This page details the individual Commodity markets offered by the Spread Bet brokers, including some points to look out for, such as which months to trade and the importance of initial research into what you’re trading.

What is Spread Betting Commodities

Spread betting commodities allow you to bet on the price direction of a market like gold or crude oil without owning the underlying asset. Using a derivative like spread betting lets you go long (buy) or short (sell) an asset, making it a valuable tool so you can speculate in bearish and bullish markets.

I think spread betting on commodity markets is the simplest way to speculate on them. Instead of using contracts (like CFDs), you bet how much you wish to stake for every point the market moves, making it easier to calculate risk and profit. For example, if you went long on gold, staking £10 per point and gold increased by 10 points, you would make £100 profit.

One unique factor for spread betting commodities is that some commodities like cocoa and wheat have seasonal patterns, which allows experienced traders to identify and benefit from them.

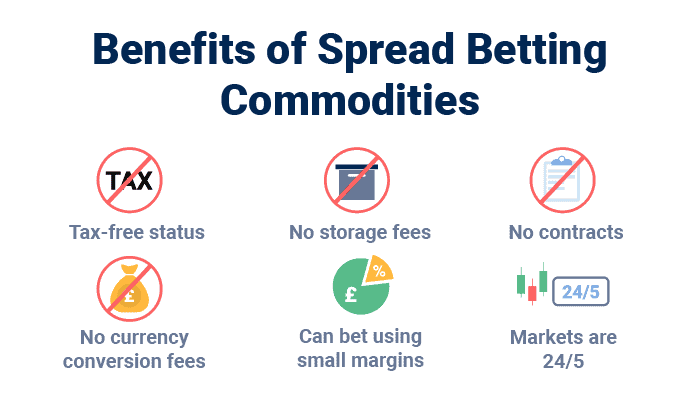

Benefits of Spread Betting Commodities

Commodity spread betting has plenty of benefits unique to UK traders which is why it’s a popular alternative to CFD trading. Here are some of the top benefits:

- Tax-free status: Profits generated through spread betting are exempt from capital gains tax, letting you keep more of your profits vs. traditional and CFD methods. As you are trading a derivative and do not own the underlying market, you also don’t pay stamp duty tax – again lowering your trading costs.

- No currency conversion fees: Bets are placed in GBP (or your base currency) so there are no currency conversions for buying USD to bet on gold or silver. This not only helps lower trading costs but eliminates currency risk from diluting your profits due to USD getting stronger which is a hidden cost to trading international markets.

- No storage fees: With spread betting being a derivative, you never own the asset so you do not have to hold and store the commodity. You can buy and sell as you wish and it only takes seconds.

- No contracts: Use stake sizes to bet on how much you want to risk per point the price moves, making it easier to know how much you will profit (or lose).

- Can bet using small margins: Leverage is built into spread betting, so you can control larger positions in commodities like silver with a 5% margin (20:1 leverage). This makes it cheaper to trade and why day traders use spread bets instead of buying physical silver.

- Markets are 24/5: Spread bet commodity markets are available 24/5 as the spread betting markets are based on the commodity futures market. With longer opening hours, it provides the same market access as forex markets for retail traders, giving you more time to bet on them if you work 9-5.

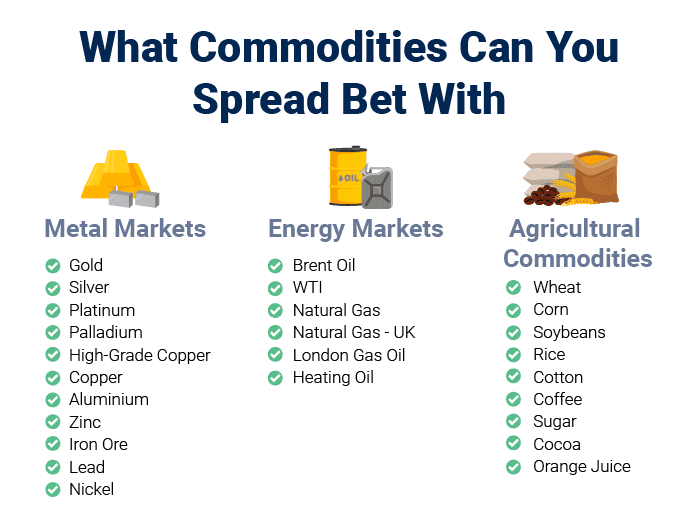

What Commodities Can You Spread Bet With

As you do not need to physically own to spread bet commodities, brokers offer a large range of markets. These are:

Precious Metals

Precious metals are probably the most liquid commodity markets available for spread betting due to their importance in industrial usage and the storage of wealth.

