This guide looks at what spread betting on interest rates are and how it works.

What Is Spread Betting Interest Rates

Spread betting on interest rates allows you to bet on the direction of interest rates without owning the underlying asset. When spread betting interest rates, the price is set out as 100 minus the interest rate, so if the interest rate was 2% then the price is 98.00. Essentially, when interest rates rise, the price of the market falls, so if it was 4% the price would be 96.00.

With spread betting being a derivative of an underlying market, you can go long (buy) or short (sell) the asset, allowing you to trade in all market conditions.

For me, I think spread betting is the best way to speculate in the UK for its tax exemptions and simplified approach to trading. Instead of buying and selling contracts, you set your stake size which is how much you wish to risk per point the market moves in a direction. So if you staked £1 per point and the market moved 5 points, you’d be up £5.

Why Spread Bet On Interest Rates

There are many benefits of spread betting interest rates that you won’t find with other forms of trading through contract for differences (CFDs) or traditional investing. These benefits include:

- Can use leverage: With leverage, you can control a large position in interest rate bets like the Sterling Overnight Index Average (SONIA) without having to pay the full amount to open the bet. Instead, you place a margin of 20% of the total position size (5:1 leverage), making it cheaper to trade on these markets.

- 24/5 Interest Rate Markets: I found you can spread bet on interest rates 24/5 with most brokers, giving you opportunities through the day and night to bet.

No currency conversion fees: As you do not buy the contracts of interest rates in other global markets and instead place bets in GBP, you do not pay currency conversion fees. This is a benefit if you bet on EURIBOR or FFR markets as it reduces your trading fees. - Tax-free exempt status: A unique feature for UK traders with spread betting is that its profits are exempt from capital gains tax and stamp duty. These dramatically reduce trading costs, making it a popular choice if you are consistently profitable.

- Predictable Market Cycles: Interest rates are linked to economic cycles and central bank policies, so when a new hawkish (reduce) or dovish (increase) cycle starts you can position your bets accordingly.

Can go long or short: As spread betting is a derivative product, you can bet on the market rising or falling which is useful if you want to hedge your positions in bearish markets.

What Interest Rates Can You Spread Bet?

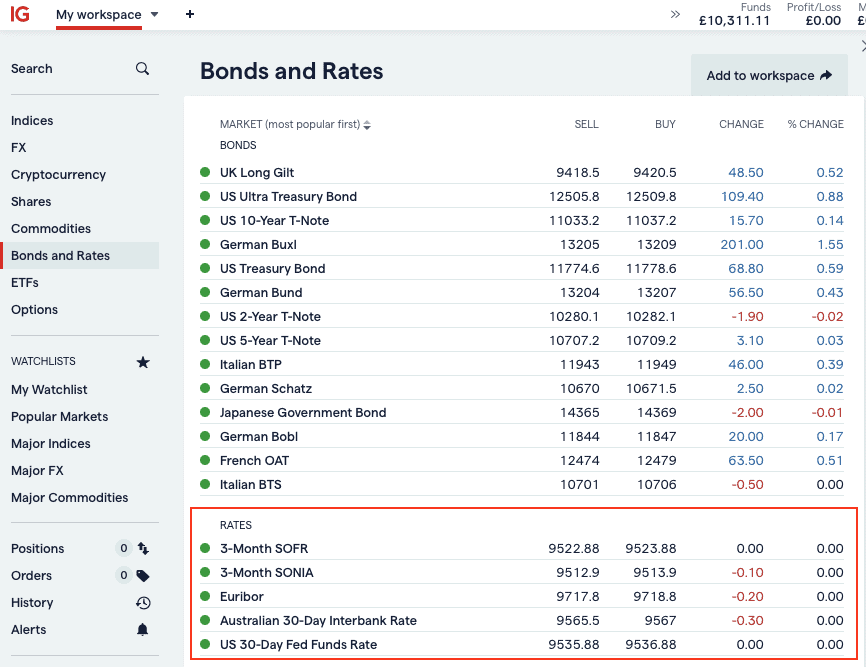

Compared to other financial markets like currency pairs (like EUR/USD) and commodities, most spread betting brokers offer a limited range of interest rates for spread betting.

Due to how interest rates impact spread betting on bonds (such as government bonds like the Bund), they are usually grouped along with their short-term futures contracts like below:

Secured Overnight Financing Rate (SOFR)

The SOFR replaced LIBOR in 2023 as the main benchmark rate for dollar-based derivatives and loans. It’s an indicator of the cost to borrow cash overnight by the U.S Treasury securities.

