Financial spread betting is a form of day trading as it involves speculating on the direction of specific markets or instruments. Conventional day trading involves the buying and selling of the underlying security (eg shares), spread betting requires no ownership. This makes it easier to trade with leverage and speculate if the market will go higher (going long) or lower (to short).

Here is a summary of traditional day trading vs spread betting day trading in the UK.

| Aspect | Day Trading | Spread Betting |

|---|---|---|

| Taxation | Capital Gains Apply | Tax-Free Status On Profits |

| Leverage | Typically lower leverage, but can be increased with margin trading accounts. | Higher leverage, as spread betting allows greater exposure to markets |

| Cost & Fees | Brokerage commissions, spreads, and possibly platform fees | No commission, but spreads are usually wider compared to other financial instruments. |

| Profit Potential | Profit potential is linked to the size of the investment and the market's movement. | High-profit potential with small initial investment due to leverage (increasing risk). |

| Risk | Limited to the amount invested unless using leverage. | Leverage can magnify both profits and losses. |

| Holding Period | Trades are typically short-term, closed by the end of the day. | Generally short-term, but can also be used for longer-term bets. |

| Asset Ownership | You own the underlying assets like stocks, currencies, etc. | No ownership of the actual assets; it's a bet on the price movement. |

| Legal Status | Considered investment/trading for tax purposes. | Classified as gambling by UK law, thus tax-free for most private individuals. |

How Do Day Traders Make Money With Spread Betting?

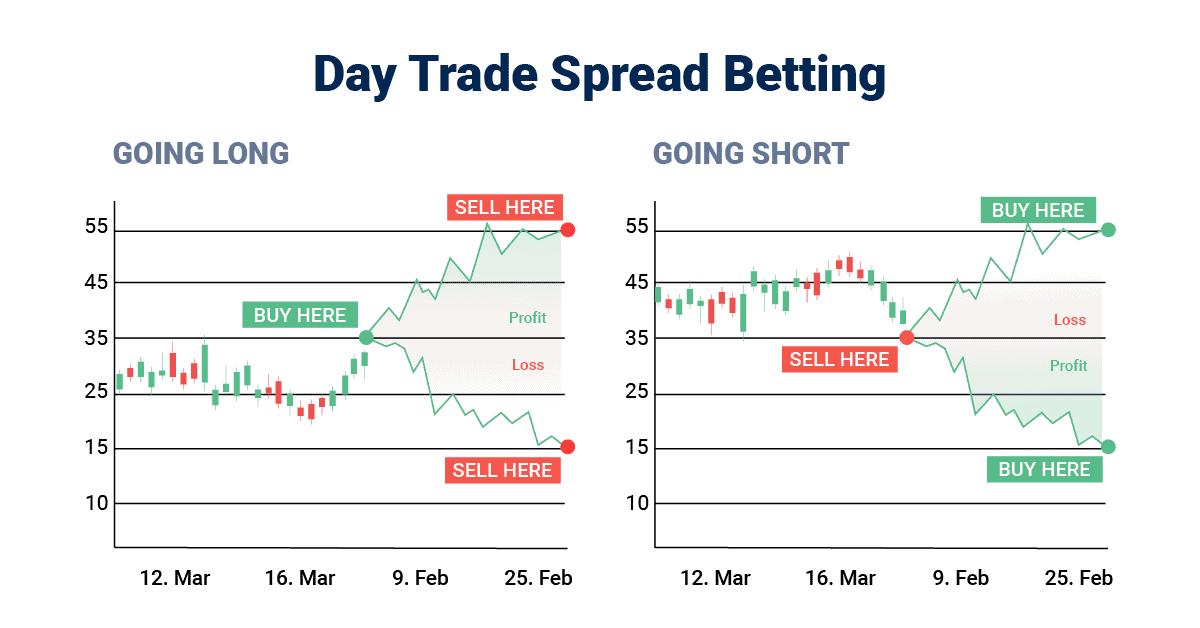

Day traders make money with spread betting by speculating on the short-term price movements of financial markets. Traders will go “long” if they think the price of an asset will rise, and they will go “short” if they think the price will fall. If the trader’s prediction is correct, they will make a profit. However, if the trader’s prediction is wrong, they will make a loss.