Gold Spread Betting Markets

Gold is the most popular commodity traded and you’ll see that it’s got a ticker of XAU/USD, this is because gold is pegged to the US dollar. Compared to other commodities, gold’s price is less volatile and seen as a hedge against market uncertainty which is why the price rises during crises.

Silver Spread Betting Markets

Silver can be found on your broker as XAG/USD and is also used as a hedge when the markets are uncertain. However, silver is more susceptible to supply and demand movements due to industrial demand like in the jewellery and technology sector needing it for electronics.

Other metals include:

- Platinum

- Palladium

- High-Grade Copper

- Copper

- Aluminium

- Zinc

- Iron Ore

- Lead

- Nickel

Energy Markets

Energy markets cover oil and gases that are traded on the exchange which are very liquid products but are also sensitive to market news.

Oil Spread Betting Markets

Oil comes in multiple options like the UK’s Brent Crude Oil, and the WTI Crude Oil which are the main benchmarks for the price of oil. Global economic growth impacts the oil demand, so fundamental analysis combined with technical analysis makes this market a top pick for day trading.

Other energy markets for spread betting include:

- Natural Gas

- Natural Gas – UK

- London Gas Oil

- Heating Oil

Agricultural Commodities

Agricultural commodities (soft commodities) are any products to do with livestock and farming, which tend to be traded by professional traders as these have lower liquidity in comparison. These are less popular which can be shown by the few markets spread betting brokers offer – some brokers don’t even offer soft commodities.

Soft commodities for spread betting include:

- Wheat

- Corn

- Soybeans

- Rice

- Cotton

- Coffee

- Sugar

- Cocoa

- Orange Juice

Commodity Futures

Some brokers like IG Group provide spread betting on commodity futures contracts, which reduces the nightly rollover fees but widens the spreads. Spread betting on commodity futures is ideal if you want to hold onto the position for longer than a week, as the trading fees will be lower over time.

Commodity Options

Another method of spread betting commodities is through options, which allows you to bet on the price direction of a commodity while benefiting from market volatility and limited risks.

With spread betting options, you pay a premium to open the bet, which becomes your maximum loss (no matter how far the market moves against you). Options have unlimited upside potential as you benefit from the price movement and the contract’s volatility, which can increase your profits further compared to traditional spread bet and CFD trading.

How To Spread Bet Commodities

Learning how to start spread bet commodities is straightforward and there are lots of educational resources online from spread betting brokers or on YouTube. Below is my outline of how to spread bet commodities:

Learn The Spread Bet Basics

Before opening an account you should learn the fundamentals of spread betting and get an idea of how the markets work. This includes learning about terms such as spreads (difference between buy and sell prices), leverage, and margin which is important to know as this impacts your trading costs and experience.

Once you learn the basics of executing trades and understanding trade management, you should start to learn how to find opportunities using different types of methods such as:

- Price action trading

- Chart patterns

- Breakout trading

- Scalping

Choose A Spread Betting Broker

As you take on new information, you should choose a spread betting broker that meets your requirements which may include a trading platform, low costs, and fast execution speeds. The good news is that all spread betting brokers are regulated by the Financial Conduct Authority (FCA), so as a UK trader your funds will be protected.

The reason you should choose a broker early is so you can open a demo account with them and practice using the broker’s services and trading platform. I prefer this way as it makes it easier to switch to a live account.

Develop And Practise A Spread Betting Strategy

Part of the learning process is to develop a spread betting strategy which is a set of rules you will use to define what is a betting opportunity. You can choose to develop one yourself and test it on a demo account, or find another trader who is profitable to emulate.