Sterling Overnight Index Average (SONIA)

SONIA is a sterling-based interest rate measuring the rate of overnight unsecured transactions outside of market hours. The Bank of England uses real-time funding from businesses to publish the rate daily.

Euro Interbank Offered Rate (EURIBOR)

The EURIBOR is the rate European banks lend money to each other at different maturities from 1-week to 1 year, and is calculated daily.

Federal Fund Rate

This is the interest rate set by the Federal Reserve’s FOMC and is the key benchmark for US monetary policies that American banks charge for overnight lending of excess reserves.

How To Spread Bet Interest Rates

You can learn how to spread bet interest rates like you would any of the financial instruments, but the advantage is being able to use fundamental analysis to help govern trade ideas in advance. Thanks to the Internet, there are a variety of online trading courses you can access either through your spread betting broker or with YouTube. Below is a short guide on how to spread bet interest rates:

Learn How To Spread Bet

Learning the basics of how to spread bet is the first step to get an idea of what everything means from learning about leverage to the functionality of the markets. There are lots of terms like the spread ( difference between the asset’s bid (buy) and ask (sell) prices), what a stop-loss order is, and how to use a trading platform.

After grasping the basics of trading and how it works, you’ll want to find a spread betting broker to open a demo account with to practise.

Find A Spread Betting Broker With Interest Rates

With the fundamentals of spread betting under your belt, you will need to find a spread betting broker with interest rates and a trading platform you like. Not all spread betting brokers offer interest rate markets, to put you in the right direction, here are some top spread betting brokers with interest rates:

- IG Markets

- Spreadex

- City Index

These brokers scored highly in my reviews and off interest rates with tight spreads and fast execution speeds, providing decent trading conditions for beginners.

Once you have chosen your broker, I recommend you open a demo account so you can practise in a risk-free trading environment and gain experience trading with virtual money. This way, you won’t be risking your money, but preparing you to trade on a live account once you’re consistently profitable.

Develop A Spread Betting Strategy

To succeed, you need to find and develop a spread betting strategy that consistently finds profitable ideas. While learning how to spread bet, you’ll have come across different ways to trade like using technical indicators, breakout trading, or price action trading.

Based on what suits your trading style, you should develop a strategy that can help you profitably analyse the spread bet markets and trust it. Spread betting strategies can take time to develop, so make sure you practise and tweak them on your demo account.

Use A Solid Risk Management Plan

Part of your trading strategy should include how you plan to enter and exit your bets, to help lower your risk while maximising your profits. Most trading platforms like MetaTrader 4 and TradingView have stop-loss orders that will close your bet if the market moves against you, protecting you from further losses.

On the flip side, there are profit orders that automatically close your bets when the markets move in your favour by a set value, helping you secure profit.

Start Trading With Real Money

After developing a risk management plan and reliable strategy on a demo account, your final step is to open a live spread betting account and deposit some funds. I like to recommend beginners to start small to ease into trading with real money as you may develop bad traits like over-trading to try and recover financial losses.

