Spread betting is a form of derivative trading where you speculate on various financial markets future price movements. Below we discuss popular spread betting strategies, and how it is different from trading CFDs.

The best spread betting strategies can help improve your chances of success when making spread bets. Spread betting means you are speculating on future price movements of financial markets so involves taking on risk. As a trader, it is therefore a good idea to know what strategies are available and when to best use them.

Some popular spread betting strategies include trend market and breakout. Below we discuss the best spread betting strategies, whilst incorporating scalping, hedging, and day trading tactics.

1. Trend Market Spread Betting Strategy

Trend market spread betting is a popular medium-term strategy, as you can follow the market momentum regardless of whether you are going long or short. Spread betters utilise technical analysis tools, like moving averages and MACD, to identify a trend and then place spread bets in line with the trend.

Trend market spread betting is useful as it allows you to track a financial market regardless of whether you are going long or short. Yet, it’s best to decide on a timeframe to watch before placing a bet and remain vigilant as trends can change instantly.

An Example Of Trend Market Spread Betting

A forex pair is on an uptrend. You open a long bet position by buying the forex pair. If the data indicates the market is going to reverse, or you reach your desired profit level, you sell the forex pair and make a profit.

If the forex pair were in a downtrend, you would sell and open a short-spread betting position.

2. Consolidating market spread betting strategies

In spread betting, consolidation describes when an asset oscillates between a well-defined pattern of trading levels. And ends when the asset’s price moves above or below the trading pattern. Consolidating market strategies often requires you to use indicators to identify entry and exit points within a range-bound market.

Often, when a spread betting market is trading within a range, there is a lower volume of trades going through, but a break in this range will often be accompanied by a rise in volume. This is where you might want to change your strategy, given the market is no longer ‘consolidating’ in a range.

One trading style you can implement in a consolidating market is scalping, which is designed to help you profit from small and frequent price changes.

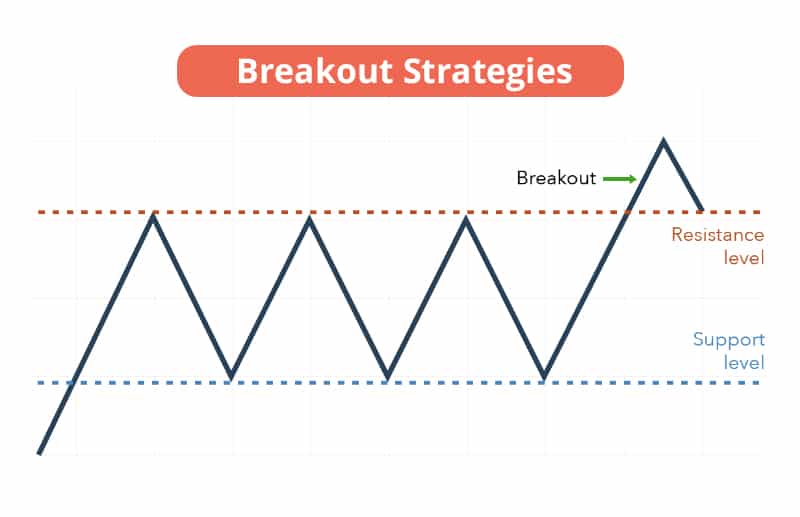

3. Breakout spread betting strategies

Breakout spread betting strategies come from the idea that key price points can be viewed as an indicator of a rise in volatility or price movement. The aim is to enter a trend as early as possible in anticipation of the asset price breaking out. If you come in at the correct time, you can take advantage of the trend from start to end.

Technical indicators used to identify resistance and support levels by spread bettors include:

- Moving average convergence/divergence (MACD)

- RSI indicators

- Volume trading indicators – breakout and consolidation patterns

An Example Of Breakout Spread Betting

Suppose gold’s current price is £1,400. After two weeks like this, the data suggests gold will break out into a downward trend. Historic support levels identify the key price point as £1,380. To implement a breakout spread betting strategy, you place an entry order to open a short position if the price decreases below £1,379.

If the asset price falls, your order is automatically triggered and placed. If it doesn’t, you haven’t gained or lost anything.