The most important thing is to find something that resonates with you and is consistently profitable when you analyse the spread bet markets.

Create A Sound Risk Management Plan

Finding opportunities is half the battle with spread betting, the other half is managing your risk. Depending on your strategy you should test and develop optimal stop-loss and take profit orders that can quickly exit your bets, locking in profit, or protecting against larger losses.

I found some brokers offer guaranteed stop-loss orders on their platform, which can be useful for your plan if you trade during market news announcements. The GLSO exits your bet at the price set if the market moves against you in a volatile market, protecting you from slippage that could cost you more in losses.

Start Trading Live

With a spread betting strategy and risk management plan tested in a demo account, your final step is to open a spread betting account and fund it with your money.

As you start on your live account, risking funds can cloud your judgement, so I like to focus on one market like gold, to begin with. Easing into the trade I’d use lower stake sizes like 50p per point to warm up to larger sizes instead of jumping in with £10 bet sizes. A small mistake could lead to a large financial loss, so it’s better to start small first.

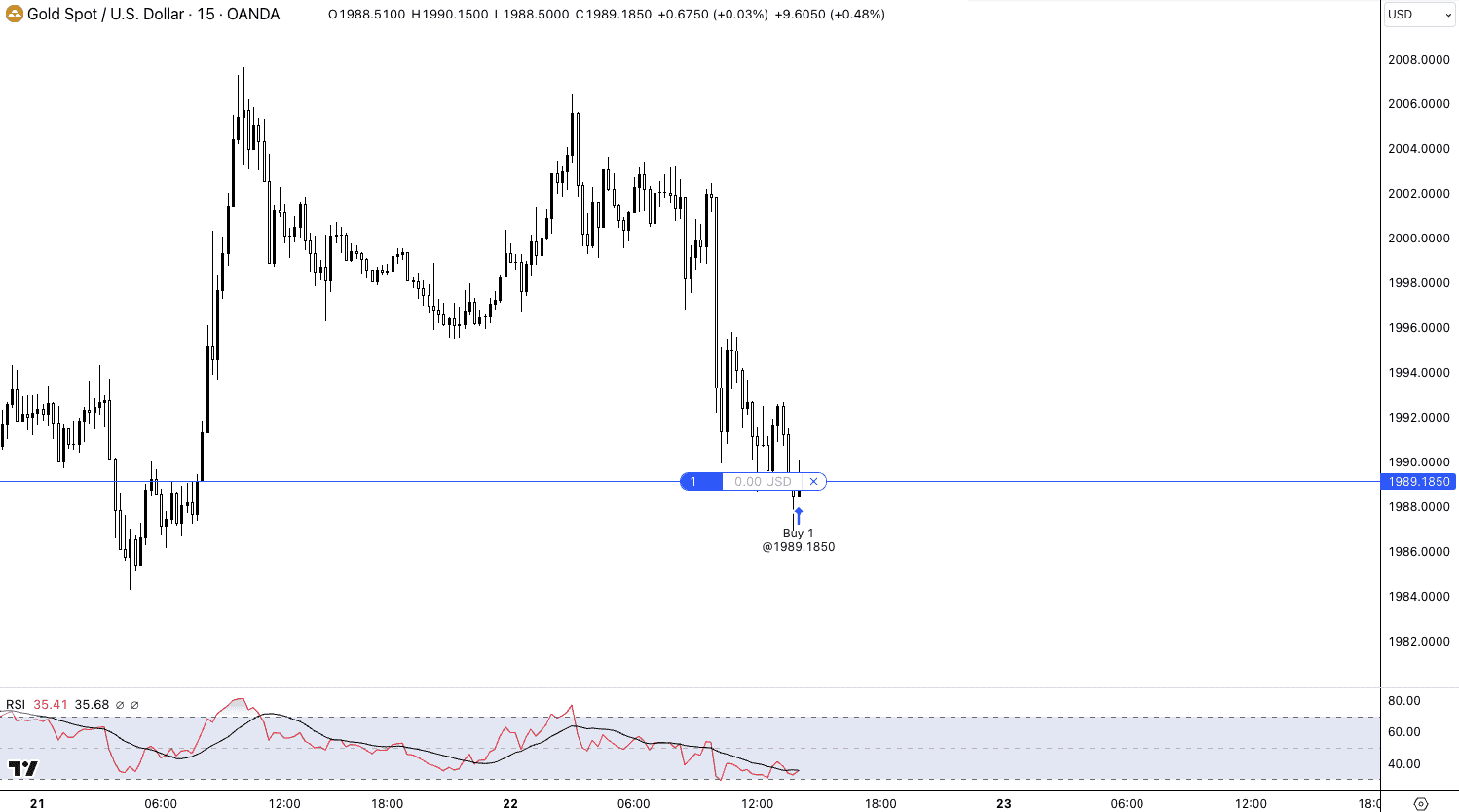

Spread Betting Commodities Example

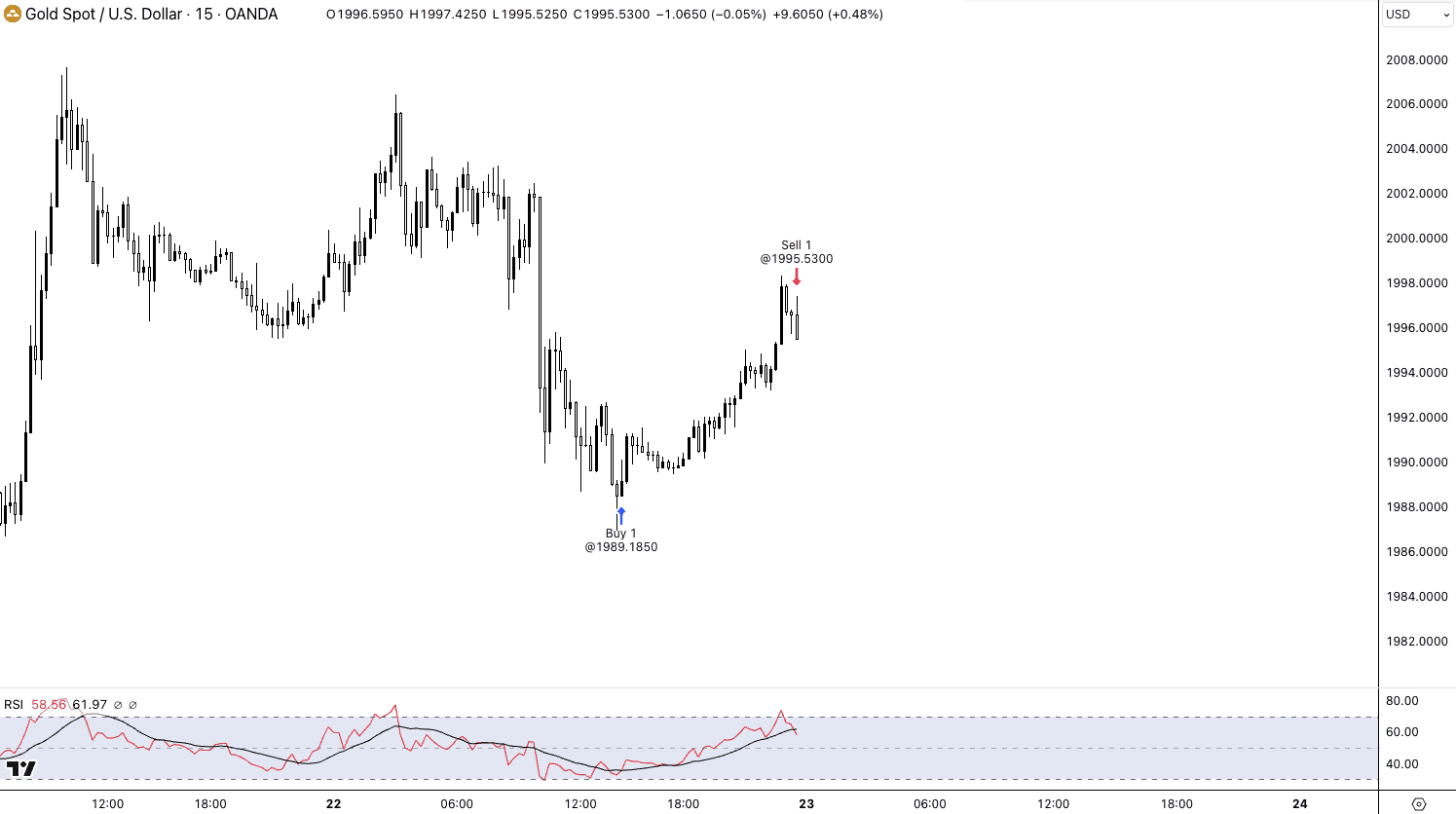

To help you understand how to spread bet on commodities, I’ll go through a spread betting example using gold:

Let’s say you want to speculate on the price of gold with a spread bet to go long (to buy) because you expect the price to rise in the next few hours. You open a spread bet to buy at 1989.1850 and stake £1 per point (for every $1 gold moves, you make or lose £1).