Day traders can make money with spread betting by capitalising on short-term price movements of the underlying financial market. They deploy a range of strategies to find new spread betting ideas and execute them quickly, as these opportunities come and go fast while day trading.

To profit, you will go long (buy) the market if you think the asset price will rise; your profit will be the difference in points between your open and close price. If you think the market will fall, you can short (sell) the market and your profit will be the number of points difference between your open price and closing price.

What Are The Most Popular Markets To Day Trade Spread Betting

With spread betting being a derivative, it can have a market with any asset that the broker deems fit. However, due to the characteristics of spread betting (low trading fees and higher leverage on liquid assets), you’ll find that spread betting markets exist only across the most popular markets.

These markets are:

- Forex – consisting of major, minor and exotic pairs.

- Indices – typically indices from the US, EU, UK (FTSE), and JPY

- Shares – these markets are more restricted with most brokers, so generally only have a selection of the most popular and liquid shares

- Commodities – you’ll find a good selection of precious metals including Gold, oil and gas markets with all brokers.

- Bonds – some brokers offer government bonds like US Treasuries and UK Gilts, ideal for speculating on interest rate changes.

- Interest Rates – speculating on the movement of interest rates in certain countries.

Pros and Cons

Below, I’ve summed up the disadvantages and advantages of spread betting:

Pros of Day Trade Spread Betting

- Tax-Free Profits: Profits from spread betting are exempt from capital gains tax and stamp duty tax, allowing you to keep more of your winnings.

- Go Long or Short on Markets: Spread betting allows you to profit from rising and falling markets, providing flexibility to adapt to various market conditions daily.

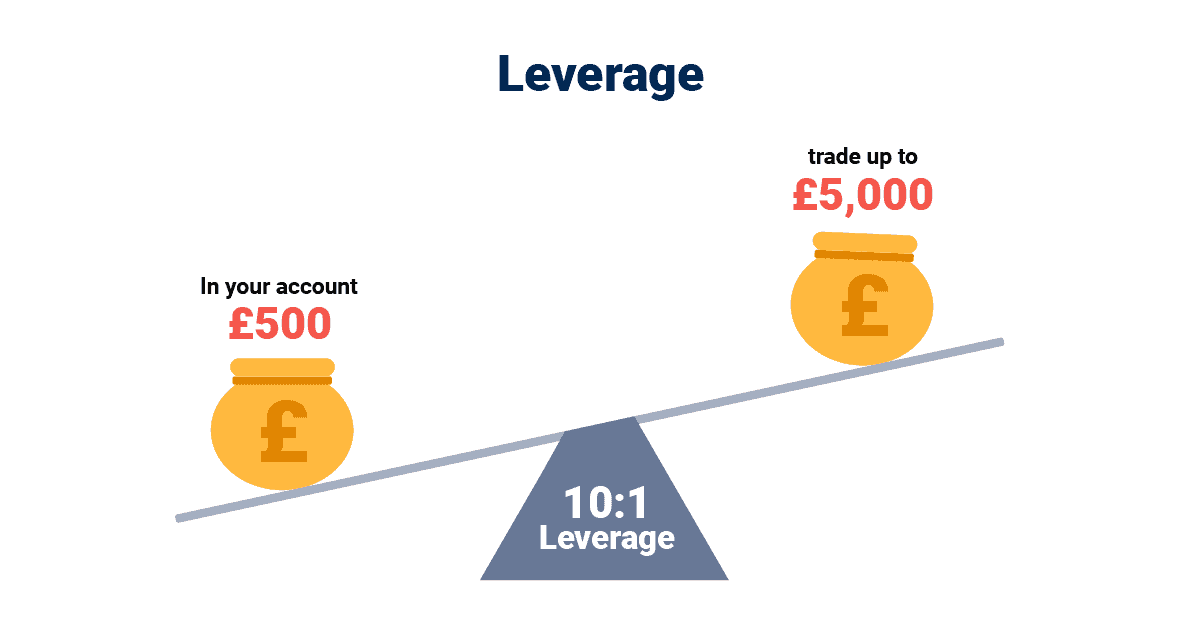

- Leverage: Leverage allows you to control larger positions with a smaller deposit and amplify your profits and losses through smaller market movements throughout the day.