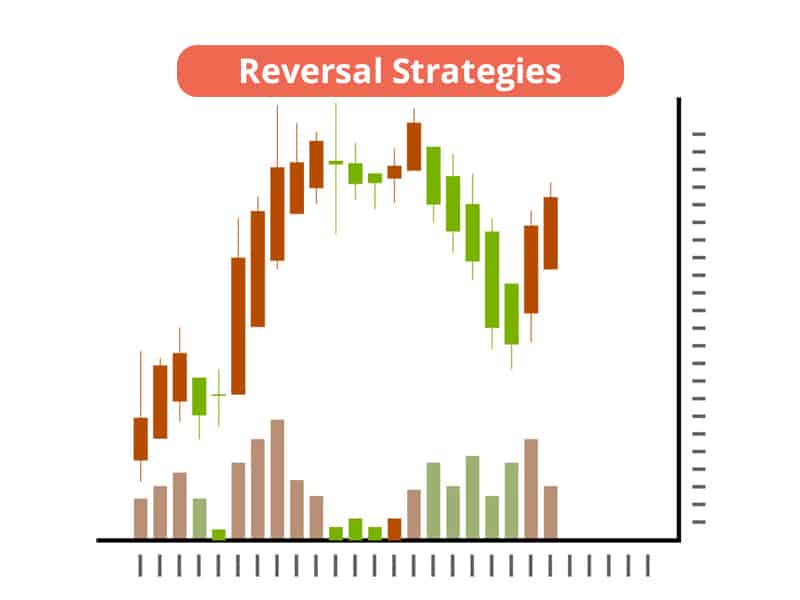

4. Reversal spread betting strategies

Reversal spread betting strategies involve using fundamental and technical analysis to identify areas where trends are likely to change direction.

To execute this strategy, you open a spread bet in the opposite direction to the current market trend (bet bullish if the market is falling, bet bearish if the market is rising).

Technical indicators and tools are vital when developing successful reversal trading plans. Spread betters will often use the Fibonacci retracement tool to help determine if a financial market is experiencing a retracement or reversing. If prices go beyond the identified levels this signifies a reversal in the market.

An Example Of Reversal Spread Betting

Say you want to place an FTSE 100 bet. After a week of being in an uptrend, your analysis suggests the index is going to experience a reversal in the short term.

Your trading plan is to place a bet if you identify a double-top candlestick pattern. If the market reverses, you’ll make a profit, but if the market moves on the same path you’ll experience a large loss.

5. News-Based Strategies

News-based spread betting strategies involve trading based on market expectations and news. As such, it will suit traders who are well-versed in global political, economic, and social events. For this trading plan to be successful, you’ll need the skills and resources to quickly analyse the information once it’s released.

News-based spread betting suits asset classes that experience high levels of volatility, such as commodities or interest rates. Nearly every day there’s news or data released regarding commodities like oil or coal that can lead to spreading betting opportunities.

Fundamental analysis tools such as economic calendars are vital when developing news-based strategies.

An Example Of News Based Spread Betting

Assume the votes for a presidential election are being counted in the United States. Two swing states voted differently from what the polls predicted. This leads to speculation that the USD will increase in value by 0.23 cents on the GBP.

Based on your knowledge of forex and the result of the previous election, you believe the value will not change in the short term. Rather than taking drastic action, you place a forex order to open a short position if the value rises by 0.20 cents.

6. Arbitrage Opportunities

Often associated with sports betting, arbitrage is when you can place two bets on the same event to guarantee a profit regardless of the outcome. In spread betting, arbitrage opportunities will arise from a difference in the bid-offer spreads of the same market from two different spread betting companies.

While rare, arbitrage opportunities allow you to capitalise on and profit from a pricing anomaly in multiple spread betting firms by taking multiple positions in mispriced, often illiquid, markets.

How To Build A Successful Spread Betting Plan

To build a successful spread betting plan involves many carefully calculated factors. Some of these key factors include choosing the right markets, utilising risk management tools such as a stop-loss order to manage your risk and developing strong trading habits. We have laid out these key factors of how to build a successful spread betting plan, below.

Build Your Spread Betting Knowledge

Building your spread betting knowledge will help you become a successful spread bettor. There are plenty of free, educational resources on spread betting, available online.