Spread Betting Interest Rates Example

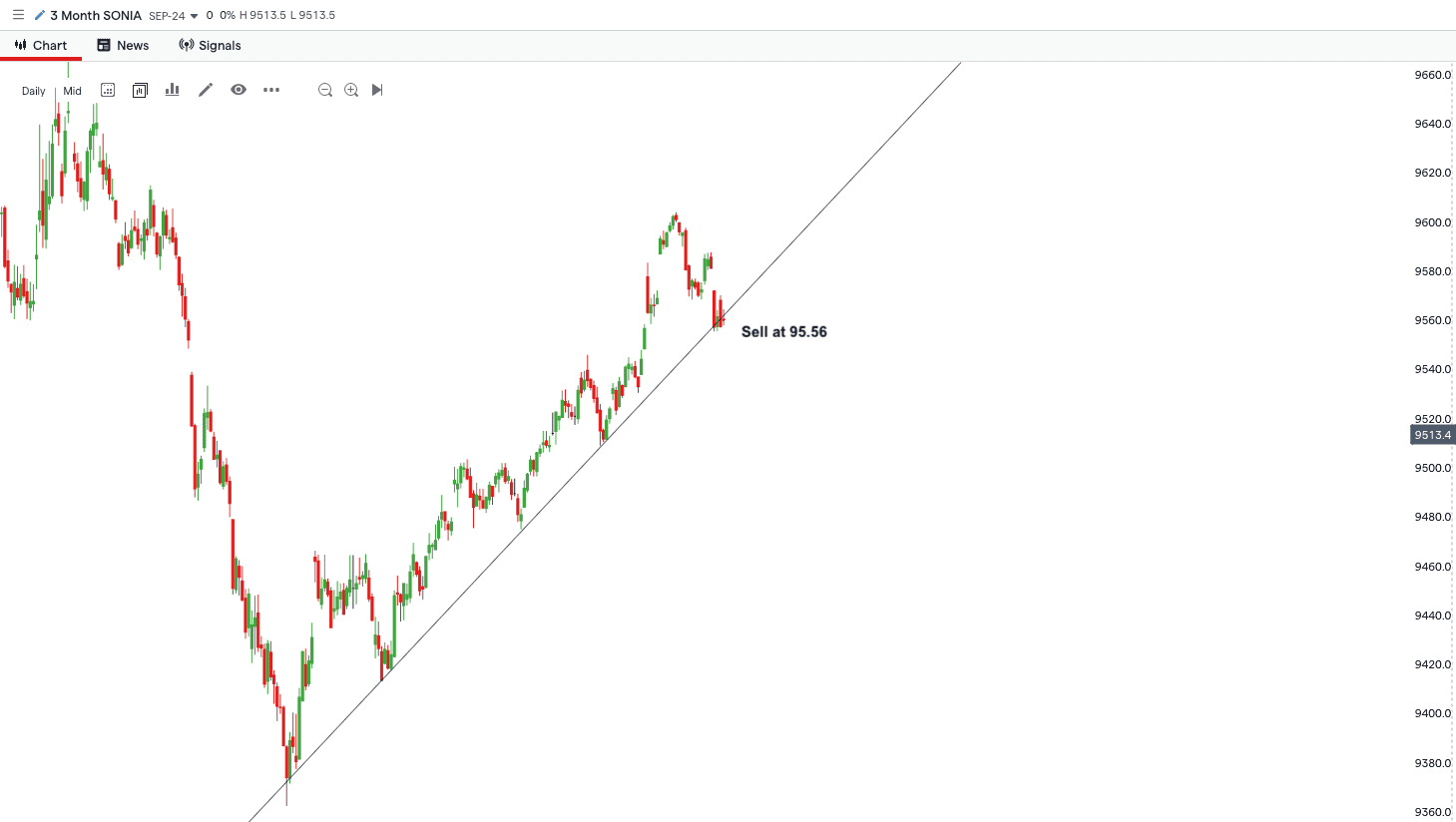

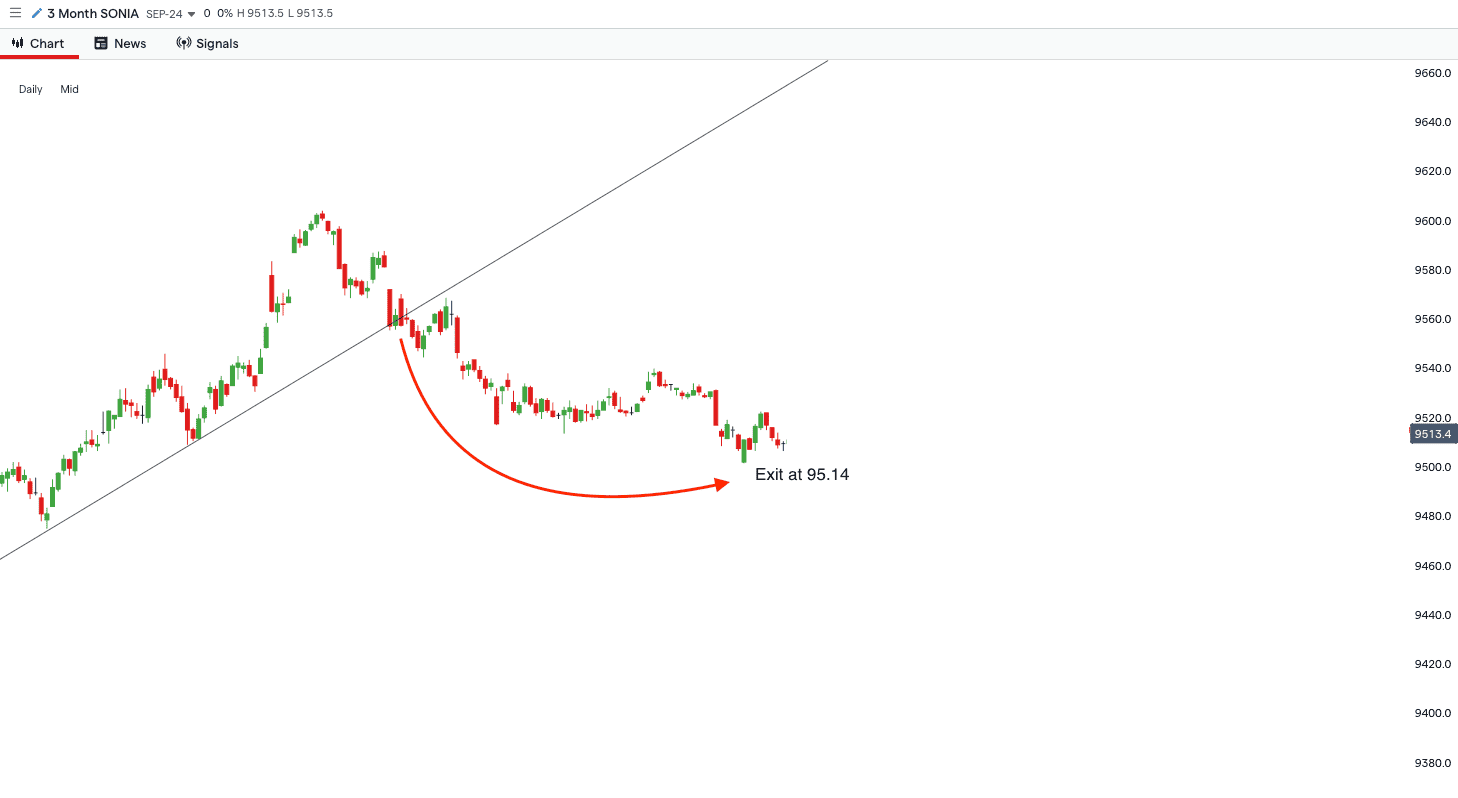

I will use a past trade on SONIA as a spread betting example for interest rates to help explain how you can profit from them.

In this example I found the SONIA was breaking its upward trend on the daily chart, taking this as a signal to short sterling overnight index average at 95.56. I placed a £10 per point stake size, meaning for every 0.01 point move below 95.56, I will make £10. For every 0.01 point above 95.56, I will lose £10.

The market continued to go lower over the next few weeks netting a solid profit on the short position. I exited the bet at the closing price of 95.14, netting a 42-point move lower (95.56-95.14), generating a profit of £420. To work out the profit you take your stake size (£10) and points made (42) and multiply them together = £10 x 42 = £420.

Best Spread Betting Interest Rates Broker

I found the best spread betting broker for trading interest rate markets is IG Markets. The broker offers the most interest rate products and low trading costs with SONIA spreads starting from 1 point making it the cheapest for interest rates. In addition, the broker’s IG Trading platform is an excellent all-round trading platform with advanced charts, 30+ indicators, and 15+ timeframes allowing you to customise your charts easily.

FAQs

How Profitable Is Spread Betting?

Spread betting can be potentially profitable if you have developed a decent trading strategy and use risk management to generate consistent returns. Due to the nature of trading, it’s impossible to define how successful it can be as different strategies, risk and reward setups will generate different outcomes.

How To Bet On Interest Rates Going Down

To bet on interest rates going down you can use spread betting and it involves you going long on the interest rate. This is because interest rate prices are based on 100 minus the interest rate. So if the price of the current interest rate is 97.60 (2.4% interest rate) and the interest rate is cut to 2%, then the new price is 98.00. With the interest rate going down, the market price goes up to 98.00.

