Spread betting is considered gambling in the UK from a tax perspective. This is why profits from spread bets on financial markets are exempt from stamp duty and capital gains tax.

However, I believe spread betting is closer to financial trading than gambling. While both involve risk, the key difference is that the outcomes of spread bets are based on movements in financial markets, which can be analysed and forecasted to some extent. After all, pension funds invest in the financial markets to protect and grow pension pots; you wouldn’t label them gamblers.

Conversely, gambling relies purely on the chance of an event happening within a certain timeframe. For example, the result of a football game is gambling, as anything can happen within 90 minutes.

Plus, you are betting against the bookmaker for an event to happen, with a limited profit potential based on the fixed odds you stake. With spread betting, you have unlimited profit potential based on getting your prediction correct.

Differences Of Spread Betting vs Gambling

There are some key differences between spread betting and gambling that I think are worth highlighting.

1. Regulation

Spread betting is overseen by the Financial Conduct Authority (FCA) as a trading activity, not by the Gambling Commission. This shows that it’s viewed as a legitimate form of financial trading.

2. Skill And Strategy

Successful spread betting requires developing trading strategies to seek profitable opportunities and manage risk. You’d associate these skills more with trading than gambling.

3. Analysis And Research

With spread betting, you’ll perform technical analysis, study economic data, and follow financial news to generate opportunities, which is the same as trading. This level of research isn’t typically associated with gambling.

While there are some surface-level similarities, I believe most traders view spread betting as a form of investing rather than gambling. It requires a different mindset and approach compared to traditional gambling activities.

Similarities Of Spread Betting Vs Gambling

Even though spread betting is more aligned with trading, it does share certain properties with gambling products.

The most obvious similarity is that spread betting and gambling involve the risk of financial loss. However, with spread betting, you can control your risk through risk management by closing a position early if necessary, limiting your losses. While with gambling products, you risk losing 100% of your stakes, even if you’ve changed your mind during the event.

You do not own the underlying markets you speculate on for either gambling or spread betting, so you do not gain any long-term benefits like you may receive from traditional investing.

Both offer high-risk, high-reward forms of speculation. With spread betting, you use leverage to open a position, which amplifies your profits (and losses) and allows you to profit from smaller price movements throughout the day.

So a small 10-pip move in EUR/USD would return 10 times your stake size, which is what makes leverage so appealing. However, if it were reversed, you’d lose 10 times your stake size, which is why risk management is vital.

Gambling’s high-risk nature lies in losing 100% of your stake size if you’re wrong about an outcome. However, I believe these similarities are largely superficial. The key difference lies in the level of control and analysis that can be applied in spread betting.

While you can’t control market movements entirely, you can analyse the markets and generate trade ideas based on proven strategies like breakout trading or chart patterns. It’s crucial to approach spread betting with a trader’s mindset, focusing on risk management and informed decision-making rather than treating it like a game of chance.

What Is Spread Betting Trading?

Spread betting is a financial derivative that allows you to speculate on the financial markets where you can profit from the price rising (or falling) without owning the underlying market.

To spread bet, you need an FCA-regulated spread betting platform in the UK to give you access to the financial markets through their platforms. A top Spread betting firm like Pepperstone offers a decent range of markets to spread bet on, with markets such as:

- Forex (currency pairs)

- Share dealing (UK and International shares like Apple or BMW)

- Stock indices (like the FTSE 100 or S&P 500)

- Commodities (such as gold, oil, or agricultural products)

- Bonds

- ETFs

- Options

- Gold and other precious metals

One key difference between traditional investing and spread betting is that you’re not buying or selling actual assets. Instead, you’re placing a bet on the price movement, allowing you to profit from the same move without owning the asset or paying additional commissions or taxes.

By not owning the underlying asset, you can potentially profit from both rising and falling markets, which is why spread betting offers more flexibility than traditional investing.