Cons of Day Trade Spread Betting

- Not Ideal for Long-Term Investments: Spread bets are designed for short-term trading due to overnight rollover fees, making them less suitable for long-term investment strategies.

- Overtrading Risks: Fast execution speeds and 24/5 markets can tempt you to overtrade and make impulsive decisions in unknown market sessions.

- Wider Spreads: Spread betting spreads can be wider than CFD trading, potentially impacting profits, especially for scalping strategies.

Risks of Day Trading Using Spread Bets

Like all forms of trading, day trading has risk, and because of the short-term nature of the bets, it’s considered high-risk due to the limited time you have for a bet to play out. Compound the short time with leverage, and you can understand why it’s high risk.

Small market movements can be insignificant on a longer timeframe and look like a volatile move. I.e.) the market jumps 20 pips on GBP/USD in a short time frame, this could wipe out your stop loss while on a longer timeframe, you may never have seen this jump.

With the short-term focus on day trading, emotions can also get the better of you as you’ll see the markets move all day. Sudden jumps in market price can indulge you with “quick profit potential” (which never works out well when you steer away from your trading strategy). These lapses in judgment can be costly and spiral you out of control by chasing losses, potentially ruining your day’s profit.

Winning Trade

You anticipate the FTSE 100 will rise, so place a long (buy) spread bet on the FTSE 100 at 6990 and risk £1 per point. For every point the market moves higher than 6990, you will make £1; for every point below 6990, you will lose £1.

Over the next hour, the FTSE 100 increased to 7000 (10-point increase), so you closed your bet. The profit of the bet is the amount of points difference from the open (6990) and close (7000) price, making you £10 (10-point increase x £1 per point staked) profit.

Losing Trade

You feel that the GBP/USD will fall, and place a short (sell) spread bet on GBP/USD at 1.2505 and risk £1 per point. For every one pip (point) the market moves lower than 1.2505, you will make £1. Meanwhile, for every pip above 1.2505, you will lose £1. You set a stop loss 20 pips higher at 1.2525, giving you a maximum loss of 20 pips on this trade.

Unfortunately, the GBP/USD increased after a major economic announcement that pushed the price higher and hit your stop loss, closing your bet at a 20 pip loss. Your total loss for this trade is £20 (20 pips x £1 staked per point).

What is Spread Betting?

Spread betting is a form of derivative trading that lets you speculate on an underlying asset’s price, allowing you to profit from rising and falling prices. Unlike traditional trading, you do not own the underlying asset when you spread bet. Instead, you bet on the number of points difference between the open and close prices of the asset.

How Does Spread Betting Work?

Spread betting is a derivative, meaning it tracks the value of an asset, usually the futures market price (which is why you can bet 24 hours a day). Below are some crucial factors about spread betting you should know:

You Can Go Long/Short

As you do not own the underlying asset, you can easily bet on the price rising or falling. Going long is when you think the market price will rise, profiting when the price increases, but you’ll lose if the asset falls in price. Going short is when you believe the asset price will fall, profit when the price decreases, and make a loss if the asset rises.

Leverage

I’ve mentioned leverage a few times because it is essential to understand that this is where the actual risk of spread betting comes from. Leverage allows you to control larger bets through a smaller deposit (the margin), which amplifies your profit and losses. For example, if you had the leverage of 1:10 on a spread bet, it means for every £1 you deposit in the margin, the broker will “loan” you £10. It lets you control £1,000 bet positions with just £10.