Is Spread Betting Really Tax Free?

Spread betting is tax-free as the HMRC in the UK deems it as a gambling product, while it’s still a regulated trading activity overseen by the Financial Conduct Authority. Being exempt from tax, means you do not pay capital gains tax on profits or stamp duty on purchases helping reduce your trading costs compared to traditional investments.

Is Spread Betting High Risk?

Spread betting is considered high risk as derivatives use leverage, allowing you to place a small deposit to control the full position. In the United Kingdom, retail investor accounts are limited to 30:1 leverage on forex majors, meaning for every £1 you put down as a deposit, you control £30. Leverage amplifies your profits compared to using traditional investing which is 1:1 in terms of leverage, but also magnifies your losses which is why most consider it high risk.

Are Interest Rates Good For Day Traders?

Spread betting interest rates are good for day traders providing decent opportunities to bet on throughout the day and they tend to respect technical analysis better than most markets. Thanks to leverage, you can profit from small price movements on interest rates as the markets don’t move much throughout the day allowing you to magnify your day trading profits. In addition, due to how interest rates are quoted, these markets do not see much volatility during the day unless it’s around an announcement, making it easier to trade.

Is Interest Rate Spread Betting Legal In UK?

Interest rates spread betting is legal in the UK and is overseen by the Financial Conduct Authority (FCA) in London, which regulates spread betting brokers ensuring your capital is protected. Like CFD trading and standard forms of investing like shares, the FCA considered spread betting a regulated trading activity.