Spread betting is a popular financial product that lets you bet on the price movements of an underlying asset without owning it. In this article, I’ll cover what spread betting is, how it works, its types, and how it compares to other trading methods.

What Is The Meaning Of Spread Betting?

Spread betting is a financial derivative that allows you to speculate on the price movements of various assets without owning the underlying market, such as a currency pair or a stock index. Instead of buying and selling assets like traditional investing, spread betting involves placing a bet on whether the price of an asset will rise or fall.

By betting on price direction, spread betting is a solid option to trade in all market conditions, as you’ll be able to profit from ranging, rising, and falling markets. Another key advantage spread betting offers is that it is exempt from capital gains tax and stamp duty so that you can keep all your profits.

Types of Spread Bets

In financial spread betting, you can use different types of spread bets to maximise your returns by lowering your trading costs depending on your strategy. Below are the different types:

1. Daily Funded Bets (DFBs)

Daily funded bets are the default option when spread betting and have the lowest spreads available compared to the other options. The drawback of using DFBs is that they are subject to overnight financing charges, which you will pay if you have a DFB position open at 22:00 UK time. With this in mind, DFBs are designed for intraday trading as you’ll get the lowest spreads and avoid being charged the financing fees if you close the bet the same day.

2. Futures Spread Bets

Futures (or Forward contracts in FX) have wider spreads than DFBs but do not incur overnight financing fees. This makes it ideal if you think your prediction will take a few days to three months or are looking to hedge an open position. Unlike DFBs, futures spread bets have a quarterly expiration, but you can close your position anytime.

How Does Spread Betting Work?

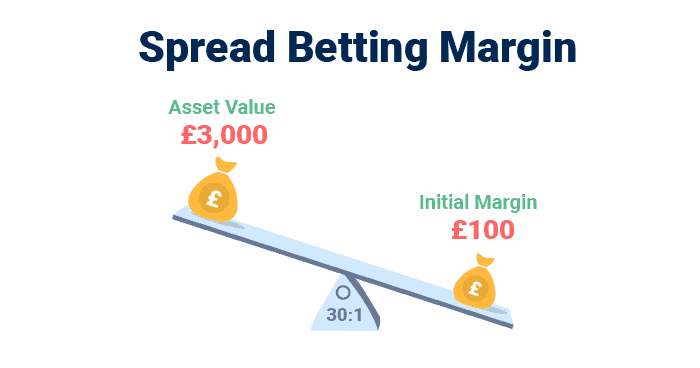

Spread betting is a derivative, meaning it follows the underlying asset’s price and derives its price from this asset (hence the name derivative). As a derivative, spread betting is a leveraged product that requires you to use margin for placing each bet and varies depending on how liquid a market is.

For example, with EUR/USD, spread betting brokers offer the maximum leverage of 30:1, which means you can open a bet on EUR/USD with a margin of 3.33%. While with stocks, you’ll find they offer a leverage of 5:1, so a 20% margin is required to place a bet.

This may seem complicated, but fortunately, spread betting brokers will provide the figures, showing you how much margin is required to place each bet. While leverage can amplify your profits, it can also magnify your losses, making proper risk management essential.

Calculating your profits and losses in spread betting is relatively simple. Your profit or loss is determined by the difference between your bet’s opening and closing prices multiplied by your stake size.

For example, if you bet £10 per point on the FTSE 100 index rising, and it goes up by 10 points, your profit would be £100 (10 points x £10 per point). If it fell 10 points, your loss would be £100, highlighting how leverage can magnify your trading performance. If you are still confused view our page on how spread betting works.

Spread Bet Examples

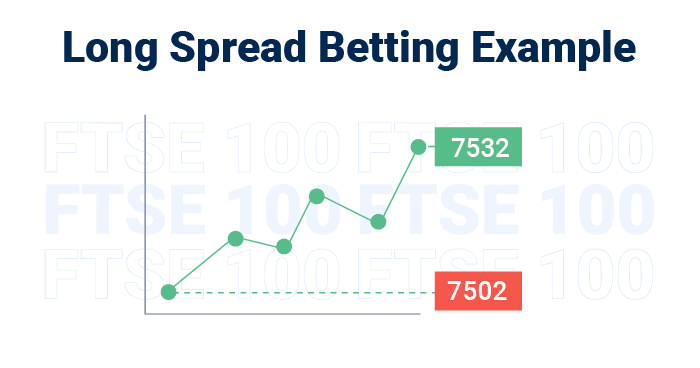

To understand the logic behind spread betting, I find it helpful to walk through examples. Let’s consider a spread bet on the FTSE 100 index.