You earn your profits as if you had £1,000, so as you can imagine, the ROI looks better considering you only used £100 to open the spread bet. The same is true for your losses, which is why leverage is a risk – losing £10 on your £1,000 position is only 1% of the total value. However, as you are using leverage, a £10 loss becomes a 10% loss as you have put up £100 in margin.

Margin

The margin is the funds you must have in your spread betting account to open a bet and is used as collateral against your losses. Each asset has a different requirement, varying from a 3.33% margin required on forex majors to 20% required for stocks.

Features of Spread Betting

I think spread betting is the simplest form of speculating on the market, as you control exactly how you wish to profit and risk with each bet you open. Below are some of the key features of spread betting:

1. Spread

The spread is the difference between the buy and sell price of the market you want to open a bet on. It’s the price you pay to the broker to enter the market, and it varies for every market. For example, if the broker offers USD/JPY at 110.50 buy / 110.48 sell, the difference is two pips (110.50 – 110.48), and if you had a bet size of £1 per pip, then it would cost you £2 to enter this bet.

2. Bet Size

The bet size is how much you wish to risk per point on the underlying market; you’ll either make or lose this amount for every point the market moves. The larger the bet size, the larger the potential profit/loss. I like this compared to CFD trading, as you just enter the amount you want to risk without calculating how many contracts you need to open to make it worthwhile.

3. Duration

The standard spread betting markets are called daily funded bets (DFBs) and never “expire”, allowing you to keep the DFB open for as long as you need. They have the lowest spreads, making them ideal for day trading, but they have rollover fees overnight, which can add up if you keep the position open too long.

If you have a longer-term trading idea, you can use the quarterly bets (or futures) that expire at the end of the quarter with wider spreads but much lower rollover fees.

4. Tax Exemption

Spread betting is exempt from capital gains and stamp duty tax, making it easier to manage your account fees and letting you keep more profits. We have a detailed article on tax and spread betting to understand the CGT and stamp duty laws in the UK

Best Spread Betting Brokers For Day Trading

I’ve compiled a list of the best spread betting brokers in UK that you can day trade with, and highlight the unique features of the broker you should know about:

1. Pepperstone – Best Spread Betting Platform In UK

Pepperstone is my top pick for day trade spread betting brokers for its low spreads, decent choice of markets, and excellent choice of spread betting platforms. The broker offers MetaTrader 4, MetaTrader 5, TradingView, and cTrader, along with free trading tools like AutoChartist, which scans the market for new betting ideas.

The range of markets includes 28 indices, 62 currency pairs, 25 commodities, and 1,000 stocks with low spreads on forex pairs from 0.7 pips.

2. City Index – Great Spread Betting With GSLO

Day trading is high-risk, and having the correct risk management tools is helpful, which is why I recommend City Index. You can access more risk management tools like guaranteed stop-loss orders (which protect your losses against slippage) and performance analysis software to find your weaknesses and strengths. The broker also offers SMART signals that can help you find new betting ideas throughout the day, helping you day trade.

City Index provides spread betting markets on 84 forex pairs, 20 indices, 4,500+ stocks, and 30 commodities with low spreads from 0.5 pips on EUR/USD.

3. IG Markets – Best For The Widest Range Of Markets

IG Markets is my top pick if you want to day trade across different markets because they provide 17,000+ spread betting markets. Providing extensive markets like 110 forex pairs, 31 commodities, 130 indices and 13,000 shares, you’ll be able to find most markets with IG and with low spreads too.

IG Group provides several spread betting platforms, which include MT4, MT5, ProRealTime (similar to MT4), and the IG Trading Platform (I think this is the best platform for IG).

