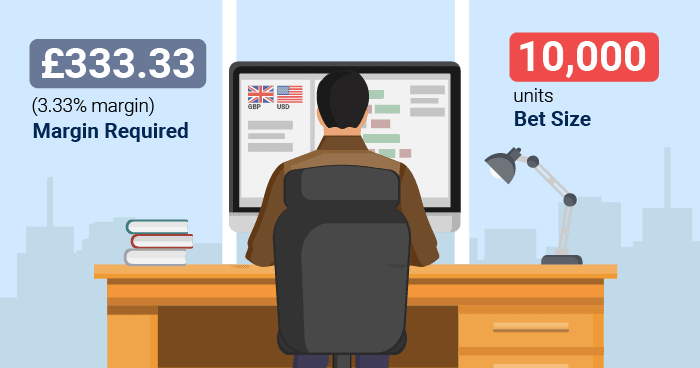

The initial margin is expressed as a percentage of the notional trade value, such as 20% for stocks or 3.33% for major forex pairs. So, if you want to open a position on EUR/USD, you must have 3.33% of the total trade size as the initial margin.

For example, if you wanted to open a micro lot trade (10,000 units) on GBP/USD, you would need a 3.33% initial margin to place your spread bet. The margin you need to deposit would be £333.30 to control £10,000. Fortunately, the broker provides all of this information for you, so you won’t have to do the maths.

If your trade starts moving against you, your broker may request additional funds to keep the position open, known as a margin call. This ensures you have enough capital to cover potential losses.

Initial margin vs. maintenance margin

When spread betting, you will come across two different margins, which are called initial and maintenance. The initial margin is the required amount to open a position, while the maintenance margin is the minimum required to continue holding it without facing a margin call. Below, I have broken down what each means:

Initial Margin

- Minimum amount of funds to open a spread bet position to use the full amount of leverage offered

- Typically higher than the maintenance margin

- You can deposit more as a margin, which lowers your leverage

Maintenance Margin

- The minimum amount of funds that must be maintained in the margin account to keep the spread bet open to avoid a margin call

- Lower margin compared to the initial margin, typically 50% of the initial margin required

- If the value of your margin drops below the maintenance margin, the broker will issue a margin call for you to top up your funds or prepare to close the bet.

- The maintenance margin ensures you have sufficient capital to protect the brokerage from losses.

Margin Call Example

Let’s say you want to open a £1/point (£10,000 position) spread bet on EUR/USD at 1.0950. The margin requirement is 3.33%, so you need £333.33 as the initial margin.

EUR/USD then falls to 1.0850, resulting in a loss of £10 (100 points x £1/point). This means your margin has dropped to £233.33. As your margin is now below the £333.33 margin required to maintain the open position, your broker may request you deposit additional funds or close the trade.

To avoid margin calls, you should monitor your positions, use stop losses, and not have multiple trades open at once in your account. Keep your free equity comfortably above margin requirements at all times.

Benefits and risks of leveraged spread betting

While leverage is a powerful tool that can boost your profits, it’s essential to understand and manage the inherent risks. Below, I’ve highlighted the key points I think you should know:

Advantages

- It allows you to capitalise on smaller market movements by controlling larger positions with fewer funds and profiting as if you owned the full bet size.

- Leverage enables you to trade multiple assets at once with fewer funds, helping spread the risk.

- It enables you to go short and profit from falling markets, as you are betting on the price direction while not owning the asset.

Disadvantages

- It amplifies your losses as easily as it does your winners. As you control a larger position, you’ll also suffer larger losses if you get the price direction wrong.

- If you hold a spread bet overnight, you are charged financing, which is charged on the full position size (not your margin). So, it isn’t ideal for long-term trading.

- Encouraged to trade with maximum leverage for every bet

View the full list of spread bet advantages on our dedicated page listing the pros.