If you are going to take on the high risk of spread betting, it is best to develop a strong understanding of different trading strategies and technical analysis techniques. To find out more about spread betting, including its advantages and disadvantages, check out our spread betting guide for beginners.

Research The Market

Researching the market is the next logical step when developing your spread betting plan. Staying informed and keeping up to date with global political, social, and economic events will help you make better trading decisions across different financial markets, especially forex and stock markets.

One market that you can capitalise on if you follow the fundamentals is spread betting bonds, due to their low spreads and wide range of instruments available.

Choose The Right Broker

When choosing a spread betting broker, there are a few key criteria, such as regulation, the competitiveness of the broker’s spreads and fees, the range of financial instruments you can spread bet on and risk management tools such as guaranteed stop loss orders.

To find a spread betting broker, you can read our Best UK Spread Betting Platforms list. From our analysis, some of the top spread betting include Pepperstone, IG and CMC Markets.

In the end, choosing the right spread betting broker always comes down to personal preference.

Choose a Market To Bet On

When choosing a market to bet on, it’s important to focus on specific financial markets and find the financial instrument that suits your trading plan and style.

We advise you to learn everything possible about a few financial markets rather than trying to do it all. Binary spread betting is one simplified way to speculate on the direction of market movements with simple ‘yes’ or ‘no’ outcomes.

Determine Your Trading Strategy

Determining a proven spread betting trading strategy is vital to your success as a trader, and it is always best to test your strategy before you start trading with real money. There are plenty of free market resources and third-party tools out there, that most brokers will offer on their websites.

What strategy you use always comes down to personal preference, there is no ‘one size fits all’ trading strategy. We listed some of the most popular spread betting trading strategies above for you to start with, which we advise you to practice with a broker’s demo account first, to see what works for you.

Open A Trading Position

You should only open a trading position once you have a good understanding of the spread betting fundamentals, you’ve chosen your broker, the market you’re going to bet on, and your trading strategy.

To open a spread betting position, you put down a small initial deposit known as the margin. Your initial margin rate when spread betting depends on the market you trade and the broker you’ve chosen.

Given spread betting is a leveraged form of trading, you never need to put down the full amount of the trade. For example, when you spread bet on the GBP/USD currency pair, your margin might be just 3.33% of the total trade size.

Manage Your Risk

Now that you’ve opened a trading position, it’s time to manage your risk by utilising risk management tools. Like most forms of trading, spread betting is a high-risk activity involving complex instruments.

You should establish your risk tolerance before you start spread betting using your broker’s various risk management tools such as stop-loss orders to avoid potentially incurring a much larger loss than your calculated risk level.

FAQ

What Are Common Trading Mistakes?

There are many trading mistakes you can make while spread betting. The most common of which include not researching the markets such as Forex properly, trading without a plan and failing to ultilise risk management tools to cut your losses. If unsure, invest some time in a good trading course to help you better prevent trading mistakes.

How Do You Successfully Spread Bet?

To spread bet successfully requires you to:

- Learn about the spread betting industry and markets

- Understand trading on specific instruments

- Select the best trading platform for your needs

- Execute the right strategies on relevant markets with good timing

- Understand spread betting risks ensuring losses don’t exceed your loss appetite

Why Is Spread Betting High Risk?

Spread betting is high risk because it is a leveraged product, meaning you are taking on more risk than your initial deposit. While you could make a profit if the market moves in your favour, the risk of spread betting is you could make significant losses if you don’t have an adequate risk management plan.

Can You Make a Living Spread Betting?

Yes, you can make a living spread betting, especially if you build a successful spread betting plan and are making consistent profits. But, as with any form of trading on the financial markets, there is no guarantee that you’ll make money. It’s also important to understand how a spread betting company makes money before you decide to become a professional spread bettor.

Is Spread Betting Gambling?

Yes, as mentioned above, spread betting is considered gambling in many jurisdictions around the world, including the UK. In the UK, spread betting is regulated by the Financial Conduct Authority. All this means, is that any realised gains from spread betting may be taxable as winnings and not capital gains or income in the UK.

Ask an Expert

What’s the best way to learn new spread betting strategies?

I’d recommend reading books, following financial news, and practicing with demo accounts to learn new strategies.