How Spread Betting Works

When you place a spread bet, you’re betting on whether the price of a financial instrument will go up or down. Your profits (or losses) are calculated based on the number of points the market has moved in (or out) of your favour. The more the market moves in your favour, the more you’ll profit, while the opposite is true if you’re in a losing position.

Instead of figuring out how many contracts or lot sizes you want to trade, spread betting uses stakes, which I think simplifies the whole process. By doing this, you declare how much you want to risk per point, and depending on the price, you’ll earn (or lose) a multiple of your initial stake.

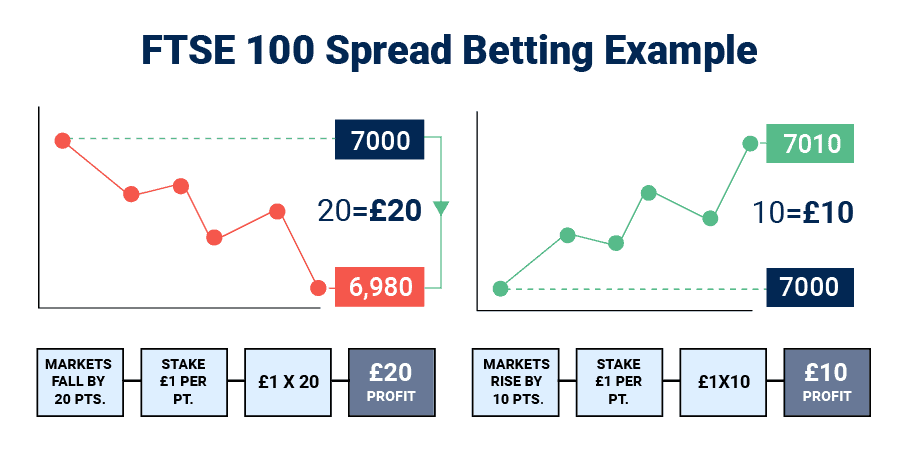

FTSE 100 Spread Betting Example

Let’s say you bought the FTSE 100 indices at 7000 with a stake size of £1 per point. If the price of the FTSE 100 increased to 7010 (10 points), you’d be £10 in profit. This profit is worked out by multiplying your stake size (£1) by the number of points increased (10), giving you a current profit of £10.

If the FTSE 100 decreased to 6980 (20 points), you’d be down £20. The opposite would happen where your stake size (£1) is multiplied by the number of points fallen (20), giving you a loss of £20.

View our spread bet examples page for more scenarios of winning and losing bets.

Is Spread Betting Regulated

Yes, spread betting is regulated in the UK, and I think this is an important point that sets it apart from gambling. The Financial Conduct Authority (FCA) oversees spread betting as a financial activity, not the Gambling Commission.

I think this regulatory approach reflects the view that spread betting is a legitimate form of trading, not just a game of chance. The FCA’s oversight aims to protect consumers and maintain the integrity of the financial markets, which is achieved through FCA-regulated spread betting companies.

From a tax perspective, financial spread betting is treated differently than traditional investing. Profits from spread betting are currently free from the UK’s capital gains tax and stamp duty. This tax treatment is more similar to gambling winnings, which are also tax-free.

I believe this unique regulatory and tax situation reflects the hybrid nature of spread betting – it’s a financial activity that shares some characteristics with both trading and gambling.

Is Spread Betting Taxable

No, spread betting is not taxable, as it is not subject to capital gains tax or stamp duty. This makes this product an attractive option for profitable traders. Compared with alternative forms of speculation like CFD trading and investing, spread betting has the lowest overall taxes.

| Spread Betting | CFDs | Investing | |

|---|---|---|---|

| Capital Gains Tax | No | Yes | Yes |

| Stamp Duty | No | No | Yes |

However, I believe it’s important to note that there’s an exception to this rule. If spread betting is your primary source of income – essentially, if you’re a professional spread bettor – you may be liable to pay income tax on your profits. In this case, the UK tax authorities might view your activities as a trade rather than speculation.

Disclaimer: Tax laws can be complex and subject to change, so I always recommend consulting with a qualified accountant or tax professional for personalised advice on your specific situation. I have a more detailed write-up on our spread bet tax page.