4. FXCM – Good MetaTrader 4 Broker

If MetaTrader 4 is your platform of choice, then FXCM is my top MT4 broker, which allows you to take full advantage of the platform through scalping, hedging, and automation. FXCM offers Capitalise.ai, an add-on for MT4 that allows you to automate your spread betting strategies without having to code an EA, making automation available for all. The broker has competitive spreads from 0.7 pips on EURUSD and offers other platforms like TradingView and TradingStation (you can also auto-trade with).

5. FxPro – Top Spread Bet Trading App

FxPro has one of the best spread betting trading apps, with 50+ indicators, 15-time frames, and built-in sentiment analysis, making it ideal for day trading on the go. You can spread bets on 2,000 stocks, 17 commodities, 69 currency pairs and 14 indices with competitive spreads. Other platforms available are MetaTrader 4, MetaTrader 5, and cTrader.

6. OANDA – Best For Spread Betting Beginners

If you are a beginner, I’d recommend you start with OANDA, which allows the smallest stake sizes available (1p per point) to spread bet. The broker also offers guaranteed stop loss orders, protecting your stop losses from slippage and a user-friendly platform. Alternatively, OANDA offers MetaTrader 4 and TradingView, which are excellent day trading choices.

You can day trade 70+ forex pairs, 20+ commodities, and 15 indices, and you can offer spreads from 0.8 pips on EUR/USD.

7. CMC Markets – Good Forex Spread Bet Broker

One of the best brokers for forex trading with spread bets is CMC Markets, which has an impressive range of 330+ currency pairs available. You can trade these through the NGEN platform, a professional-looking platform with a beginner-friendly touch that includes tools like pattern scanners to help you find new ideas daily. The broker also impresses with low spreads from 0.5 pips on EUR/USD, making it an ideal choice for day trading.

8. Spreadex – Best Sports And Financial Spread Betting Platform

Spreadex offers day trading and sports spread betting under one company, making it easy if you want to bet on sports and financial markets. You can quickly spread bet on major financial markets with access to over 10,000 markets in addition to betting on live sporting events during the day. The broker has an impressive platform that offers tools that can automatically draw major support, resistance levels, and pattern recognition scanners, which are helpful in day trading.

9. ThinkMarkets – Great MT4 Broker

I like to recommend ThinkMarkets if you automate your spread bets with MT5, as the broker offers a free VPS service so that you can automate your bets 24/5. Another neat feature is that they offer low stakes too (from 10p per point), allowing you to start with smaller stakes when starting (vs. 50p per point minimum elsewhere). The broker has decent spreads from 1.1 pips on EUR/USD.

10. Markets.com – Top Spread Betting Demo Account

Markets.com is a top broker for spread betting demo accounts because they have unlimited funds and won’t expire, allowing you to keep all your test trading data. You can open a demo account on the Markets.com Trading Platforms that includes MetaTrader 4 and MT5, giving you a decent choice. You can access Market.com’s markets with 1,500 stocks (unavailable on MT4), 16 indices, 28 forex pairs and 20+ commodities.

Day Trading FAQ

Can I Make A Living From Day Trade Spread Betting?

You can earn a living with day trading spread betting markets, but you need a reliable trading strategy and robust risk management to spread bet the markets successfully. If you become a professional spread bettor, you may become liable for income tax, so seek advice from a professional.

What Is The Best Way To Learn How To Day Trade Spread Betting?

You can use various methods to learn how to day trade spread betting, like through online courses or spread betting guides. There is no “correct” way for you to learn day trading; most of it is picked up from experience on a demo account.

Is Spread Betting Regulated?

Spread betting is legal and regulated by the Financial Conduct Authority (FCA), which oversees and issues a license to all spread betting firms.

Key Takeaways

- Day trading in spread betting focuses on profiting from small market movements amplified through leverage and opening and closing bets within the same day.

- Spread betting as a day trader offers advantages like tax-free benefits, the ability to go long or short the markets, and the use of leverage to bet.

- Brokers offer a selection of popular markets, including forex, indices, shares and commodities, with lower fees than traditional trading.

- Day trading is a high-risk activity, and having a sound trading plan and risk management strategy is essential.

Ask an Expert