Spread betting firms earn from spreads—setting buy prices slightly above and sell prices just below market rates. They profit whether clients win or lose, by matching bets and charging overnight fees when a trader holds a position longer term.

What Are The Basics Of Spread Betting?

There are three basic features of spread betting: the spread, bet size, and bet duration. The spread is the charge you’ll pay for a position, the bet size is the amount of money you wish to bet, and the bet duration is how long you will hold that position before it expires.

Simply put, spread betting is a derivative strategy, in which you speculate on the direction of a financial market without actually owning the underlying asset.

How Brokers Make Revenue From The Spread?

All brokers make revenue through the spreads they charge to clients by adding a small margin to the usual market spread. As an example, a stock normally quoted at $50 to buy and $51 to sell, may be quoted at $49 to sell and $52 to buy in a spread bet.

This means that when a spread is quoted, the buy price is always higher than the sell price, ensuring the broker makes a profit from the spread, whether you, as the client, win or lose.

Do Spread Betting Firms Profit From Client Losses?

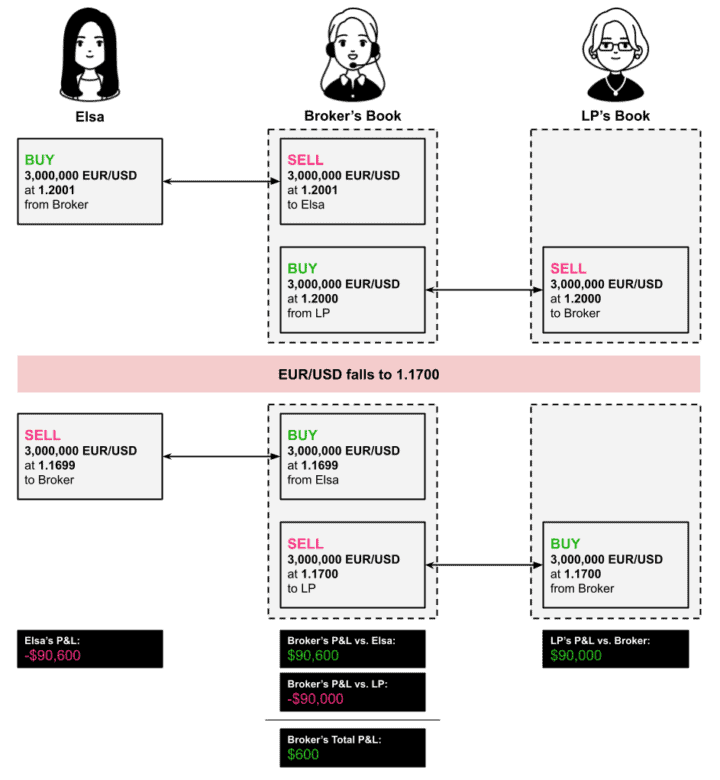

Yes, spread betting firms can profit from client losses in two different ways. Firstly, it is through the spread, even if a client loses money on a particular spread bet. Secondly, some brokers operate a B Book where they profit when clients lose money.

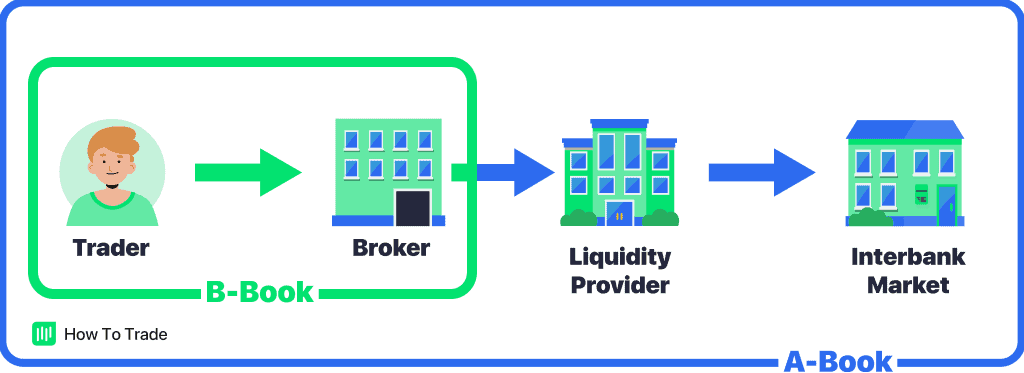

Unlike traditional sports betting companies, however, spread betting firms can make money when their clients make money too. Of the three main types of spread betting firms, A Book, B Book, and Hybrid brokers, we have explained which profit from client losses below.

1. No – A Book Brokers

A book brokers categorise their clients as a dependable stream of revenue. If you’re an A book client, your risk is substantially lower than B book clients, and you are trusted to expose the market (and not the broker) to risk.

As such, while you may be charged a premium on the standard spread, or a specially negotiated fee as an A book client, you will typically be making money anyway.

2. Yes – B Book Broker

B book brokers place their clients who have a track record of losing money into that spread betting broker’s B book. Bets from B-book clients are not sent to the market. Instead, the spread betting company actively bets against them. In this scenario, if you are a losing client, the broker will win on your losing spread bet.

3. Maybe – Hybrid Brokers

A hybrid broker is a combination of an A Book and B Book broker. These brokers may decide to execute your spread bets internally (A Book) or offset your bets externally to a liquidity provider (B Book). As such, your broker may take the other side of the trade, in which case they will make money if you lose on the spread bet.