Is Spread Betting Profitable

Yes, spread betting can be profitable, but it isn’t easy. Like any form of trading, success in spread betting requires skill, knowledge, and careful risk management.

To be classed as profitable, you have to generate positive returns from your trading ideas consistently, and the best way to achieve this is by developing a trading strategy. By having a strategy, you can have a repeatable process to generate profitable trading ideas, which is what separates successful traders from those who give up.

Successful spread bettors often spend time learning about markets, developing and tweaking their strategies, and practising good risk management. It’s not a get-rich-quick scheme but a form of trading that requires dedication and skill to be consistently profitable. Most professionals in the UK choose spread betting over CFDs based on the tax treatment.

Managing Risk in Spread Betting

I think one of the key differences between spread betting and gambling is the ability to manage risk effectively. Spread betting platforms offer several tools to help control potential losses:

- Stop-loss orders: These automatically close your position if the market moves against you by a certain amount. I believe stop-losses are crucial for protecting your capital.

- Guaranteed stop-loss orders: These work like regular stop-losses but guarantee execution at the exact price you set, even if the market gaps beyond that price, protecting you from price slippage. Guaranteed stop-loss orders usually come with a small premium, but you only pay this if the order gets executed, so it’s a win-win.

- Negative balance protection: All FCA-regulated brokers offer accounts where your maximum loss is limited to your deposit, protecting you from negative balances. This functionality is excellent as short-term market volatility can change at any moment and provides you with a final safety net should your bets lose.

These risk management tools give you more control over your potential losses than traditional gambling. However, it’s important to use them wisely and understand that they don’t eliminate risk entirely.

I believe developing a solid risk management strategy is crucial to succeed in spread betting. It’s not just about making profitable trades but also about protecting your capital during inevitable losing streaks.

FAQs

Is Spread Betting Illegal In The UK?

No, spread betting is completely legal in the UK. It’s a regulated financial activity under the Financial Conduct Authority’s oversight. Only FCA-regulated brokers can offer spread betting services to UK citizens and must follow strict frameworks set by the FCA to operate legally.

Do I Need To Declare Spread Betting?

Generally, you don’t need to declare spread betting profits on your tax return in the UK, as they’re usually tax-free. However, if spread betting is your main source of income, you might need to declare it, but this depends on your personal circumstances. I recommend consulting a tax professional for personalised advice.

Spread Betting vs CFD

Spread betting and CFDs (Contracts for Difference) are similar in many ways. They allow you to speculate on markets (like forex) without owning the underlying asset, and both are leveraged products. One of the main benefits of spread betting is its tax treatment. Spread betting profits are tax-free in the UK, while CFD profits are subject to capital gains tax.

What Is The Minimum Deposit To Start Spread Betting?

A safe minimum deposit to start trading would be around £500. This initial deposit lets you open a betting account while meeting the minimum margin requirements to place a trade. I think it’s important to note that the amount of money you should deposit upfront depends on what you can afford to lose. A spread betting demo account is another way to enter the markets in a risk-free environment.

Is Spread Betting Safe?

Spread betting is safe as it is a regulated financial activity by the Financial Conduct Authority (FCA), which ensures the markets are transparent and fair. The FCA has policies to ensure your money is safe by ensuring all brokers offer Negative Balance Protection, ensuring you never lower more than your deposit.

Is Spread Betting Haram?

Islamic scholars consider spread betting to be haram in Islam. It is viewed as a form of gambling, which is prohibited by Islamic law. Spread betting involves speculation on price movements without owning the underlying asset, contains elements of uncertainty and can be seen as profiting from others’ losses.

Ask an Expert

Is spread betting considered gambling in the UK?

In the UK, spread betting is considered gambling for tax purposes, but it is regulated as a financial activity by the FCA.

What makes spread betting different from traditional gambling?

Unlike traditional gambling, spread betting involves predicting price movements in financial markets rather than betting on chance.