The broker is offering the FTSE 100 with a spread of 7500 – 7502, meaning you can “buy” at 7502 if you think the index will rise or “sell” at 7500 if you think it will fall.

You decide to “buy” with a stake of £10 per point, believing the index will rise. Your total exposure would be £75,020 (7502 x £10), but due to 20:1 leverage, you only need to have a margin of £3,751 (5%) to open the bet.

1. Winning Example

If the FTSE 100 rises to 7532 and you decide to close your position, you would “sell” (or close trade) at 7532. Your profit would be calculated as follows:

(Closing price – Opening price) x Stake = (7532 – 7502) x £10 = £300

The result from this bet gave you a return on investment of ~8% based on your margin (300/3751). Without the leverage, you would have had to deposit the full £75,020 to open the trade and wouldn’t have achieved the same ROI.

2. Losing Example

However, if the market had moved against you and fallen to 7452, closing your position by at 7452 would result in a loss:

(Closing price – Opening price) x Stake = (7452 – 7502) x £10 = -£500

As you can see in the example, the underlying market (FTSE 100) only moved 30-50 points, which can happen in minutes on a volatile trading day. Leverage magnified both the results of the losing and winning examples, which is why it’s important to know the financial markets you are betting on and implement risk management.

Here’s another example, this time with a forex pair:

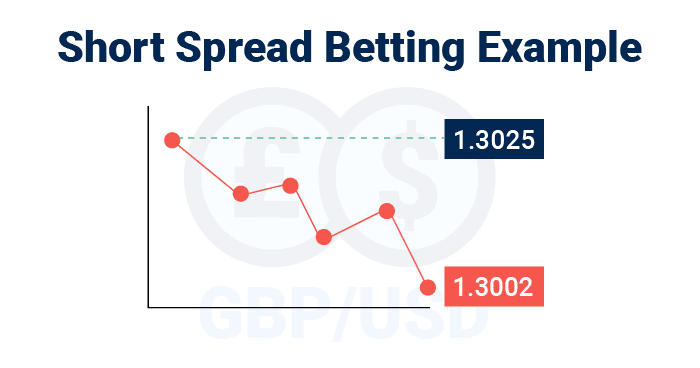

3. Short Spread Bet Example

This time, you want to spread bet on the GBP/USD and believe the price direction will fall over the next few hours after poor economic news from the UK. Using a GBP/USD Daily Funded Bet (DFB), you decide to “sell” at 1.3025 with a stake of £5 per pip, believing the pound will weaken against the dollar.

If the price drops to 1.3002 and you close your position by “buying” at 1.3002, your profit would be:

(Opening price – Closing price) x Stake = (1.3025 – 1.3002) x £5 per pip = £115 profit.

The examples above show how spread betting works in multiple markets and with different outcomes. If you are new to spread betting, you should open a demo account to practise placing bets in a risk-free environment, allowing you to learn and familiarise yourself with the markets.

Spread betting vs CFD

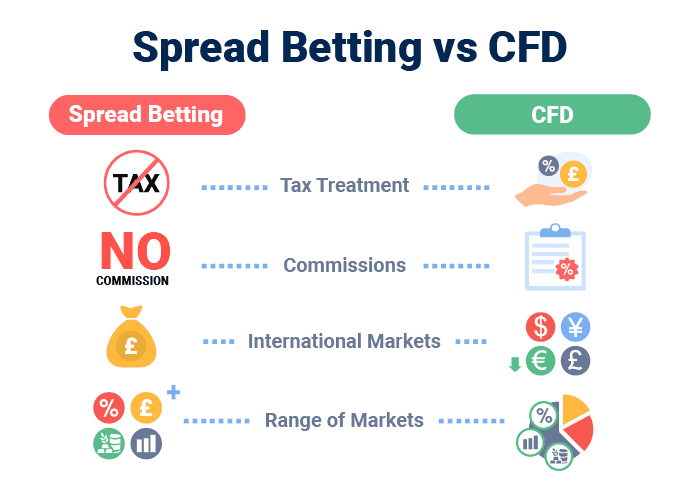

Both spread betting and CFDs share many properties, such as allowing you to use leverage to trade, paying no stamp duty, and never owning the underlying asset. However, there are some clear differences between spread betting vs CFD trading which are:

- Tax treatment: In the UK, spread betting profits are tax-free, while profits from CFD trading are subject to capital gains tax. This is one of the main reasons I prefer spread betting for my trading.

- Commissions: Spread betting typically doesn’t involve separate commissions because the cost is built into the spread, similar to a CFD broker’s Standard account option. However, CFDs can have tighter spreads but charge a separate commission.