How a hybrid broker determines who to choose for which model depends on different factors like trade size and a customer’s profitability profile.

What Are The Costs When Spread Betting?

When spread betting, there are a few costs to consider, the main ones being the spread itself and your margin. Other spread betting costs include holding costs, guaranteed stop loss order (GSLO) premiums and inactivity fees.

Holding costs: you’re charged a holding cost fee if you hold a spread bet position overnight

GSLO premiums: if you execute a GSLO, you will be charged a premium, which is often refunded if the GSLO isn’t triggered

Inactivity fees: some brokers charge an inactivity fee if you don’t use your spread betting account for a certain period

To calculate your costs when spread betting, we have formulated a spread betting calculator with a few simple inputs. All you have to do is choose your market, input your position size and update the opening and closing price levels to determine your profit or loss, and margin requirements.

What is The Regulatory Environment Of Spread Betting Companies?

All spread betting companies are required to be regulated by the Financial Conduct Authority in the UK. Whether a spread betting provider offers financial spread betting or sports spread betting, both are subject to investment regulation, despite being considered gambling.

This means it’s not only important to keep financial records for tax purposes but also to choose an FCA-regulated spread betting firm as a UK spread bettor.

For more information, check out our guide on spread betting regulation.

How Do You Choose The Right Spread Betting Broker?

When choosing the right spread betting broker, the first step is to opt for an FCA-regulated broker for compliance, security, and a trustworthy trading environment.

Then, we recommend selecting a broker aligned with your needs, considering available spread betting markets, your preferred platform, risk management tools, and customer support for a personalised trading experience.

To make your choice easier, you can check out our spread betting guide for a detailed analysis.

Who Are The Best Spread Betting Companies

Choosing the best spread betting companies all comes down to personal preference, but the most popular brokers are Pepperstone, OANDA and Capital.com from our analysis.

We analysed many factors, from the spreads to the trading platform offered, as well as the risk management tools for spread betting.

We put together a full list of the best UK spread betting brokers, but you can check out a quick summary of our top three brokers below.

1. OANDA: Best Beginner Spread Betting Broker

OANDA is the best spread betting broker for beginners, due to the broker’s proprietary trading platform, OANDA Trade. We like that OANDA Trade is user-friendly with excellent charting tools (over 100 technical indicators) and it allows you to trade smaller bet sizes, making it ideal for beginners.

OANDA also has the lowest published forex spreads, with a 0.70 pip average spread across the 5 most traded forex pairs compared to the industry average of 1.52 pips. This ensures your trading costs remain low when spread betting on forex.

2. Pepperstone: Best Low Spread Broker For Beginners

Pepperstone is the best low spread broker for beginners for multiple reasons. Firstly, Pepperstone has the fastest execution speed of any spread betting provider in the UK, which keeps your trading costs low with less change of slippage.

Secondly, Pepperstone offers the lowest fee, spread betting account, with the lowest spreads across the 6 major U.S. currency pairs.

Lastly, Pepperstone offers MT4, MT5 and cTrader as trading platforms and was one of the first to introduce TradingView to spread betting, which is one of the best platforms based on functionality and charting.

3. Capital.com: Offers TradingView

Capital.com not only offers TradingView but is one of the top TradingView spread betting providers out there. TradingView is a user-friendly platform, with advanced charts, including 12 customisable charts and 100 technical indicators, to trade the broker’s +3500 spread betting markets.

Capital.com also offers an innovative proprietary platform, as well as high-quality market research and strong educational content, which will suit both beginners and experienced traders.

FAQs

How profitable is spread betting?

Spread betting be profitable if you place your bets correctly. To become profitable as a spread betting trader, you must create a proven trading plan following lots of trading practice. To spread bet successfully requires years of experience and, most importantly, patience.

Can You Make A Living Spread Betting?

Yes, it is possible to make a living from spread betting, but you must go in with realistic expectations about the level of risk involved. While the profit potential may be high, spread betting also amplifies your risk of a loss.

Only a small percentage of spread bettors become spread betting professionals, achieving consistent profits over the long run requires a successful and proven spread betting plan.

What is the difference between spread betting and forex trading?

The main difference between forex trading and spread betting involves tax, with spread betting recognised as a form of gambling. In contrast, forex trading is officially recognised as a form of speculative investment.

This means spread betting is free from Capital Gains Tax (CGT) and stamp duty and you won’t pay any commissions, while forex trading could involve all three. You can, however, combine both worlds with forex spread betting.

Are Spread Betting And CFD Trading Similar?

Spread betting and CFD trading are similar in that they’re both leveraged trading products that offer many of the same benefits. This means you can open a relatively large position (using leverage) while depositing just a small percentage of the full value of the trade (which is called margin).

Ask an Expert

What spread betting firm makes the lowest profit per trade?

Thats a really difficult question to definitively answer as spread vary for each currency pair and throughout the day but in our experience Pepperstone spreads are very competitive and a broker worth considering.

Is it possible to consistently make money with spread betting?

While it’s possible to make money consistently, spread betting carries risks, and profits are not guaranteed.

How can I minimise losses and maximise gains in spread betting?

Minimising losses involves using stop-loss orders, while maximising gains means taking advantage of trends.