The market rallies over the next few hours, and you decide to close for a profit. You closed at $1995.53, making you £6.34 profit ($1885.53 – $1989.1850 = 6.34 x £1 per point staked). If the markets fell $6.34 instead, you would have lost £6.34.

Best Spread Betting Brokers for Commodities

The best spread betting broker for trading commodities is Pepperstone with a decent selection of 20+ commodities and 1200+ markets and average spreads of 0.16 cents on gold.

In addition to low spreads on the broker’s markets, they offer a top selection of trading platforms like MetaTrader 4 (ideal if you want to automate your bets). Other platforms include TradingView, cTrader, and MetaTrader 5.

If you are more experienced and want to use specialised spread betting products like futures and options, IG Group and Spreadex are both top picks with these markets available.

FAQs

Are Commodities Good For Day Traders?

Spread betting commodities are good for day traders because there are many opportunities to bet on the asset throughout the day, especially as commodities are a 24/5 financial market. You also have access to leverage with spread betting, which allows you to profit from smaller commodity market movements (but it can also amplify your losses).

What Is The Spread In A Commodities Market?

The spread is the difference between the buy and sell price of the commodity on offer, and this is the fee the broker charges to execute your spread bet. Let’s say, for example, the buy price of gold is at 2000, and the sell price is 2001; then the price difference is 1 point (this is the spread.

If you want to work out the spread and the total trading costs associated with your spread bet, you should use a spread betting calculator that can help confirm your costs.

Commodities Spread Betting Legal In UK?

Spread betting commodities is legal in the UK and you can spread bet on a wide range of commodities from crude oil to soybeans. The Financial Conduct Authority, one of the world’s top regulators, regulates spread betting, protecting you from malpractice within the brokering industry.