- International Markets: All spread betting transactions are done in GBP as you are betting on the price movement, saving you from paying currency conversion fees and being exposed to currency fluctuations. CFDs are subject to this cost plus currency fluctuations, potentially weakening your overall profits once converted into GBP.

- Range of Markets: While both offer a wide range of markets, I’ve found that CFDs offer more markets in general, especially for stocks. However, spread betting markets offer major markets like forex, indices, bonds, commodities, stocks and precious metals like Gold.

It’s worth noting that a number of UK brokers offer CFD trading but won’t allow traders to spread bet. Therefore you need to view our Spread Betting Platform UK page to make sure a spread betting account is offered by the FCA regulated provider.

Spread Betting vs. Traditional Investing

Spread betting differs greatly from traditional investing as it offers a low-cost way of profiting from an asset’s price movement without owning the underlying asset. However, spread betting has leverage, which introduces higher risk, which some day traders may not want. Below are the key differences between spread betting and traditional investing.

| Feature | Spread Betting | Traditional Investing |

|---|---|---|

| Market Exposure | Speculation on price movements without asset ownership | Direct ownership of assets (stocks, bonds, funds) |

| Profit Potential | Profit from both rising and falling markets | Profits when the value of the asset rises and if the company pays dividends |

| Leverage | Utilises leverage, allowing larger positions with smaller capital | No leverage |

| Tax Implications (UK) | Profits are tax-free, exempt from capital gains tax and stamp duty | Subject to capital gains tax and stamp duty on share purchases and tax on dividends received |

| Risk Profile | Higher risk due to leverage | Risk is limited to the amount invested |

| Market Access | Wide range of markets (stocks, indices, forex, commodities) | Can trade any market |

| Costs | No commission, costs built into the spread | Usually involves commissions, spreads, and potentially other fees like stamp duty |

| Ownership Rights | No ownership rights or shareholder privileges | Has ownership rights, including potential dividends and voting rights |

| Time Horizon | Often used for short to medium-term trading strategies | More suited for longer-term investment horizons |

| Currency Exposure | Transactions are made in GBP, so no currency exposure or conversion fees | It may involve currency conversion costs and exposure to exchange rate fluctuations if you buy non-UK assets like US stocks |

Pros and Cons of Spread Betting

Like any trading method, spread betting comes with its own set of advantages and disadvantages. Here’s my take on the main pros and cons:

Pros:

- Potential for tax-free profits: The fact that spread betting profits are free from capital gains tax and stamp duty makes them a great option to lower your costs.

- Wide range of markets: With most spread betting brokers, you can bet on every market, from forex to bonds, while benefiting from its low trading costs.

- You can short-sell the market: Unlike traditional investing, spread betting allows you to “short” markets, potentially profiting when prices fall, allowing you to bet in all trading conditions.

- Lower capital requirements: Due to leverage, you can control large positions with a relatively small amount of capital, which makes it easier for traders with lower funds to start betting.

Cons:

- Forced to trade short-term: As each bet incurs overnight charges if left open, you are forced to either pay the fees or close the trade before the end of the day.

- High-risk through leverage: While leverage can amplify profits, it can also lead to significant losses that can be larger than the initial margin you used to open the bet. Fortunately, spread betting brokers have Negative Balance Protection, ensuring your account never falls below £0.

We have a detailed page on the advantages of a spread bet compared to CFDs or share trading.

FAQs

Is Spread Betting Gambling?

Spread betting is not gambling, as you have to use the same risk management, strategies, and market knowledge to profit from your bets as traditional investing. Plus, the FCA notes it as a regulated financial product in the UK. The only thing I believe relates spread betting to gambling is that they are both tax-free on profits.

What Assets Can You Spread Bet With?

Spread betting is a derivative product that can technically be used in any market. Most commonly, spread betting brokers offer stocks and indices, forex markets, commodities, and bonds/interest rates.

Can I Spread Bet Without Leverage?

No, leverage is built into the spread betting product and is the only way to open a bet with the broker. If you are worried about taking on too much leverage, you can lower it by depositing more as a margin.

How Are Spread Bets Taxed?

Spread betting is not taxable and is exempt from capital gains tax, so you don’t have to pay tax on your spread betting profits. You are also exempt from stamp duty tax as you do not own the underlying market. View our spread bet tax page to learn more.

Ask an Expert

Why do traders choose spread betting over other forms of trading?

Traders choose spread betting because it offers tax-free profits in the UK and the ability to use leverage to control larger positions.

What is spread betting and how does it work?

Spread betting is a form of financial trading where you speculate on the price movements of an asset without owning it.