Managing Risk with Leveraged Spread Bets

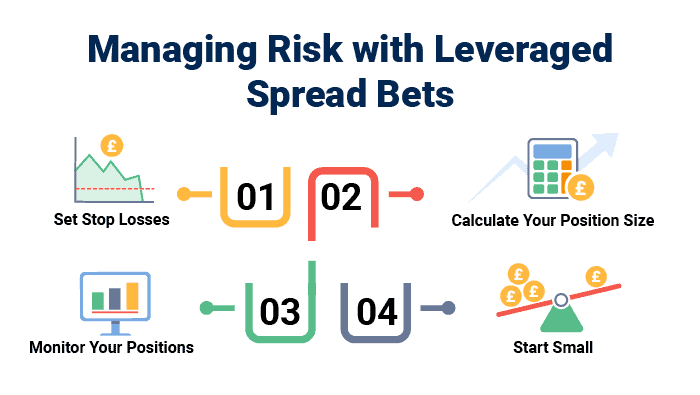

Leverage makes markets like forex and gold seem volatile, so you must focus on risk management to help reduce your risk. Without it, leverage can magnify your losses quickly and wipe out your trading account. Below are some key risk management tips that you may find useful.

1. Set Stop Losses

To help limit your downside risk, you can use a stop loss order that automatically closes your bet if the market moves against you by a certain amount (set by you). There are two stop-loss orders you can use, these are:

- Regular stop loss: Once the stop level is reached, you close your trade at the best available price. However, due to market volatility, you may face slippage if the market gaps. Slippage can increase your losses by exiting at the next best price, which could be a few pips worse than you originally wanted.

- Guaranteed stop loss: This option closes your trade exactly at the specified level, even if the market gaps past your stop loss level. Brokerages typically charge a premium for guaranteed stops, but you only pay the premium if your guaranteed stop loss is triggered.

Always use a stop loss and place it at a level that prevents you from losing more than you can afford on each trade.

2. Calculate Your Position Size

Position sizing is a way to determine how much you can risk for each bet you place, helping you limit losses for each trade and protecting the overall health of your account. Most professional traders risk no more than 1-2% of their account balance on any single bet, as they understand that not every trade is a winner.

For example, if you have a £10,000 account and risk 2% per trade, your maximum loss per position would be £200. If the market requires a 5% margin, you could open a position worth up to £4,000 (£200 / 5%).

3. Monitor Your Positions

You should frequently check your open positions, especially during volatile market conditions, to ensure your margin levels aren’t falling. If a trade is going well, be ready to adjust your stop loss levels to help lock in profit while releasing some of the margins back to your spread betting account. I think it’s also important to be disciplined to close losing trades promptly before losses grow.

A top spread betting broker will offer you multiple spread betting trading platform mobile apps. You can use the app to monitor your positions away from the desktop and receive push notifications that help you stay connected with your open bets.

4. Start Small

If you’re new to spread betting, start with small position sizes until you gain experience and confidence. Make sure you have first practised trading on a demo account. Focus on preserving your capital, not chasing large gains, as this can quickly ruin your trading account. As you become more skilled, you can gradually increase your risk per trade.

Applying these risk management techniques can protect your trading capital and give you staying power in the markets. Remember, the most successful traders are disciplined risk managers first and profit seekers second.

Examples of Spread Betting Leverage

Leverage is a great tool in spread betting that can significantly increase your potential profits, but it’s important to understand that it also amplifies your potential losses. Let’s look at a spread betting example to illustrate how it works in practice.

Leverage Magnifying Profits

Let’s say you want to spread bet on the price of gold, currently trading at $1,800 per ounce. Your broker offers a spread bet with a margin requirement of 5%, which means you have leverage of 20:1.

You decide to place a long bet of £10 per point (per ounce in this case), expecting the price of gold to rise. To open this position, you only need to put up 5% of the total trade value as a margin and place your bet at the buy price of $1,800 on your deal ticket:

- Total trade value: $1,800 x 10 = $18,000

- Margin required: $18,000 x 5% = £900

If your prediction is correct and gold rises to $1,850, you would make a profit of £500:

- Price increase: $1,850 – $1,800 = $50

- Profit: £50 x £10 per point = £500

That’s a 55.56% return on your initial margin of £900, thanks to leverage magnifying your returns on a small $50 move. Without leverage, you would have to invest the full $18,000 to make the same $500 profit, a return of just 2.78%.

Leverage Amplifying Losses

Now, let’s consider how leverage can amplify losses when the markets move against you.

Using the same example as above, suppose you open a £10 per point long position on gold at $1,800 with 20:1 leverage (5% margin). But instead of rising, the price of gold falls to $1,750.