Is Spread Betting With Commodities A Good Strategy?

Spread betting with commodities is a good strategy as the markets tend to be very liquid (lots of activity) and volatile (lots of price movements). You can use the same financial spread betting strategies you’ve developed from other markets like forex trading, which can have similar results as the gold, silver, and oil markets are all paired with the USD.

Can Spread Betting Be Profitable?

Spread betting can be profitable but the amount of money you can make is determined by how consistent your trading strategy and risk management are. You need to identify how to profit from commodity prices moving which comes through experience, knowledge, and practice. In addition, you need to have discipline to follow your plans because spread betting can evoke emotions which can cause you to take unnecessary losses.

What is the difference between spread betting and CFDs?

The main difference between spread betting and CFDs is the way they are treated for tax purposes. Spread betting is exempt from tax, so you don’t pay capital gains tax on profits or stamp duty on purchases. CFDs do not pay stamp duty, but their profits are taxable. However, this allows your losses to be written off against your profits lowering the tax burden.

Is Financial Spread Betting Gambling?

Financial spread betting is not gambling according to the Financial Conduct Authority (FCA) as spread betting is a regulated trading activity, just like CFDs and traditional investing. The only consideration it has for being a gambling product is that it’s tax-free, but this is where the similarities end. Financial spread betting lets you speculate on a range of financial markets including forex (EUR/USD), indices (FTSE 100), shares, ETFs, and commodities (gold).

Ask an Expert