In this case, you would incur a loss of £500:

- Price decrease: $1,800 – $1,750 = $50

- Loss: $50 x £10 per point = £500

That’s a 55.56% loss on your initial margin of $900. If gold fell further to $1,720 (an 80-point drop), your entire margin would be wiped out:

- Price decrease: $1,800 – $1,720 = $80

- Loss: $80 x £10 per point = £800

At this point, you would either need to deposit more funds upfront to keep the position open, or your broker would close it automatically.

Spread Betting vs CFDs

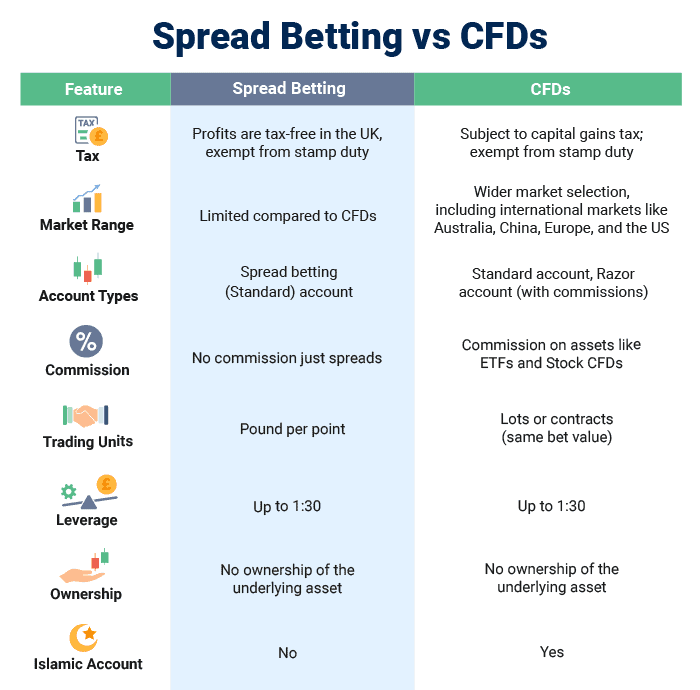

Spread betting and CFDs (contracts for difference) are similar in how they work, allowing you to speculate on a financial instrument without owning the underlying market. The key difference is how they are taxed.

In the UK, spread betting is a derivative that tracks the asset’s price and is classified as gambling, so profits are tax-free. Being tax-free means your profits are exempt from capital gains tax, and you don’t have to pay stamp duty, making it an attractive option. However, you also can’t offset losses against other capital gains.

CFD is another type of leveraged product in which you do not own the underlying asset. Still, it is considered a financial instrument, so profits are subject to capital gains tax, but losses can be used to offset gains elsewhere. Trading CFDs could be considered better for tax purposes, depending on your individual circumstances.

Both financial instruments are regulated and legal for use in the UK for retail investor accounts. The financial markets available are the same, allowing you to trade from FTSE 100 to gold, speculating on market price movements. However, I have found that brokers typically offer more markets for CFD trading than spread betting.

FAQs

How profitable is spread betting?

Spread betting can be profitable for professional traders with solid strategy and risk management skills, as you can use the spread betting leverage to capitalise on smaller market movements. However, it’s important to note that you can lose money due to the high-risk nature of leveraged trading, and you should never bet more than you can afford to lose.

Is Spread Betting Legal In The UK?

Yes, spread betting is legal and regulated in the UK by the Financial Conduct Authority (FCA). Only brokers authorised by the FCA can offer spread betting services to UK residents.

How much do I need to start spread betting?

Most UK spread betting providers require a minimum initial deposit of around £100 to £200 to open an account and start trading. However, starting with a larger amount of money is recommended so you’re not over-leveraged. An ideal range to start with is £1,000 to £2,000, giving you plenty of room to open your bets.

What are the risks of using leverage in spread betting?

The main risk of leverage in spread betting is that it amplifies potential losses (and profits), and it only takes a few pips to have a bad impact on your position. A highly leveraged bet can quickly drain your trading account if the market moves against you, which is why you should always use stop losses and proper risk management to protect your capital.

Ask an Expert

What is leverage in spread betting?

Leverage in spread betting allows traders to control a larger position than the initial deposit, amplifying both potential gains and losses.

How does leverage work in spread betting?

Leverage works by allowing you to borrow funds to increase your exposure to a market, meaning you only need a small deposit to control a larger trade.